Question: please help me answer this i need it asap -- CHALLENGE PROBLEMS 1. Taxes. MM's proposition I suggests that in the absence of taxes it

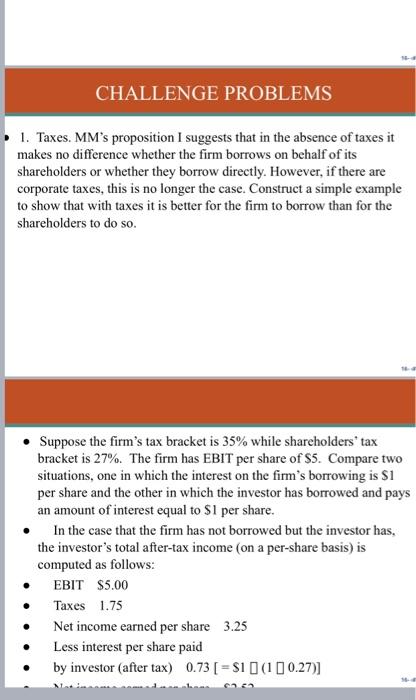

-- CHALLENGE PROBLEMS 1. Taxes. MM's proposition I suggests that in the absence of taxes it makes no difference whether the firm borrows on behalf of its shareholders or whether they borrow directly. However, if there are corporate taxes, this is no longer the case. Construct a simple example to show that with taxes it is better for the firm to borrow than for the shareholders to do so. . Suppose the firm's tax bracket is 35% while shareholders' tax bracket is 27%. The firm has EBIT per share of $5. Compare two situations, one in which the interest on the firm's borrowing is $1 per share and the other in which the investor has borrowed and pays an amount of interest equal to $1 per share. In the case that the firm has not borrowed but the investor has, the investor's total after-tax income (on a per-share basis) is computed as follows: EBIT $5.00 Taxes 1.75 Net income earned per share 3.25 Less interest per share paid by investor (after tax) 0.73 [= $1 (1 0.27)]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts