Question: Please help me answer this. Thank you so so much! Exercise 2-6 On January 1, 2019 Michael and Rafael agreed to combine their existing businesses

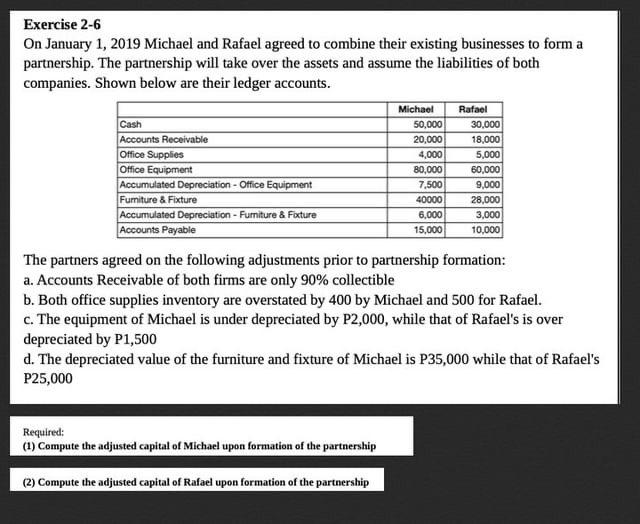

Exercise 2-6 On January 1, 2019 Michael and Rafael agreed to combine their existing businesses to form a partnership. The partnership will take over the assets and assume the liabilities of both companies. Shown below are their ledger accounts. Cash Accounts Receivable Office Supplies Office Equipment Accumulated Depreciation - Office Equipment Furniture & Fixture Accumulated Depreciation - Furniture & Fixture Accounts Payable Michael 50,000 20,000 4,000 80,000 7,500 40000 6,000 15,000 Rafael 30,000 18,000 5,000 60,000 9,000 28,000 3,000 10.000 The partners agreed on the following adjustments prior to partnership formation: a. Accounts Receivable of both firms are only 90% collectible b. Both office supplies inventory are overstated by 400 by Michael and 500 for Rafael. c. The equipment of Michael is under depreciated by P2,000, while that of Rafael's is over depreciated by P1,500 d. The depreciated value of the furniture and fixture of Michael is P35,000 while that of Rafael's P25,000 Required: (1) Compute the adjusted capital of Michael upon formation of the partnership (2) Compute the adjusted capital of Rafael upon formation of the partnership Exercise 2-6 On January 1, 2019 Michael and Rafael agreed to combine their existing businesses to form a partnership. The partnership will take over the assets and assume the liabilities of both companies. Shown below are their ledger accounts. Cash Accounts Receivable Office Supplies Office Equipment Accumulated Depreciation - Office Equipment Furniture & Fixture Accumulated Depreciation - Furniture & Fixture Accounts Payable Michael 50,000 20,000 4,000 80,000 7,500 40000 6,000 15,000 Rafael 30,000 18,000 5,000 60,000 9,000 28,000 3,000 10.000 The partners agreed on the following adjustments prior to partnership formation: a. Accounts Receivable of both firms are only 90% collectible b. Both office supplies inventory are overstated by 400 by Michael and 500 for Rafael. c. The equipment of Michael is under depreciated by P2,000, while that of Rafael's is over depreciated by P1,500 d. The depreciated value of the furniture and fixture of Michael is P35,000 while that of Rafael's P25,000 Required: (1) Compute the adjusted capital of Michael upon formation of the partnership (2) Compute the adjusted capital of Rafael upon formation of the partnership

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts