Question: please help me check am i doing correct for (a) and please answer question (b) Thank you. Question 1 sume 2019 Jan. A fund manager

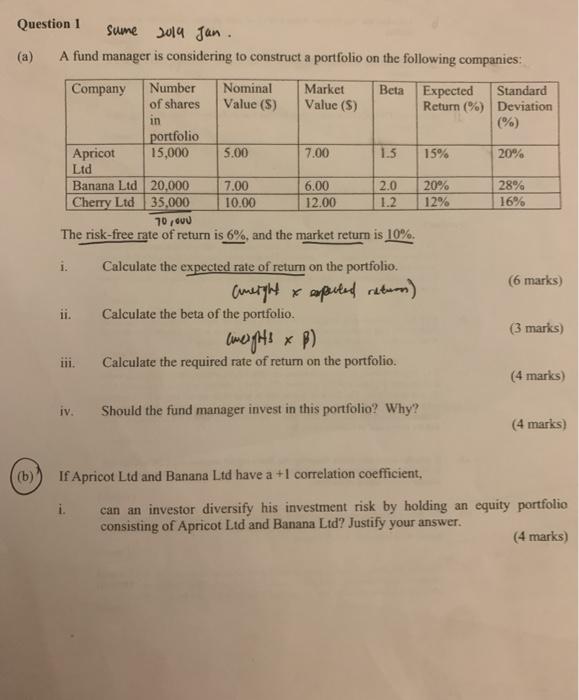

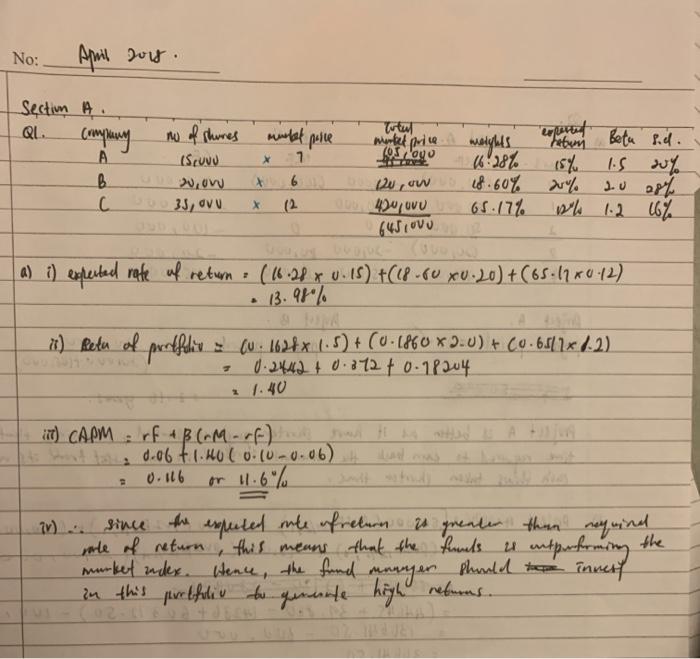

Question 1 sume 2019 Jan. A fund manager is considering to construct a portfolio on the following companies: Company Number Nominal Market Beta Expected Standard of shares Value (S) Value (5) Return (%) Deviation in (%) portfolio Apricot 15,000 5.00 7.00 1.5 15% 20% Ltd Banana Ltd 20,000 7.00 6.00 2.0 20% 28% Cherry Ltd 35.000 10.00 12.00 1.2 12% 16% 70,000 The risk-free rate of return is 6%, and the market return is 10%. i. (6 marks) ii. Calculate the expected rate of return on the portfolio. ameight & expected return) Calculate the beta of the portfolio. ( weights x B) Calculate the required rate of return on the portfolio. (3 marks) iii. (4 marks) iv. Should the fund manager invest in this portfolio? Why? (4 marks) (b) If Apricot Ltd and Banana Ltd have a +1 correlation coefficient, i. can an investor diversify his investment risk by holding an equity portfolio consisting of Apricot Ltd and Banana Ltd? Justify your answer. (4 marks) No: April Joy. molt pare Section A QL. company A B. C X 1 no of shores ISCONO 20, ow 35, OVU Titul model price walglets 16.28% 12w, ow 18.60% 400 UN 65.17% esperant 15% IS 20% 25% su 986 1.2 16% X (2 64JI OVU a) i) expected rate of return: (66.28 xw.cs) tlp.60 x0.20)+(65:17*0:12) 13.97% *) Rete of portfelis Cu: 1628x (:S)+(0.1860 *3.0) + (0.65/1x1-2). . 0.2442 + 0.372 f 0.18204 11.40 + n) CAPM : rf & B (rMof) th d t hs with a 0.06 +1.0 C 0.0 -0.06) 0.116 or 11.6% 2 iv). Since since the expected te freturn is greater than nequind me of return, this means that the finants it in performing the Hence, the fund manyen phould the innert in this portfolio to genuude high returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts