Question: Please help me answer this question Question 10 (5 points) A trader sold a portfolio containing 4 call options and 4 put options on a

Please help me answer this question

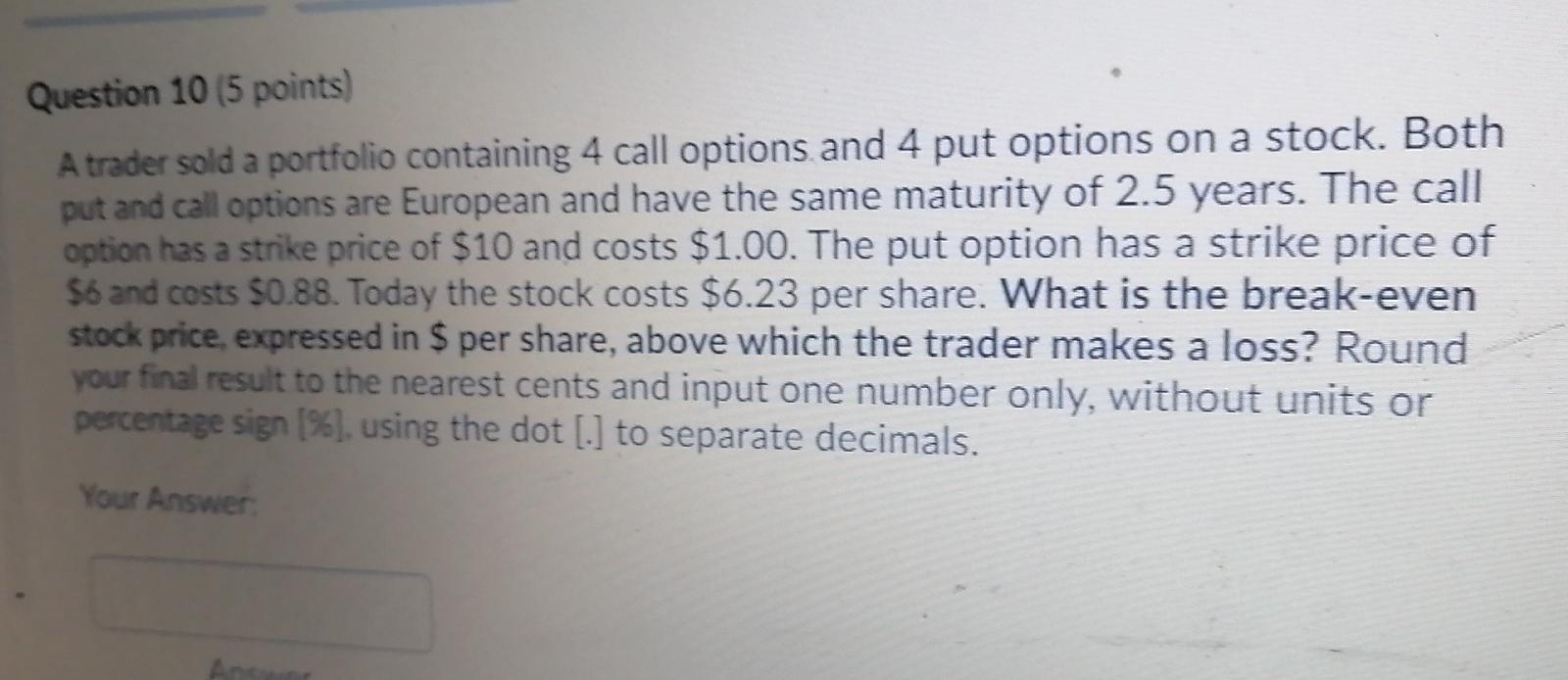

Question 10 (5 points) A trader sold a portfolio containing 4 call options and 4 put options on a stock. Both put and call options are European and have the same maturity of 2.5 years. The call option has a strike price of $10 and costs $1.00. The put option has a strike price of $6 and costs $0.88. Today the stock costs $6.23 per share. What is the break-even stock price, expressed in $ per share, above which the trader makes a loss? Round your final result to the nearest cents and input one number only, without units or percentage sign [%], using the dot (.) to separate decimals. Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts