Question: please help me do it in excel(spreadsheet) please. please provide the steps please. i know the solution but its hard for me to enter it

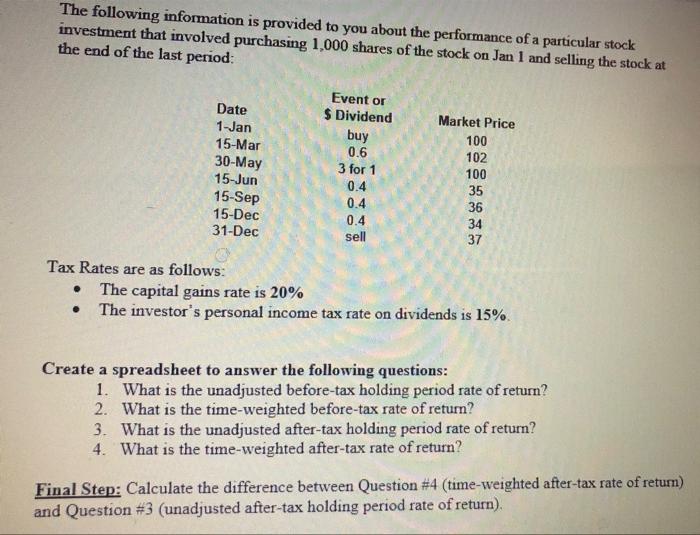

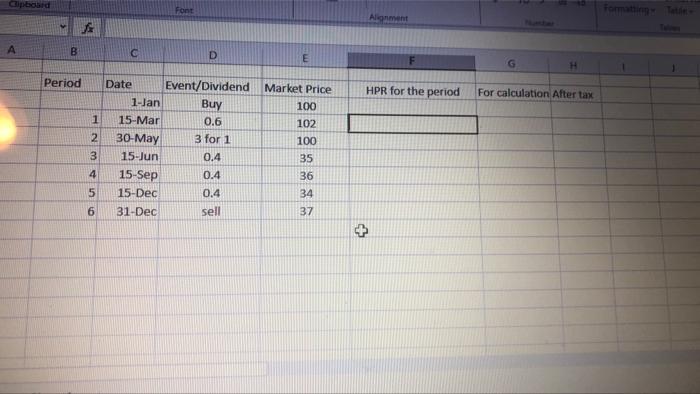

The following information is provided to you about the performance of a particular stock investment that involved purchasing 1,000 shares of the stock on Jan 1 and selling the stock at the end of the last period: Event or $ Dividend buy 0.6 Date 1-Jan 15-Mar 30-May 15-Jun 15-Sep 15-Dec 31-Dec 3 for 1 0.4 0.4 0.4 sell Market Price 100 102 100 35 36 34 37 Tax Rates are as follows: The capital gains rate is 20% The investor's personal income tax rate on dividends is 15% Create a spreadsheet to answer the following questions: 1. What is the unadjusted before-tax holding period rate of return? 2. What is the time-weighted before-tax rate of return? 3. What is the unadjusted after-tax holding period rate of return? 4. What is the time-weighted after-tax rate of return? Final Step: Calculate the difference between Question #4 (time-weighted after-tax rate of return) and Question #3 (unadjusted after-tax holding period rate of return). Gipboard Font Format Alignment A B C D E F H HPR for the period For calculation After tax Period Date Event/Dividend 1-Jan Buy 1 15-Mar 0.6 2 30-May 3 for 1 3 15-Jun 0.4 4 15-Sep 0.4 5 15-Dec 0.4 6 31-Dec sell Market Price 100 102 100 35 36 34 37 +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts