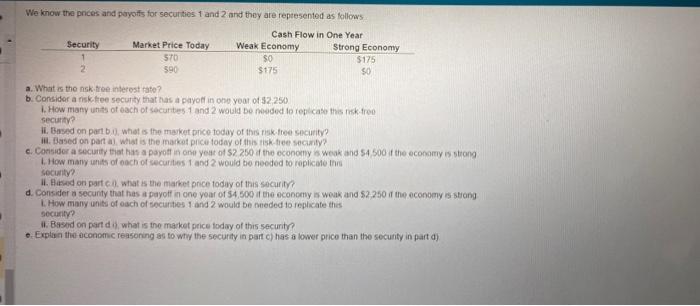

Question: please help me answer part a-e. thank you! We know the prices and poyoffs for securties 1 and 2 and they are reptesented as follows

We know the prices and poyoffs for securties 1 and 2 and they are reptesented as follows a. What is the nsik troe interest rate? b. Consider a risk-tee securty that has a payolf in one yeat of $2,250 1. How many unts of each of secuntes 1 and 2 woisld be nooded lo replicase this risk-free seciarity? ii. Based on part b. 2), whet is the maket price today of this risk-free security? iil. Based on part al what is the market pricu today of this risk-tiee secanty? 1. How many units of each of securites 1 and 2 would be needed to roplicale thes secianty? ii. Baswed on part co, what is the market price today of this socurity? d. Consider a secunty that has a payoff in one yoar of $4,500 if the economy as weak and $2,250 if the economy is stiong 1. How many units of each of socunties 1 and 2 would be neded to replicate this security? ii. Basod on part d 1), what is the maket price foday of this security? e. Explas the oconomic reasoning as to why the security in part c) has a lower price than the security in part a)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts