Question: please help me asap Points 1 Bronx has been working since she was 18 years old and is now age 60. She plans on retiring

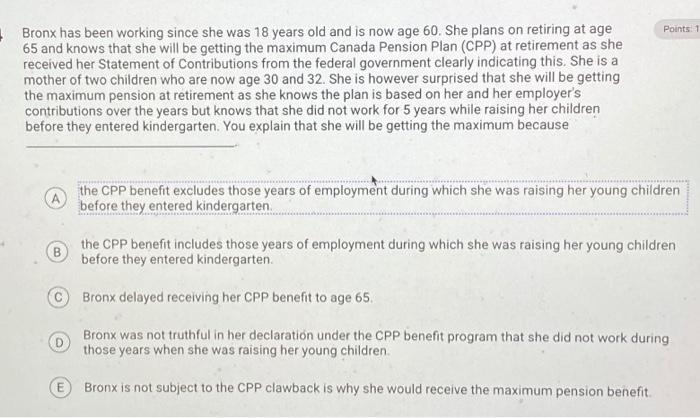

Points 1 Bronx has been working since she was 18 years old and is now age 60. She plans on retiring at age 65 and knows that she will be getting the maximum Canada Pension Plan (CPP) at retirement as she received her Statement of Contributions from the federal government clearly indicating this. She is a mother of two children who are now age 30 and 32. She is however surprised that she will be getting the maximum pension at retirement as she knows the plan is based on her and her employer's contributions over the years but knows that she did not work for 5 years while raising her children before they entered kindergarten. You explain that she will be getting the maximum because A the CPP benefit excludes those years of employment during which she was raising her young children before they entered kindergarten B the CPP benefit includes those years of employment during which she was raising her young children before they entered kindergarten Bronx delayed receiving her CPP benefit to age 65. D Bronx was not truthful in her declaration under the CPP benefit program that she did not work during those years when she was raising her young children E Bronx is not subject to the CPP clawback is why she would receive the maximum pension benefit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts