Question: please help me answer those 2 question asap. also please make sure the answers is correct. thanks A local university received a $150,000.00 gift to

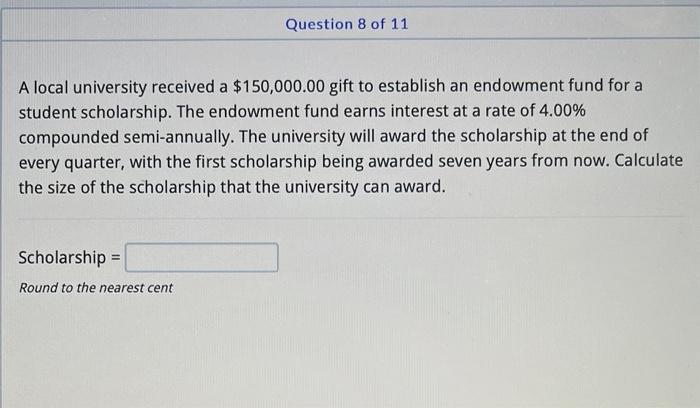

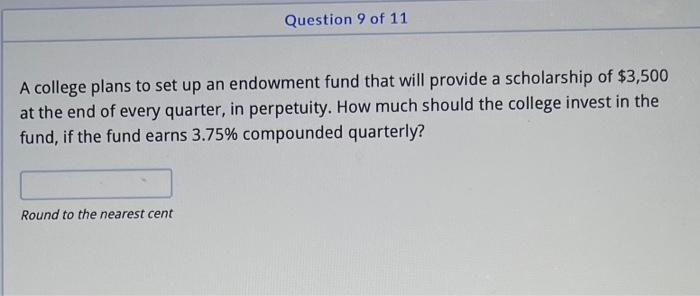

A local university received a $150,000.00 gift to establish an endowment fund for a student scholarship. The endowment fund earns interest at a rate of 4.00% compounded semi-annually. The university will award the scholarship at the end of every quarter, with the first scholarship being awarded seven years from now. Calculate the size of the scholarship that the university can award. Scholarship = Round to the nearest cent A college plans to set up an endowment fund that will provide a scholarship of $3,500 at the end of every quarter, in perpetuity. How much should the college invest in the fund, if the fund earns 3.75% compounded quarterly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts