Question: Please help me do this question, and my D8 =0. Please also make sure the your answers are all accurate and your words should be

Please help me do this question, and my D8 =0. Please also make sure the your answers are all accurate and your words should be clearly seen (Dont write too ugly). Thanks

Please help me do this question, and my D8 =0. Please also make sure the your answers are all accurate and your words should be clearly seen (Dont write too ugly). Thanks

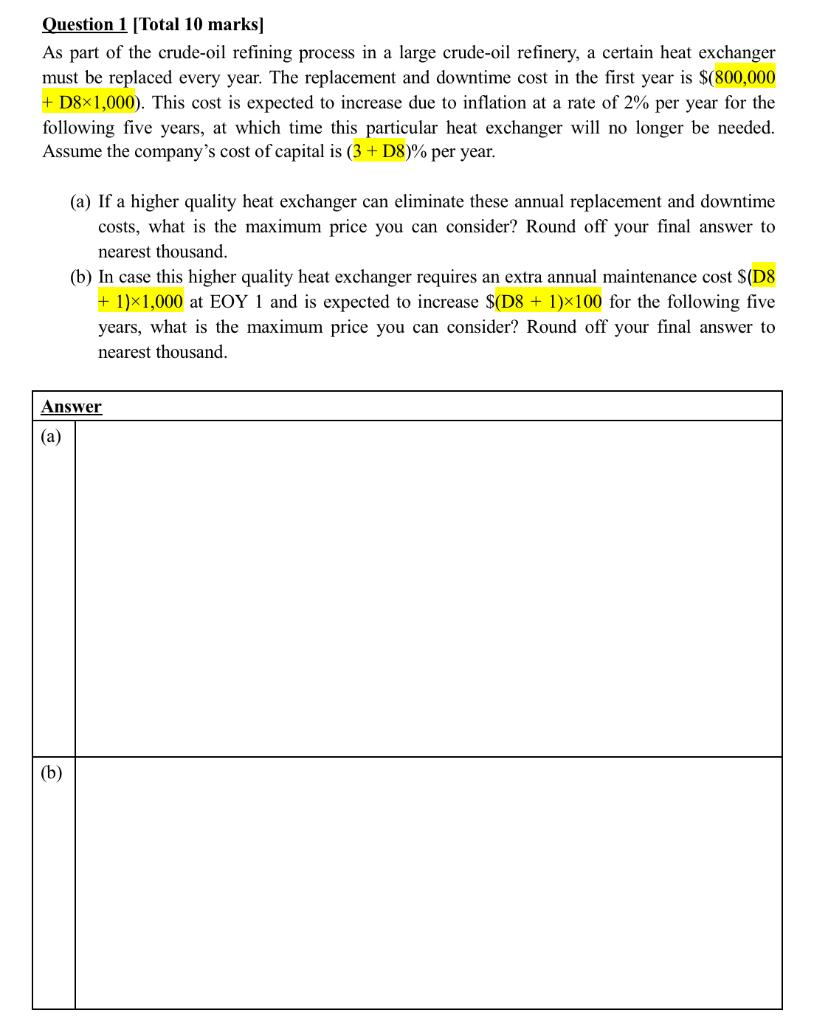

Question 1 [Total 10 marks] As part of the crude-oil refining process in a large crude oil refinery, a certain heat exchanger must be replaced every year. The replacement and downtime cost in the first year is $(800,000 + D81,000). This cost is expected to increase due to inflation at a rate of 2% per year for the following five years, at which time this particular heat exchanger will no longer be needed. Assume the company's cost of capital is (3 +D8% per year. (a) If a higher quality heat exchanger can eliminate these annual replacement and downtime costs, what is the maximum price you can consider? Round off your final answer to nearest thousand. (b) In case this higher quality heat exchanger requires an extra annual maintenance cost $(DS + 1)*1,000 at EOY 1 and is expected to increase $(D8 + 1)x100 for the following five years, what is the maximum price you can consider? Round off your final answer to nearest thousand. Answer (a) (b) Question 1 [Total 10 marks] As part of the crude-oil refining process in a large crude oil refinery, a certain heat exchanger must be replaced every year. The replacement and downtime cost in the first year is $(800,000 + D81,000). This cost is expected to increase due to inflation at a rate of 2% per year for the following five years, at which time this particular heat exchanger will no longer be needed. Assume the company's cost of capital is (3 +D8% per year. (a) If a higher quality heat exchanger can eliminate these annual replacement and downtime costs, what is the maximum price you can consider? Round off your final answer to nearest thousand. (b) In case this higher quality heat exchanger requires an extra annual maintenance cost $(DS + 1)*1,000 at EOY 1 and is expected to increase $(D8 + 1)x100 for the following five years, what is the maximum price you can consider? Round off your final answer to nearest thousand. Answer (a) (b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts