Question: please help me do this on excel and show functions i really am struggling 1) Open Excel/ Google Sheets and create a new sheet 2)

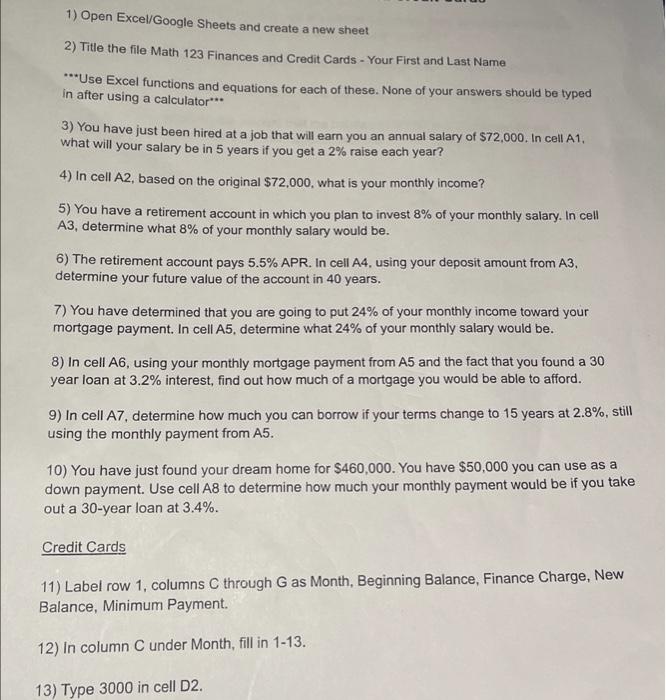

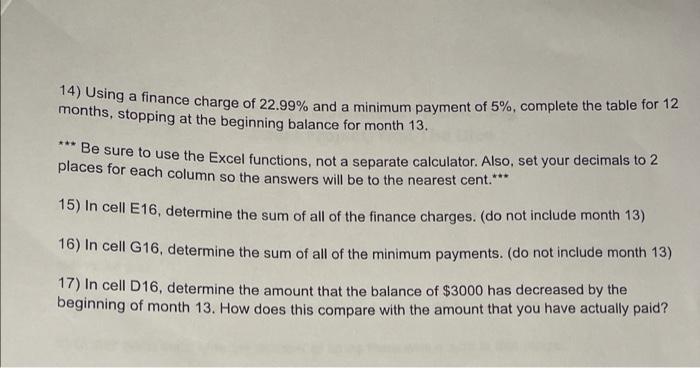

1) Open Excel/ Google Sheets and create a new sheet 2) Title the file Math 123 Finances and Credit Cards - Your First and Last Name ***Use Excel functions and equations for each of these. None of your answers should be typed in after using a calculator*** 3) You have just been hired at a job that will earn you an annual salary of $72,000. In cell A1. what will your salary be in 5 years if you get a 2% raise each year? 4) In cell A2, based on the original $72,000, what is your monthly income? 5) You have a retirement account in which you plan to invest 8% of your monthly salary. In cell A3, determine what 8% of your monthly salary would be. 6) The retirement account pays 5.5% APR. In cell A4, using your deposit amount from A3. determine your future value of the account in 40 years. 7) You have determined that you are going to put 24% of your monthly income toward your mortgage payment. In cell A5, determine what 24% of your monthly salary would be. 8) In cell A6, using your monthly mortgage payment from A5 and the fact that you found a 30 year loan at 3.2% interest, find out how much of a mortgage you would be able to afford. 9) In cell A7, determine how much you can borrow if your terms change to 15 years at 2.8%, still using the monthly payment from A5. 10) You have just found your dream home for $460,000. You have $50,000 you can use as a down payment. Use cell A8 to determine how much your monthly payment would be if you take out a 30-year loan at 3.4%. Credit Cards 11) Label row 1, columns C through G as Month, Beginning Balance, Finance Charge, New Balance, Minimum Payment. 12) In column C under Month, fill in 1-13. 13) Type 3000 in cell D2. 14) Using a finance charge of 22.99% and a minimum payment of 5%, complete the table for 12 months, stopping at the beginning balance for month 13. Be sure to use the Excel functions, not a separate calculator. Also, set your decimals to 2 places for each column so the answers will be to the nearest cent.*** 15) In cell E16, determine the sum of all of the finance charges. (do not include month 13) 16) In cell G16, determine the sum of all of the minimum payments. (do not include month 13) 17) In cell D16, determine the amount that the balance of $3000 has decreased by the beginning of month 13. How does this compare with the amount that you have actually paid? 1) Open Excel/ Google Sheets and create a new sheet 2) Title the file Math 123 Finances and Credit Cards - Your First and Last Name ***Use Excel functions and equations for each of these. None of your answers should be typed in after using a calculator*** 3) You have just been hired at a job that will earn you an annual salary of $72,000. In cell A1. what will your salary be in 5 years if you get a 2% raise each year? 4) In cell A2, based on the original $72,000, what is your monthly income? 5) You have a retirement account in which you plan to invest 8% of your monthly salary. In cell A3, determine what 8% of your monthly salary would be. 6) The retirement account pays 5.5% APR. In cell A4, using your deposit amount from A3. determine your future value of the account in 40 years. 7) You have determined that you are going to put 24% of your monthly income toward your mortgage payment. In cell A5, determine what 24% of your monthly salary would be. 8) In cell A6, using your monthly mortgage payment from A5 and the fact that you found a 30 year loan at 3.2% interest, find out how much of a mortgage you would be able to afford. 9) In cell A7, determine how much you can borrow if your terms change to 15 years at 2.8%, still using the monthly payment from A5. 10) You have just found your dream home for $460,000. You have $50,000 you can use as a down payment. Use cell A8 to determine how much your monthly payment would be if you take out a 30-year loan at 3.4%. Credit Cards 11) Label row 1, columns C through G as Month, Beginning Balance, Finance Charge, New Balance, Minimum Payment. 12) In column C under Month, fill in 1-13. 13) Type 3000 in cell D2. 14) Using a finance charge of 22.99% and a minimum payment of 5%, complete the table for 12 months, stopping at the beginning balance for month 13. Be sure to use the Excel functions, not a separate calculator. Also, set your decimals to 2 places for each column so the answers will be to the nearest cent.*** 15) In cell E16, determine the sum of all of the finance charges. (do not include month 13) 16) In cell G16, determine the sum of all of the minimum payments. (do not include month 13) 17) In cell D16, determine the amount that the balance of $3000 has decreased by the beginning of month 13. How does this compare with the amount that you have actually paid

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts