Question: Please help me answer this question. Thank you very much!! QUESTION 2 When you initiate a project, say building a bridge between islands that will

Please help me answer this question. Thank you very much!!

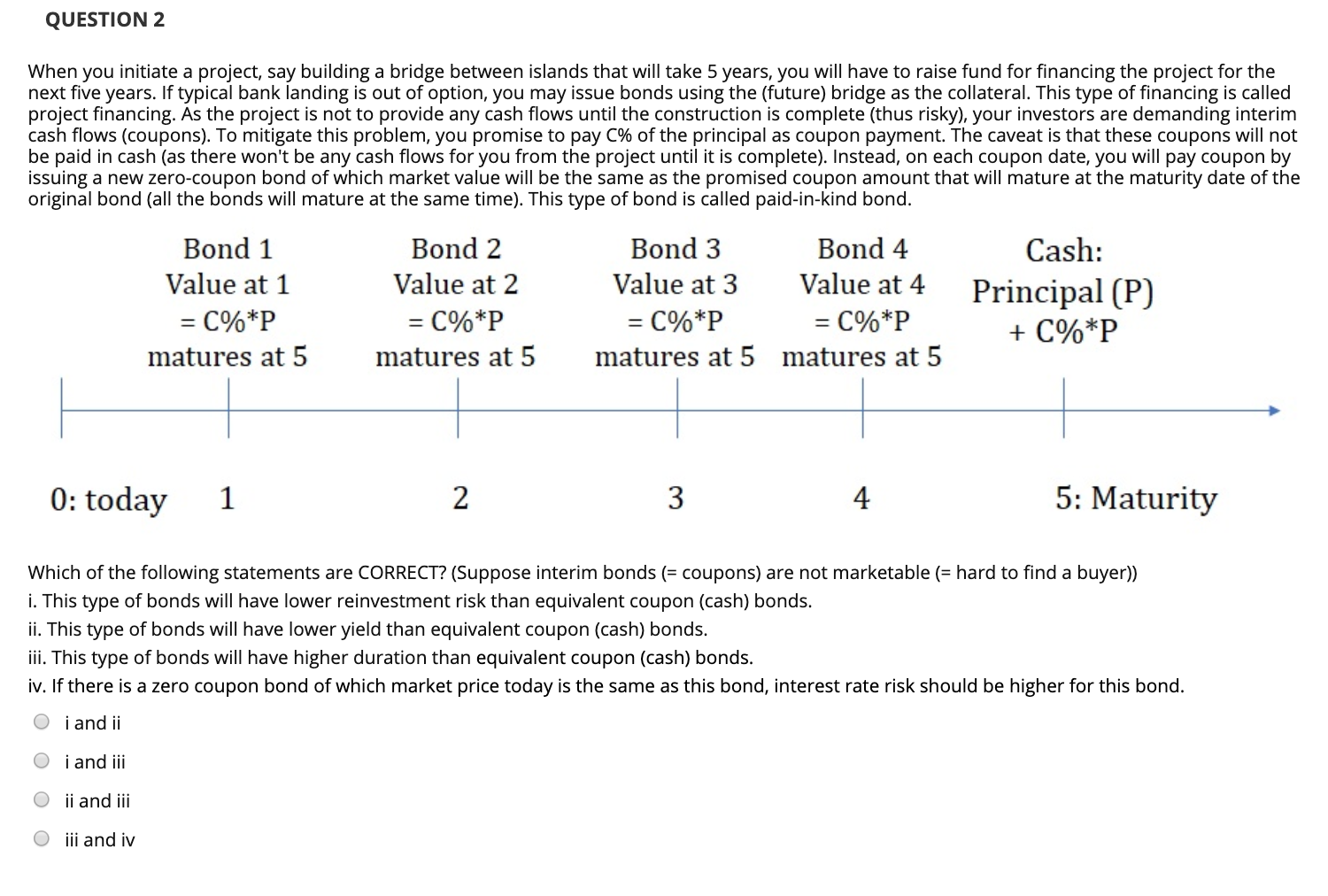

QUESTION 2 When you initiate a project, say building a bridge between islands that will take 5 years, you will have to raise fund for financing the project for the next five years. If typical bank landing is out of option, you may issue bonds using the (future) bridge as the collateral. This type of financing is called project financing. As the project is not to provide any cash flows until the construction is complete (thus risky), your investors are demanding interim cash flows (coupons). To mitigate this problem, you promise to pay C% of the principal as coupon payment. The caveat is that these coupons will not be paid in cash (as there won't be any cash flows for you from the project until it is complete). Instead, on each coupon date, you will pay coupon by issuing a new zero-coupon bond of which market value will be the same as the promised coupon amount that will mature at the maturity date of the original bond (all the bonds will mature at the same time). This type of bond is called paid-in-kind bond. Bond 1 Value at 1 =C%*P matures at 5 Bond 2 Value at 2 = C%*P matures at 5 Bond 3 Bond 4 Value at 3 Value at 4 = C%*P = C%*P matures at 5 matures at 5 Cash: Principal (P) +C%*P 0: today 1 4 5: Maturity Which of the following statements are CORRECT? (Suppose interim bonds (= coupons) are not marketable (= hard to find a buyer)) i. This type of bonds will have lower reinvestment risk than equivalent coupon (cash) bonds. ii. This type of bonds will have lower yield than equivalent coupon (cash) bonds. iii. This type of bonds will have higher duration than equivalent coupon (cash) bonds. iv. If there is a zero coupon bond of which market price today is the same as this bond, interest rate risk should be higher for this bond. O i and ii O i and iii O ji and iii O iii and iv

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts