Question: Please help me as much as you can on these questions. ABC is trying to determine its optimal capital structure. The Company's capital structure consists

Please help me as much as you can on these questions.

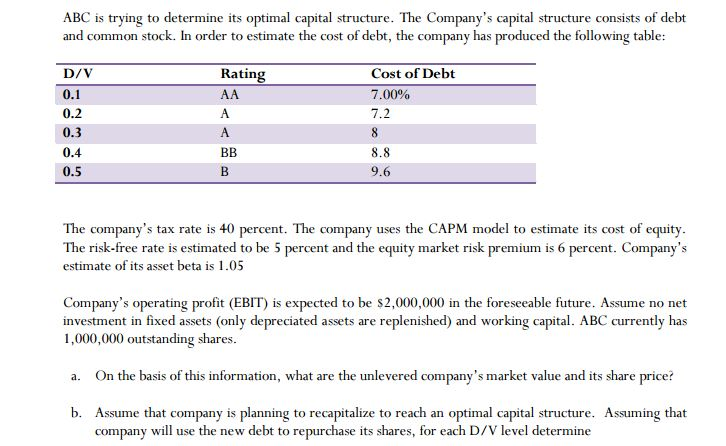

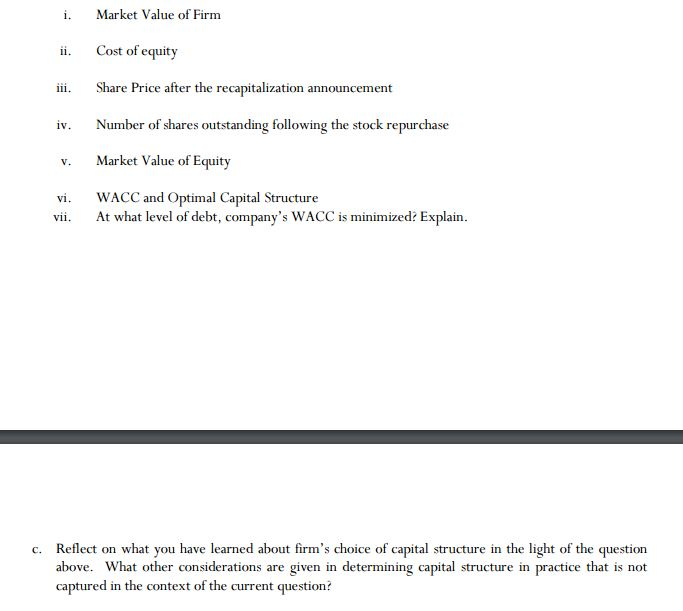

ABC is trying to determine its optimal capital structure. The Company's capital structure consists of debt and common stock. In order to estimate the cost of debt, the company has produced the following table: Cost of Debt D/V Rating 0.1 AA 7.00% 0.2 7.2 A 8 0.3 0.4 BB 8.8 9.6 0.5 The company's tax rate is 40 nt. The company uses the CAPM model to estimate its cost of equity. The risk-free rate is estimated to be 5 percent and the equity market risk premium is 6 percent. Company's estimate of its asset beta is 1.05 Company's operating profit (EBIT) is expected to be s2,000,000 in the foreseeable future. Assume no net investment in fixed assets (only depreciated assets are replenished) and working capital. ABC currently has 1,000,000 outstanding shares a. On the basis of this information, what are the unlevered company's market value and its share price? b. Assume that company is planning to recapitalize to reach an optimal capital structure. Assuming that company will use the new debt to repurchase its shares, for each D/V level determine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts