Question: Please help me answer the following solutions and show how to do it if possible! Thank you in advance! I will be sure to give

Please help me answer the following solutions and show how to do it if possible! Thank you in advance! I will be sure to give you a upvote!

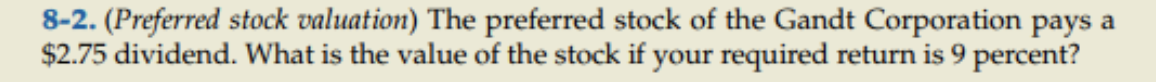

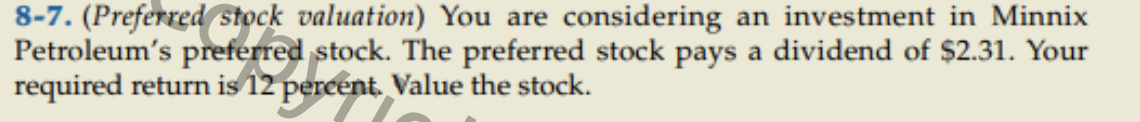

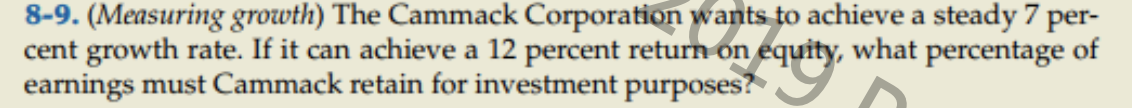

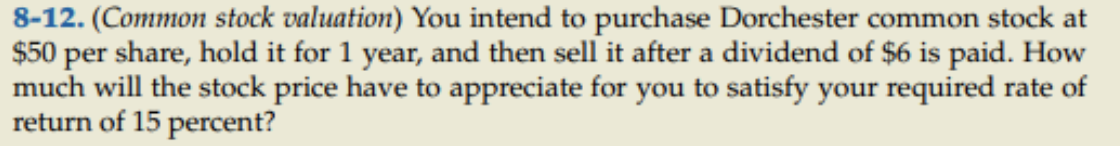

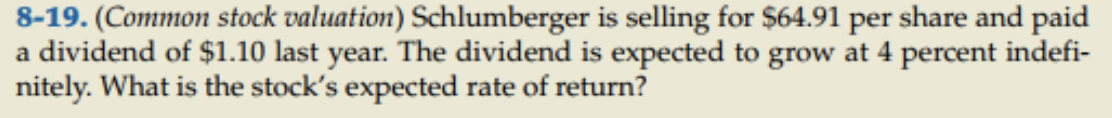

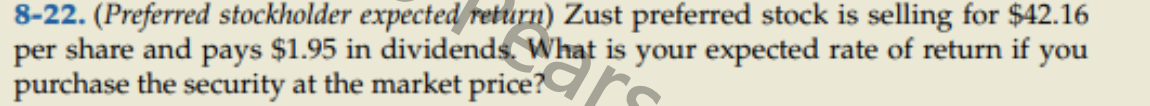

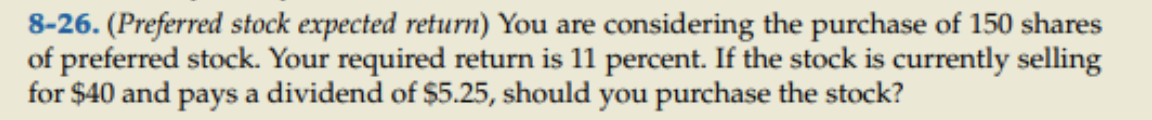

8-2. (Preferred stock valuation) The preferred stock of the Gandt Corporation pays a $2.75 dividend. What is the value of the stock if your required return is 9 percent? 8-7. (Preferred stock valuation) You are considering an investment in Minnix Petroleum's preferred stock. The preferred stock pays a dividend of $2.31. Your required return is 12 percent. Value the stock. 8-9. (Measuring growth) The Cammack Corporation wants to achieve a steady 7 per- cent growth rate. If it can achieve a 12 percent return on equity, what percentage of earnings must Cammack retain for investment purposes? 8-12. (Common stock valuation) You intend to purchase Dorchester common stock at $50 per share, hold it for 1 year, and then sell it after a dividend of $6 is paid. How much will the stock price have to appreciate for you to satisfy your required rate of return of 15 percent? 8-19. (Common stock valuation) Schlumberger is selling for $64.91 per share and paid a dividend of $1.10 last year. The dividend is expected to grow at 4 percent indefi- nitely. What is the stock's expected rate of return? 8-22. (Preferred stockholder expected return) Zust preferred stock is selling for $42.16 per share and pays $1.95 in dividends. What is your expected rate of return if you purchase the security at the market price? 8-26. (Preferred stock expected return) You are considering the purchase of 150 shares of preferred stock. Your required return is 11 percent. If the stock is currently selling for $40 and pays a dividend of $5.25, should you purchase the stock? 8-31. (Common stockholder expected return) The market price for the Earnest Corporation's common stock is $43 per share. The price at the end of 1 year is expected to be $48, and dividends for next year should be $2.84. What is the expected rate of return? 8-32. (Common stockholder expected return) If you purchased 125 shares of common stock that pays an end-of-year dividend of $3, what is your expected rate of return if you purchased the stock for $30 per share? Assume the stock is expected to have a constant growth rate of 7 percent. 8-33. (Common stockholder expected return) Ziercher executives anticipate a growth rate of 12 percent for the company's common stock. The stock is currently selling for $42.65 per share and pays an end-of-year dividend of $1.45. What is your expected rate of return if you purchase the stock for its current market price of $42.65? fed retur

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts