Question: Please help me answer the following 5 questions, please only attempt if you can help me answer all 5. Thank you!! will rate Buffy is

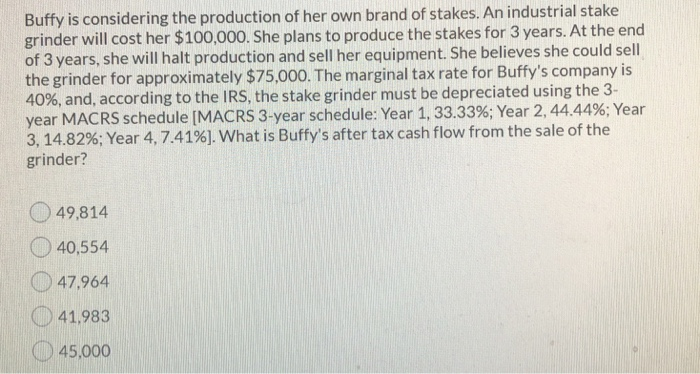

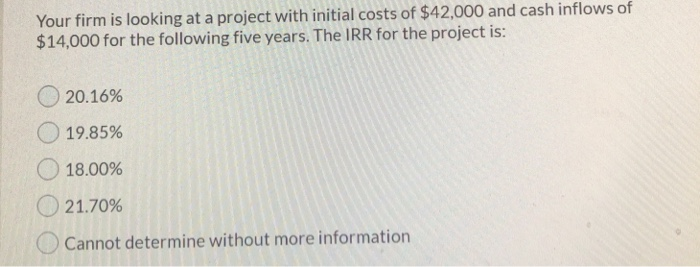

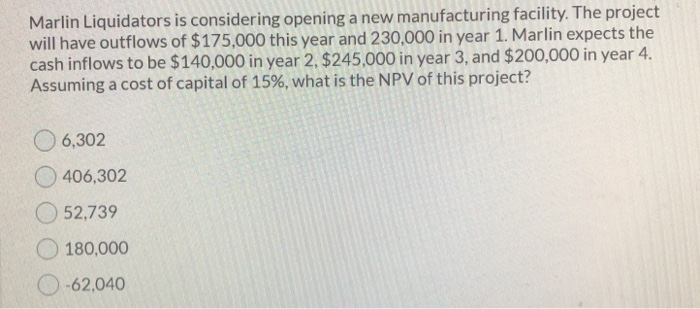

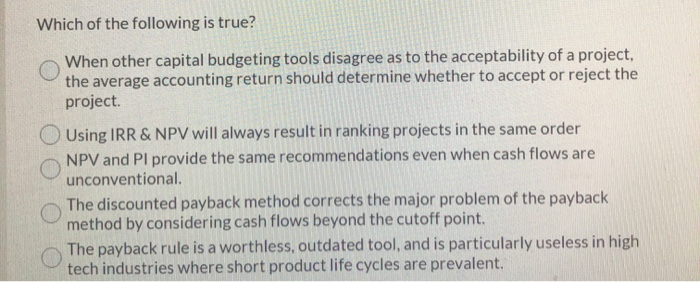

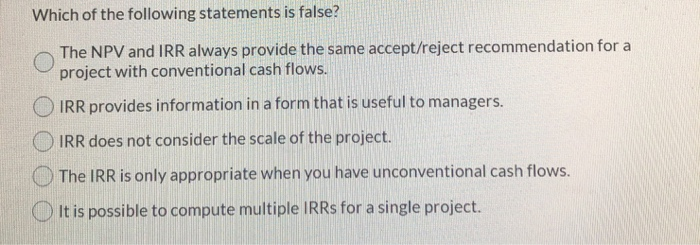

Buffy is considering the production of her own brand of stakes. An industrial stake grinder will cost her $100,000. She plans to produce the stakes for 3 years. At the end of 3 years, she will halt production and sell her equipment. She believes she could sell the grinder for approximately $75,000. The marginal tax rate for Buffy's company is 40%, and, according to the IRS, the stake grinder must be depreciated using the 3- year MACRS schedule (MACRS 3-year schedule: Year 1, 33.33%; Year 2, 44.44%; Year 3, 14.82%; Year 4, 7.41%). What is Buffy's after tax cash flow from the sale of the grinder? 49,814 40,554 47,964 41,983 45,000 Your firm is looking at a project with initial costs of $42,000 and cash inflows of $14,000 for the following five years. The IRR for the project is: 20.16% 19.85% O 18.00% 21.70% Cannot determine without more information Marlin Liquidators is considering opening a new manufacturing facility. The project will have outflows of $175,000 this year and 230,000 in year 1. Marlin expects the cash inflows to be $140,000 in year 2. $245,000 in year 3, and $200,000 in year 4. Assuming a cost of capital of 15%, what is the NPV of this project? 6,302 406,302 52,739 180,000 0-62,040 Which of the following is true? When other capital budgeting tools disagree as to the acceptability of a project, the average accounting return should determine whether to accept or reject the project. Using IRR & NPV will always result in ranking projects in the same order NPV and Pl provide the same recommendations even when cash flows are unconventional. The discounted payback method corrects the major problem of the payback method by considering cash flows beyond the cutoff point. The payback rule is a worthless, outdated tool, and is particularly useless in high tech industries where short product life cycles are prevalent. Which of the following statements is false? The NPV and IRR always provide the same accept/reject recommendation for a project with conventional cash flows. O IRR provides information in a form that is useful to managers. IRR does not consider the scale of the project. The IRR is only appropriate when you have unconventional cash flows. It is possible to compute multiple IRRs for a single project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts