Question: Please help me answer this question, thanks. Green Spokes is now considering bringing this product to the market but will require an additional production facility

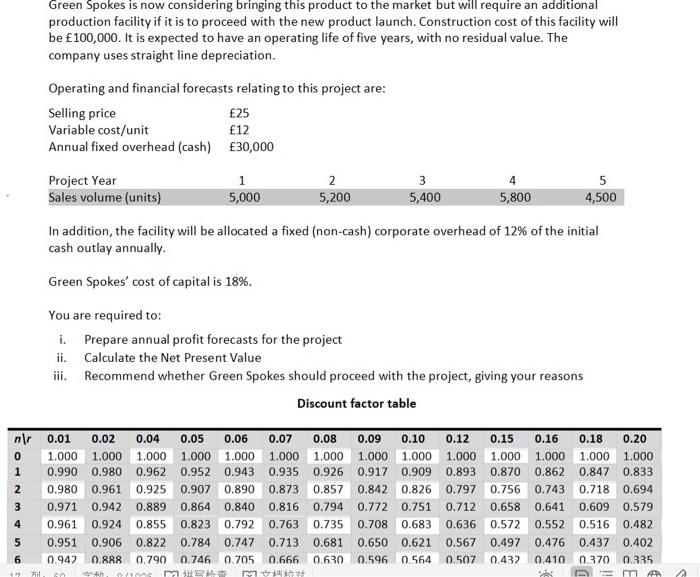

Green Spokes is now considering bringing this product to the market but will require an additional production facility if it is to proceed with the new product launch. Construction cost of this facility will be 100,000. It is expected to have an operating life of five years, with no residual value. The company uses straight line depreciation. Operating and financial forecasts relating to this project are: Selling price 25 Variable cost/unit 12 Annual fixed overhead (cash) 30,000 Project Year 1 2 3 5 Sales volume (units) 5,000 5,200 5,400 5,800 4,500 sh) corporate overhead of 12% of the initial In addition, the facility will be allocated a fixed (no cash outlay annually. Green Spokes' cost of capital is 18%. You are required to: i. Prepare annual profit forecasts for the project ii. Calculate the Net Present Value iii. Recommend whether Green Spokes should proceed with the project, giving your reasons Discount factor table nir 0.01 0.02 0.04 0.05 0.06 0.07 0.08 0.09 0.10 0 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1 0.990 0.980 0.962 0.952 0.943 0.935 0.926 0.917 0.909 2 0.980 0.961 0.925 0.907 0.890 0.873 0.857 0.842 0.826 3 0.971 0.942 0.889 0.864 0.840 0.816 0.794 0.772 0.751 4 0.961 0.924 0.855 0.823 0.792 0.763 0.735 0.708 0.683 5 0.951 0.906 0.822 0.784 0.747 0.713 0.681 0.650 0.621 6 0.942 0.888 0.790 0.746 0.705 0.666 0.630 0.596 0.564 me M 0.12 0.15 1.000 1.000 0.893 0.870 0.797 0.756 0.712 0.658 0.636 0.572 0.567 0.497 0.507 0.437 0.16 1.000 0.862 0.743 0.641 0.552 0.476 0.410 0.18 0.20 1.000 1.000 0.847 0.833 0.718 0.694 0.609 0.579 0.516 0.482 0.437 0.402 0.370 0.335 AN hal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts