Question: Please help me do the following question as instructed and would be glad if explanation is provided as well. value: 10.00 points Pachel Corporation reports

Please help me do the following question as instructed and would be glad if explanation is provided as well.

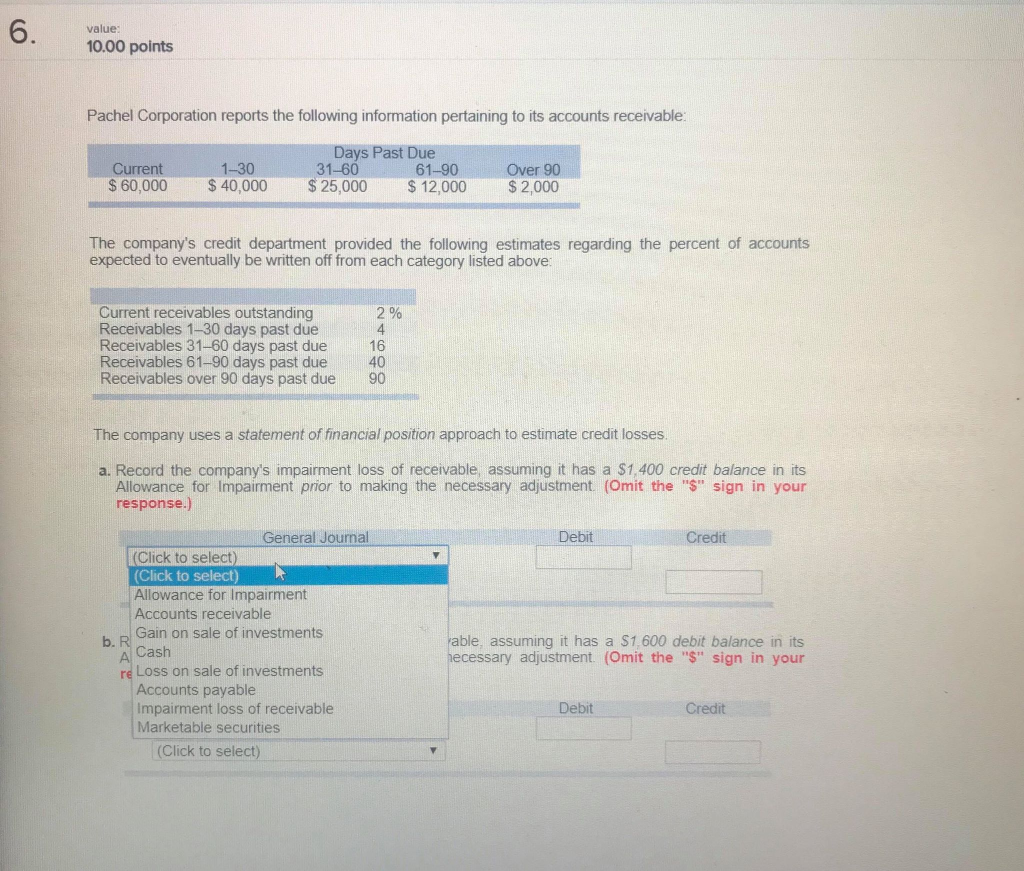

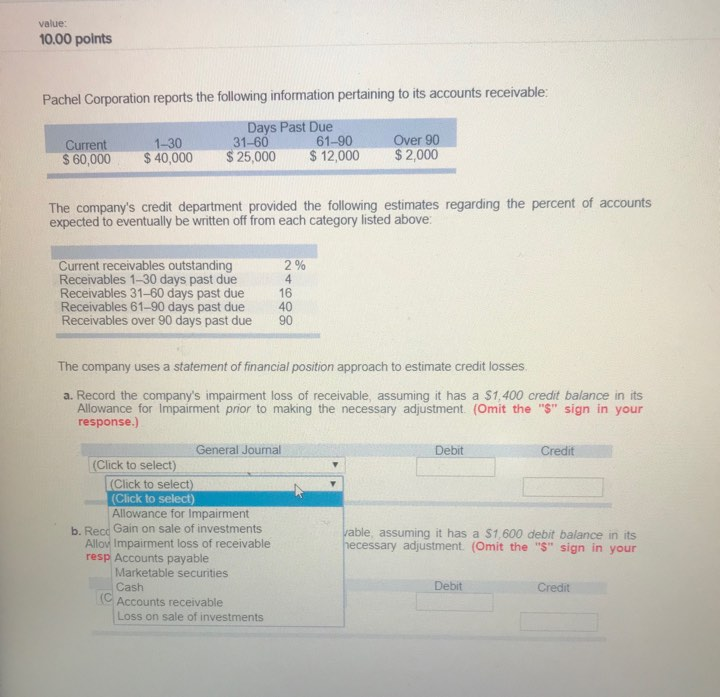

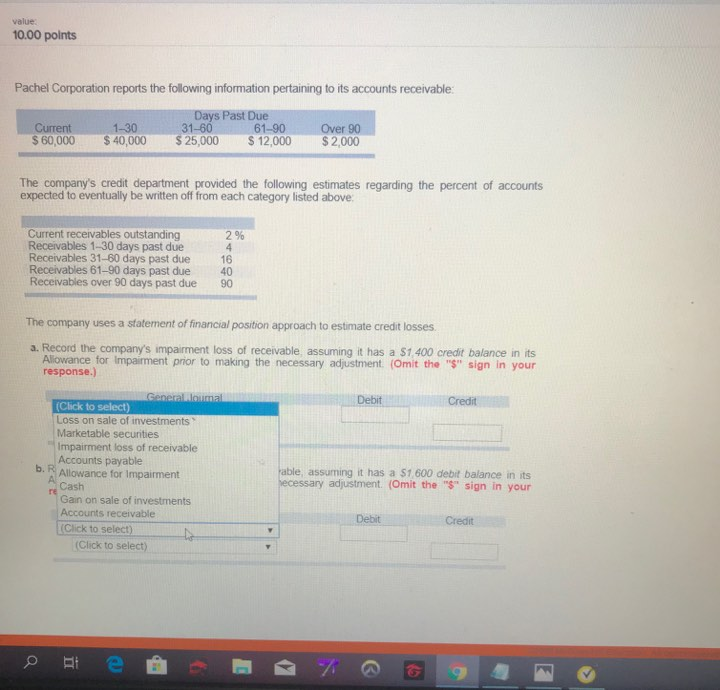

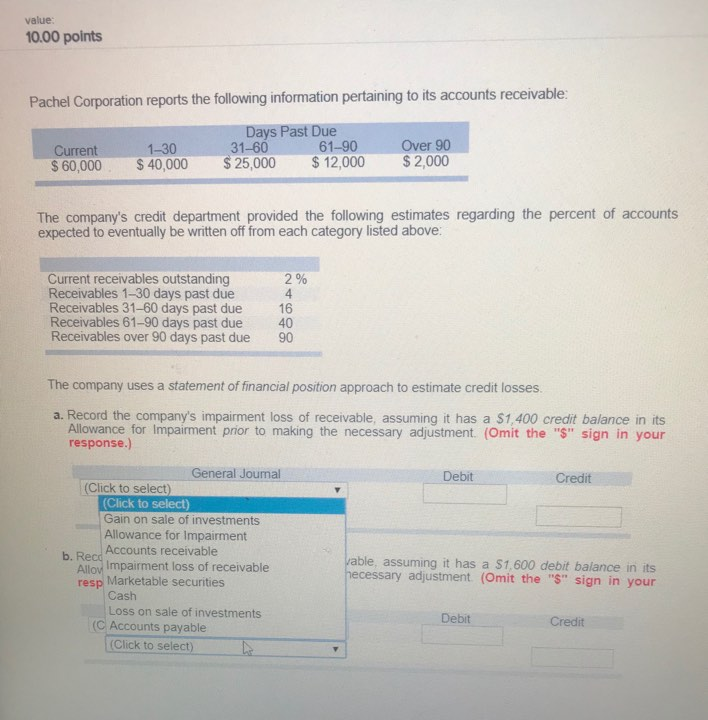

value: 10.00 points Pachel Corporation reports the following information pertaining to its accounts receivable: Days Past Due 31-60 $ 60,000 $40,000 $25,000 12,000 $2,000 Current 1-30 61-90 Over 90 The company's credit department provided the following estimates regarding the percent of accounts expected to eventually be written off from each category listed above Current receivables outstanding Receivables 1-30 days past due Receivables 31-60 days past due6 Receivables 61-90 days past due 40 Receivables over 90 days past due 90 2% 4 The company uses a statement of financial position approach to estimate credit losses. a. Record the company's impairment loss of receivable, assuming it has a S1,400 credit balance in its Allowance for Impairment prior to making the necessary adjustment. (Omit the "$" sign in your response.) General Journal Debit Credit (Click to select) (Click to select) Allowance for Impairment Accounts receivable Gain on sale of investments Cash able, assuming it has a S1,600 debit balance in its ecessary adjustment (Omit the "s" sign in your re Loss on sale of investments Accounts payable Impairment loss of receivable Marketable securities Debit Credit (Click to select) value: 10.00 points Pachel Corporation reports the following information pertaining to its accounts receivable: Days Past Due 1-30 31-60 61 61-90 Over 90 Current $ 60,000 40,000 $25,000 12,000 $ 2,000 The company's credit department provided the following estimates regarding the percent of accounts expected to eventually be written off from each category listed above Current receivables outstanding Receivables 1-30 days past due Receivables 31-60 days past due Receivables 61-90 days past due Receivables over 90 days past due 2% 4 16 40 90 The company uses a statement of financial position approach to estimate credit losses a. Record the company's impairment loss of receivable, assuming it has a $1,400 credit balance in its Allowance for Impairment prior to making the necessary adjustment. (Omit the "$" sign in your response.) General Journal Debit Credit (Click to select) (Click to select) (Click to select) Allowance for Impairment b. Recd Gain on sale of investments Allov Impairment loss of receivable resp Accounts payable able, assuming it has a $1,600 debit balance in its ecessary adjustment. (Omit the "S" sign in your Marketable securities Cash Debit Credit C Accounts receivable Loss on sale of investments value: 10.00 polnts Pachel Corporation reports the following information pertaining to its accounts receivable Past Due 31-60 Current S 60,000 $40,000 $25,000 $ 12,000 $ 2,000 1-30 61-90 Over 90 The company's credit department provided the following estimates regarding the percent of accounts expected to eventually be written off from each category listed above Current receivables outstanding Receivables 1-30 days past due Receivables 31-60 days past due 16 Receivables 61-90 days past due 40 Receivables over 90 days past due 90 2% The company uses a statement of financial position approach to estimate credit losses a. Record the company's impairment loss of receivable assuming it has a S1 400 credt balance in its Alowance for impairment prior to making the necessary adjustment. (Omit the "$" sign in your response.) Debit Credit Click to select) Loss on sale of investments Marketable securities Impairment loss of receivable Accounts payable Allowance for Impairment Cash Gain on sale of investments Accounts receivable able, assuming it has a $1,600 debit balance in its ecessary adjustment. (Omit the "$" sign in your b. re Debit Credit Click to select) (Click to select) value: 10.00 points Pachel Corporation reports the following information pertaining to its accounts receivable Days Past Due 31-60 61-90 Over 90 Current $ 60,000 $40,000 25,000 12,000 $2,000 1-30 The company's credit department provided the following estimates regarding the percent of accounts expected to eventually be written off from each category listed above 2% Current receivables outstanding Receivables 1-30 days past due Receivables 31-60 days past due Receivables 61-90 days past due Receivables over 90 days past due 4 16 40 90 The company uses a statement of financial position approach to estimate credit losses. a. Record the company's impairment loss of receivable, assuming it has a $1,400 credit balance in its Allowance for Impairment prior to making the necessary adjustment. (Omit the "" sign in your response.) General Joumal Debit Credit (Click to select) Click to select) Gain on sale of investments Allowance for Impairment Accounts receivable b. Rec Allov Impairment loss of receivable resp Marketable securities able, assuming it has a S1,600 debit balance in its ecessary adjustment (Omit the "S" sign in your Cash Loss on sale of investments Debit Credit (C Accounts payable (Click to select)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts