Question: please help me answer this before 10pm Thank you. Tom died this year in September. Tom lives in Texas and is unmarried. His income prior

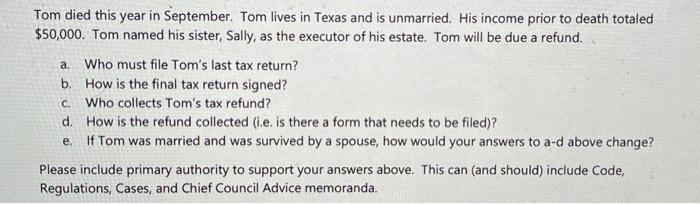

Tom died this year in September. Tom lives in Texas and is unmarried. His income prior to death totaled $50,000. Tom named his sister, Sally, as the executor of his estate. Tom will be due a refund. a who must file Tom's last tax return? b. How is the final tax return signed? c. Who collects Tom's tax refund? d. How is the refund collected (i.e. is there a form that needs to be filed)? e. If Tom was married and was survived by a spouse, how would your answers to a-d above change? Please include primary authority to support your answers above. This can (and should) include Code, Regulations, Cases, and Chief Council Advice memoranda

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts