Question: PLEASE HELP ME ANSWER THESE QUESTIONS WITH FULL FORMULA, AND STEPS. THANK YOU SO MUCH House Mortgage Suppose you purchase a house for $620,000 and

PLEASE HELP ME ANSWER THESE QUESTIONS WITH FULL FORMULA, AND STEPS. THANK YOU SO MUCH

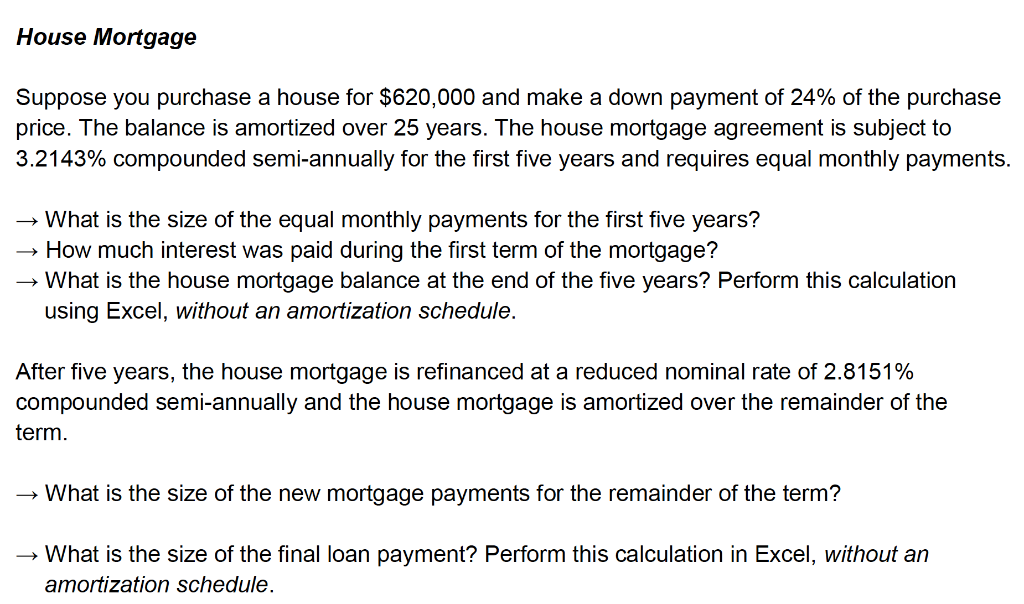

House Mortgage Suppose you purchase a house for $620,000 and make a down payment of 24% of the purchase price. The balance is amortized over 25 years. The house mortgage agreement is subject to 3.2143% compounded semi-annually for the first five years and requires equal monthly payments. What is the size of the equal monthly payments for the first five years? How much interest was paid during the first term of the mortgage? What is the house mortgage balance at the end of the five years? Perform this calculation using Excel, without an amortization schedule. After five years, the house mortgage is refinanced at a reduced nominal rate of 2.8151% compounded semi-annually and the house mortgage is amortized over the remainder of the term. What is the size of the new mortgage payments for the remainder of the term? What is the size of the final loan payment? Perform this calculation in Excel, without an amortization schedule. House Mortgage Suppose you purchase a house for $620,000 and make a down payment of 24% of the purchase price. The balance is amortized over 25 years. The house mortgage agreement is subject to 3.2143% compounded semi-annually for the first five years and requires equal monthly payments. What is the size of the equal monthly payments for the first five years? How much interest was paid during the first term of the mortgage? What is the house mortgage balance at the end of the five years? Perform this calculation using Excel, without an amortization schedule. After five years, the house mortgage is refinanced at a reduced nominal rate of 2.8151% compounded semi-annually and the house mortgage is amortized over the remainder of the term. What is the size of the new mortgage payments for the remainder of the term? What is the size of the final loan payment? Perform this calculation in Excel, without an amortization schedule

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts