Question: Please help me answer Q's 7, 8 and 9 7) You have a liability of $1,000,000 (FV - SIM) due in 10 years. Your re-invesment

Please help me answer Q's 7, 8 and 9

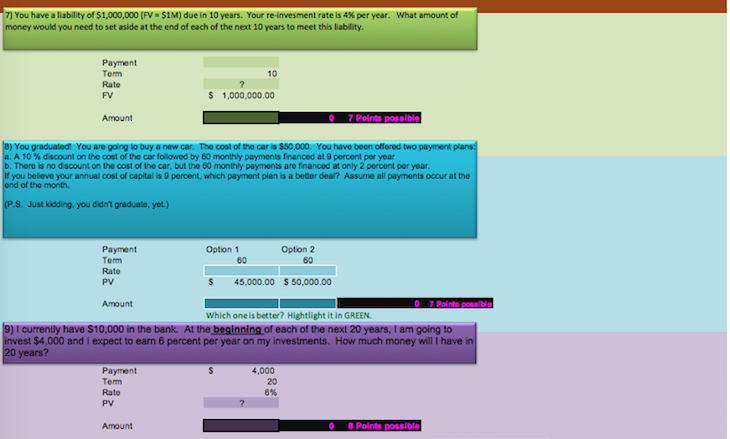

7) You have a liability of $1,000,000 (FV - SIM) due in 10 years. Your re-invesment rate is 4% per year. What amount of money would you need to set aside at the end of each of the next 10 years to meet this liability 10 Payment Term Rato FV $ 1,000,000.00 Amount 7 Points possible B) You graduated You are going to buy a new car. The cost of the car is $50,000. You have been offered two payment plans a. A 10% discount on the cost of the car followed by 60 monthly payments financed at 9 percent per your b. There is no discount on the cost of the car, but the 60 monthly payments are financed at only 2 percent per year. w you believe your annual cost of capital is 9 percent, which payment plan is a better deal? Assume all payments occur at the end of the month. (P.S. Just kidding, you didn't graduate, yet.) Payment Term Rate PV Option 1 80 Option 2 80 45,000.00 $ 50,000.00 Amount 7. Paint poble Which one is better? Hightlight it in GREEN. 9) I currently have $10,000 in the bank. At the beginning of each of the next 20 years, I am going to invest $4.000 and I expect to earn 6 percent per year on my investments. How much money will have in 20 years? Payment Term $ 4,000 20 6% Rate PV Amount 8 Points possible

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts