Question: Please help me do 9-7 FIFO, LIFO, and average cost. The second picture is how I need to format it. y turnover ory. 9-6 On

Please help me do 9-7 FIFO, LIFO, and average cost. The second picture is how I need to format it.

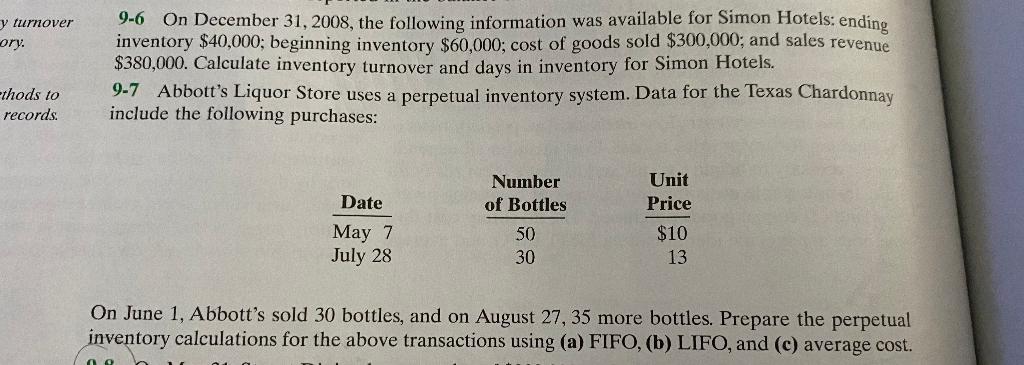

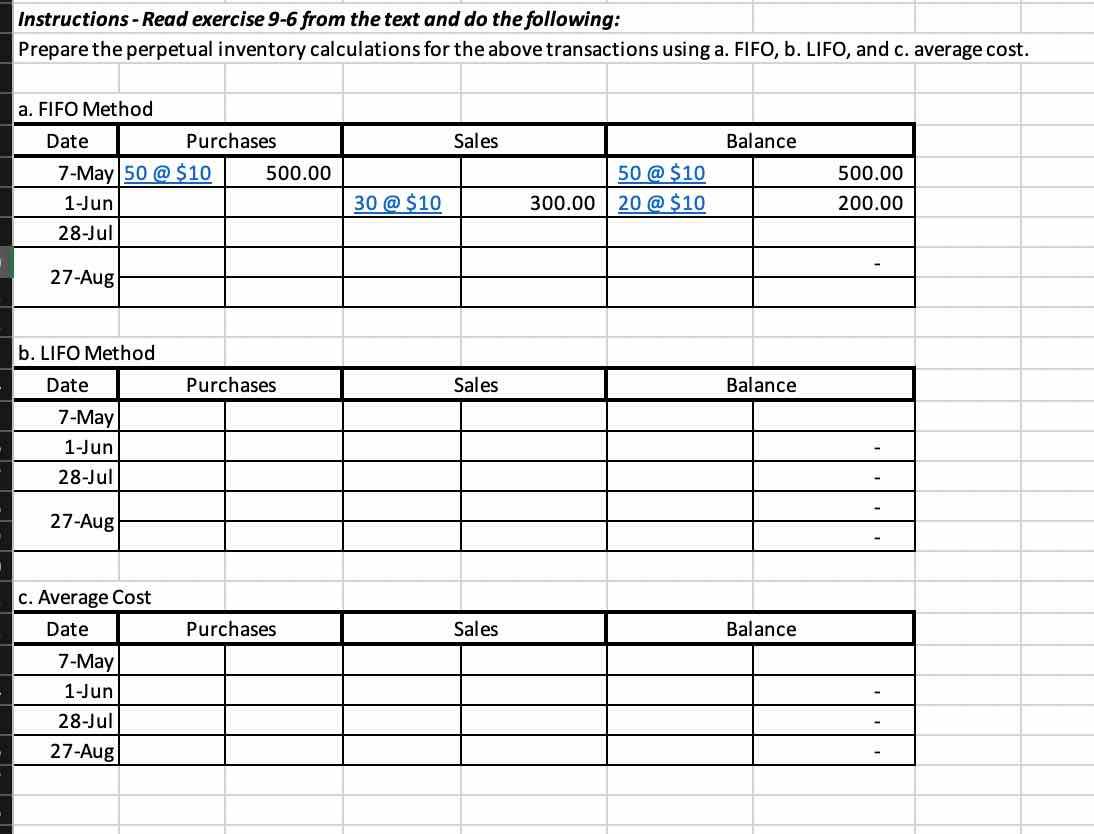

y turnover ory. 9-6 On December 31, 2008, the following information was available for Simon Hotels: ending inventory $40,000; beginning inventory $60,000; cost of goods sold $300,000; and sales revenue $380,000. Calculate inventory turnover and days in inventory for Simon Hotels. 9-7 Abbott's Liquor Store uses a perpetual inventory system. Data for the Texas Chardonnay include the following purchases: -thods to records Number of Bottles Unit Price Date May 7 July 28 50 30 $10 13 On June 1, Abbott's sold 30 bottles, and on August 27,35 more bottles. Prepare the perpetual inventory calculations for the above transactions using (a) FIFO, (b) LIFO, and (c) average cost. Instructions - Read exercise 9-6 from the text and do the following: Prepare the perpetual inventory calculations for the above transactions using a. FIFO, b.LIFO, and c. average cost. a. FIFO Method Sales Balance Date Purchases 7-May 50 @ $10 500.00 1-Jun 28-Jul 50 @ $10 20 @ $10 500.00 200.00 30 @ $10 300.00 27-Aug b. LIFO Method Date Purchases Sales Balance 7-May 1-Jun 28-Jul 27-Aug C. Average Cost Date Purchases Sales Balance 7-May 1-Jun 28-Jul 27-Aug

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts