Question: please help me answer these questions! Question 4 1 pts For the year of 203, Ouyang Inc. has a P/E ratio of 2.3 and Huang

please help me answer these questions!

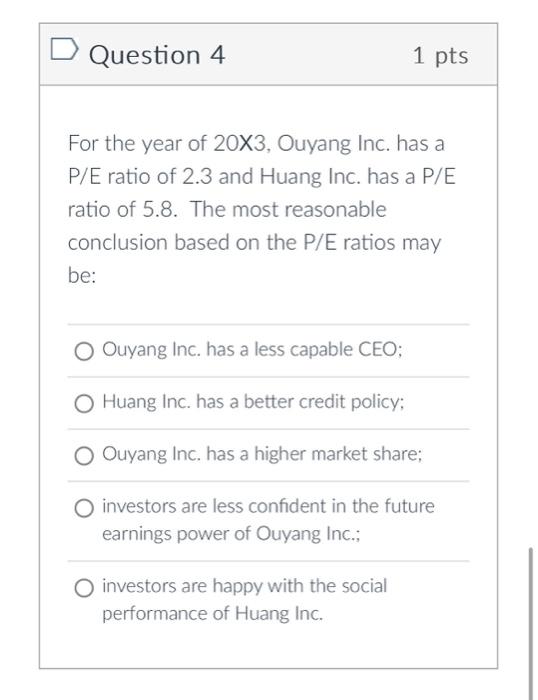

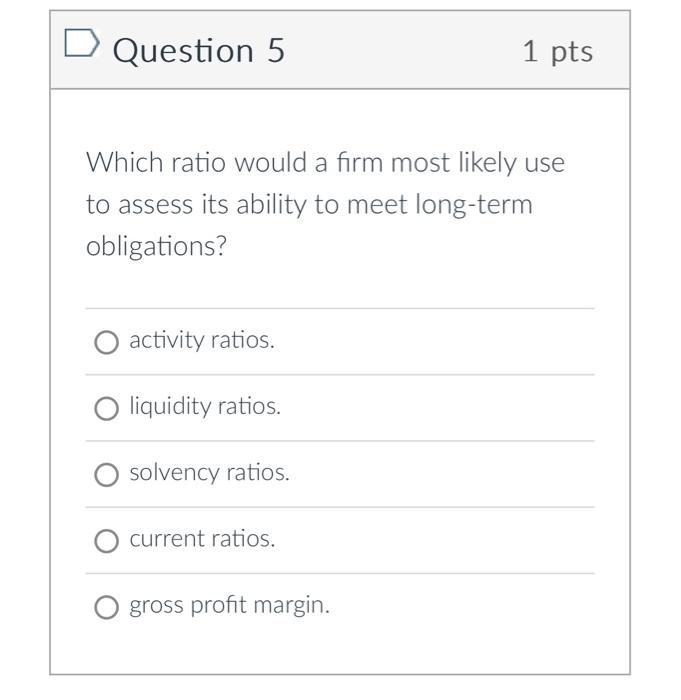

Question 4 1 pts For the year of 203, Ouyang Inc. has a P/E ratio of 2.3 and Huang Inc. has a P/E ratio of 5.8. The most reasonable conclusion based on the P/E ratios may be: Ouyang Inc. has a less capable CEO; Huang Inc. has a better credit policy; Ouyang Inc. has a higher market share; investors are less confident in the future earnings power of Ouyang Inc.; investors are happy with the social performance of Huang Inc. Question 5 1 pts Which ratio would a firm most likely use to assess its ability to meet long-term obligations? activity ratios. liquidity ratios. solvency ratios. current ratios. gross profit margin

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock