Question: Please help me! complete both problems please! i will like correct answers! Clemson Store has a cost of equity of 11.4 percent, the VTM on

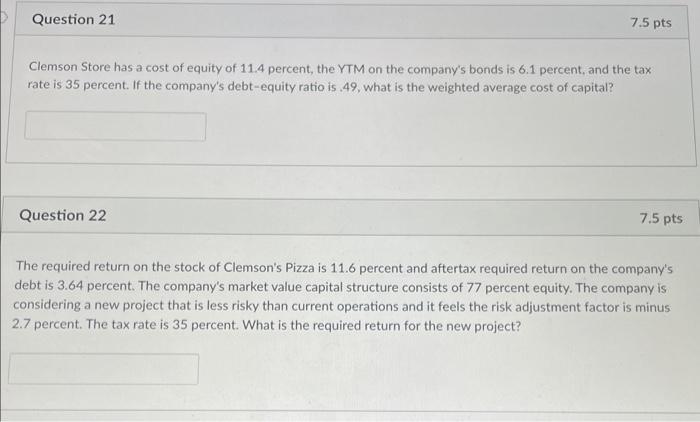

Clemson Store has a cost of equity of 11.4 percent, the VTM on the company's bonds is 6.1 percent, and the tax rate is 35 percent. If the company's debt-equity ratio is .49 , what is the weighted average cost of capital? Question 22 \\( 7.5 \\mathrm{pts} \\) The required return on the stock of Clemson's Pizza is 11.6 percent and aftertax required return on the company's debt is 3.64 percent. The company's market value capital structure consists of 77 percent equity. The company is considering a new project that is less risky than current operations and it feels the risk adjustment factor is minus: 2.7 percent. The tax rate is 35 percent. What is the required return for the new project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts