Question: Please help me answer this question Question 3 (5 points) A trader sold a portfolio containing 2 call options and 4 put options on a

Please help me answer this question

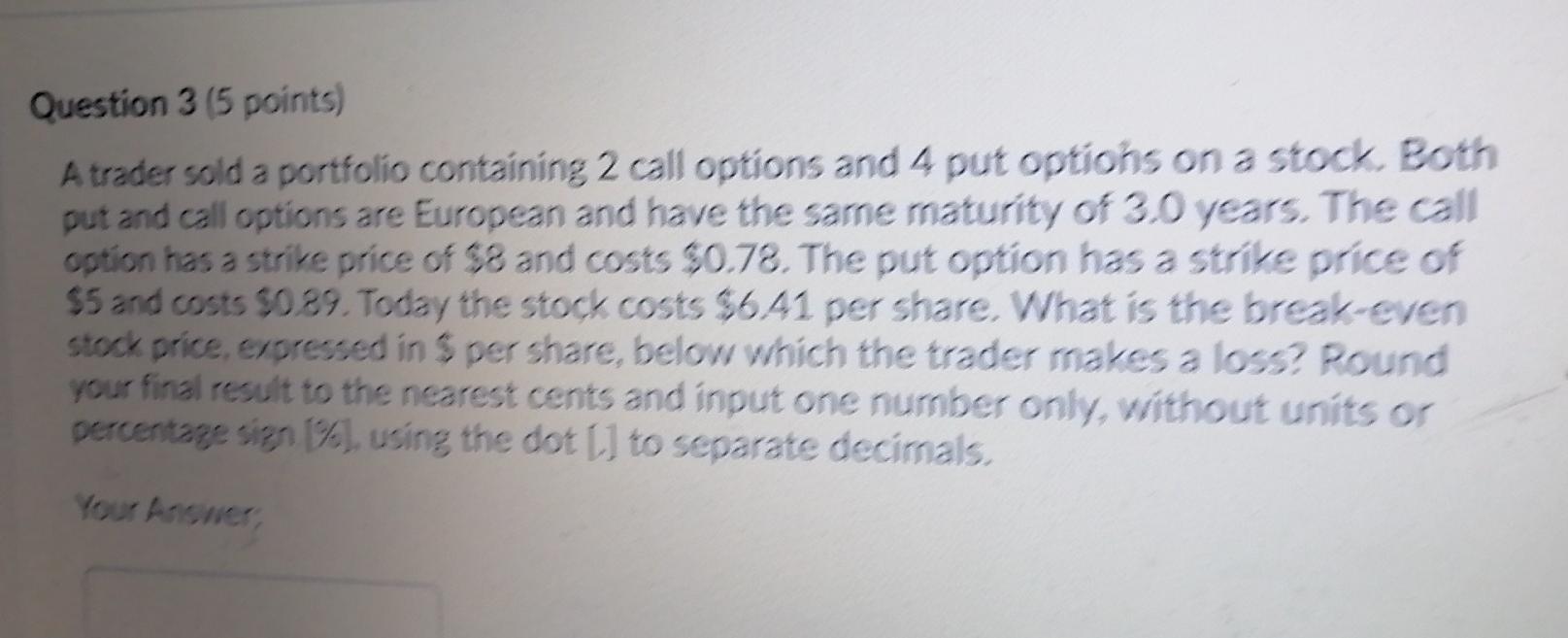

Question 3 (5 points) A trader sold a portfolio containing 2 call options and 4 put options on a stock. Both put and call options are European and have the same maturity of 30 years. The call option has a strive price of S8 and costs $0.72. The put option has a strike price of $5 and costs $0 89. Today the stock costs $6.41 per share. What is the break-even stock price, expressed in S per share, below which the trader makes a loss? Round your final result to the nearest cents and input one number only, without units or percentage sign 1%), using the dot [] to separate decimals, Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts