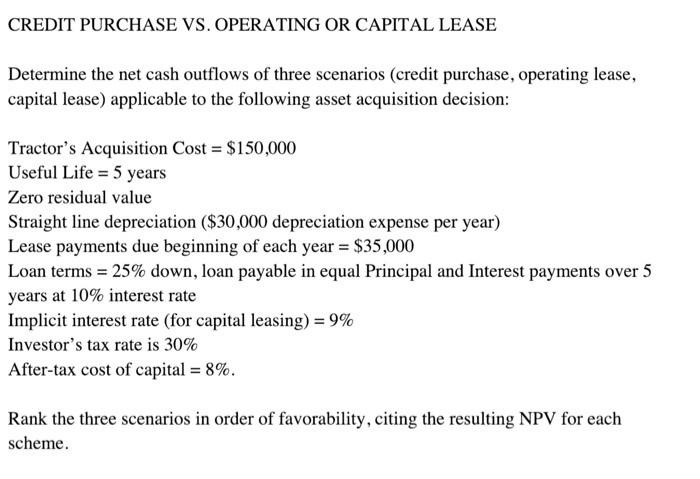

Question: Please help me do this problem, thank you very much! CREDIT PURCHASE VS. OPERATING OR CAPITAL LEASE Determine the net cash outflows of three scenarios

CREDIT PURCHASE VS. OPERATING OR CAPITAL LEASE Determine the net cash outflows of three scenarios (credit purchase, operating lease, capital lease) applicable to the following asset acquisition decision Tractor's Acquisition Cost = $150,000 Useful Life 5 years Zero residual value Straight line depreciation ($30,000 depreciation expense per year) Lease payments due beginning of each year $35,000 Loan terms-25% down, loan payable in equal Principal and interest payments over 5 years at 10% interest rate Implicit interest rate (for capital leasing) = 9% investor's tax rate is 30% After-tax cost of capital 8% Rank the three scenarios in order of favorability, citing the resulting NPV for each scheme

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts