Question: please help me answer this. needs to be in excel and include formats too if you can. You are presented with two options: Option A

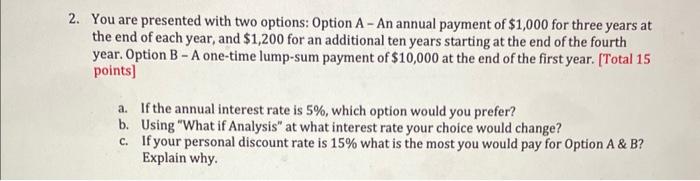

You are presented with two options: Option A - An annual payment of $1,000 for three years at the end of each year, and $1,200 for an additional ten years starting at the end of the fourth year. Option B - A one-time lump-sum payment of $10,000 at the end of the first year. [Total 15 points] a. If the annual interest rate is 5%, which option would you prefer? b. Using "What if Analysis" at what interest rate your choice would change? c. If your personal discount rate is 15% what is the most you would pay for Option A \& B? Explain why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts