Question: Please help me answer those questions and post up here in the right way that the answer will not be partially hidden. Thank you! Bi

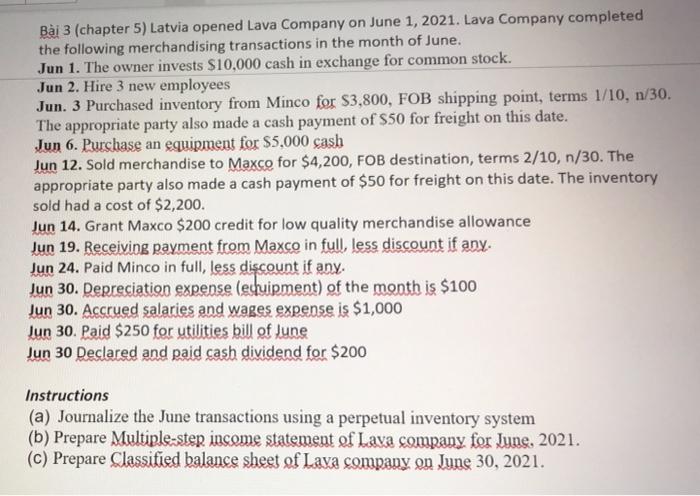

Bi 3 (chapter 5) Latvia opened Lava Company on June 1, 2021. Lava Company completed the following merchandising transactions in the month of June. Jun 1. The owner invests $10,000 cash in exchange for common stock. Jun 2. Hire 3 new employees Jun. 3 Purchased inventory from Minco for $3,800, FOB shipping point, terms 1/10, n/30. The appropriate party also made a cash payment of $50 for freight on this date. Jun 6. Purchase an equipment for $5,000 cash Jun 12. Sold merchandise to Maxco for $4,200, FOB destination, terms 2/10, n/30. The appropriate party also made a cash payment of $50 for freight on this date. The inventory sold had a cost of $2,200. Jun 14. Grant Maxco $200 credit for low quality merchandise allowance Jun 19. Receiving payment from Maxco in full, less discount if any. Jun 24. Paid Minco in full, less discount if any. Jun 30. Depreciation expense (esuipment) of the month is $100 Jun 30. Accrued salaries and wages expense is $1,000 Jun 30. Paid $250 for utilities bill of June Jun 30 Declared and paid cash dividend for $200 Instructions (a) Journalize the June transactions using a perpetual inventory system (b) Prepare Multiple-step income statement of Lava company for June, 2021. (c) Prepare Classified balance sheet of Lava company on June 30, 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts