Question: Please help me answer these questions based on below table. I need this before 9PM. ASAP. Thank you. Q1: Has [Company Xs] gross profit margin

Please help me answer these questions based on below table. I need this before 9PM. ASAP. Thank you.

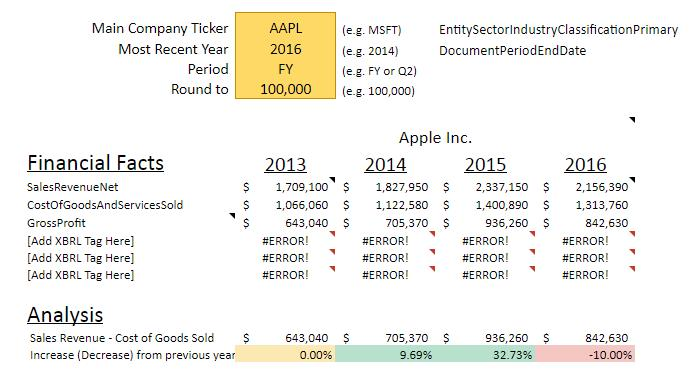

Q1: Has [Company Xs] gross profit margin (net sales revenue minus cost of good sold) increased from 2013 to 2016?

Q2: Has [Company X's] current ratio (current assets divided by current liabilities) increased from 2013 to 2016?

Q3: Has [Company X's] debt-to-equity (total debt divided by total equity) ratio decreased from 2013 to 2016?

Main Company Ticker Most Recent Year Period Round to EntitySectorindustryClassification Primary DocumentPeriodEndDate AAPL 2016 FY 100,000 (e.g. MSFT) (eg. 2014) leg. FY or 02) (e.g. 100,000) Financial Facts SalesRevenueNet CostOfGoodsAndServicesSold GrossProfit [Add XBRL Tag Here] [Add XBRL Tag Here] [Add XBRL Tag Here] $ $ S Apple Inc. 2014 2015 1,827,950 $ 2,337,150 1,122,580 $ 1,400,890 705,370 S 936,260 #ERROR! #ERROR! #ERROR! #ERROR! #ERROR! #ERROR! 2013 1,709,100 $ 1,066,060 $ 643,040 $ #ERROR! #ERROR! #ERROR! 1 2016 2,156,390 1,313,760 842,630 #ERROR! #ERROR! #ERROR! Analysis Sales Revenue - Cost of Goods Sold Increase (Decrease) from previous year S $ 643,040 $ 0.00% 705,370 $ 9.69% 936,260 32.73% 842,630 -10.00% Main Company Ticker Most Recent Year Period Round to EntitySectorindustryClassification Primary DocumentPeriodEndDate AAPL 2016 FY 100,000 (e.g. MSFT) (eg. 2014) leg. FY or 02) (e.g. 100,000) Financial Facts SalesRevenueNet CostOfGoodsAndServicesSold GrossProfit [Add XBRL Tag Here] [Add XBRL Tag Here] [Add XBRL Tag Here] $ $ S Apple Inc. 2014 2015 1,827,950 $ 2,337,150 1,122,580 $ 1,400,890 705,370 S 936,260 #ERROR! #ERROR! #ERROR! #ERROR! #ERROR! #ERROR! 2013 1,709,100 $ 1,066,060 $ 643,040 $ #ERROR! #ERROR! #ERROR! 1 2016 2,156,390 1,313,760 842,630 #ERROR! #ERROR! #ERROR! Analysis Sales Revenue - Cost of Goods Sold Increase (Decrease) from previous year S $ 643,040 $ 0.00% 705,370 $ 9.69% 936,260 32.73% 842,630 -10.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts