Question: Problems Valuation Stocks Problem 1: One-stage model (from now constant growth for ever) You want to determine the potential valuation for the firm LGM using

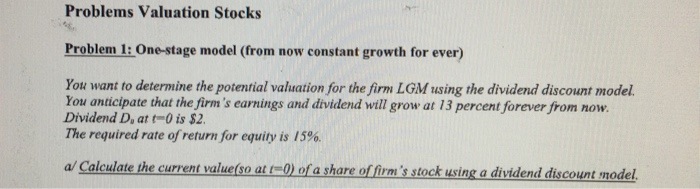

Problems Valuation Stocks Problem 1: One-stage model (from now constant growth for ever) You want to determine the potential valuation for the firm LGM using the dividend discount model You anticipate that the firm's earnings and dividend will grow at 13 percent forever from Dividend D, at t-0 is $2 The required rate of return for equity is 15% now a/ Calculate the current value(so at t=0) of a share of firm's stock using a dividend discount model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts