Question: Please help me figure out the correct answer. Exercise 13-25 (Algorithmic) (LO. 7) Compute the additional Medicare tax for the following taxpayers. If required, round

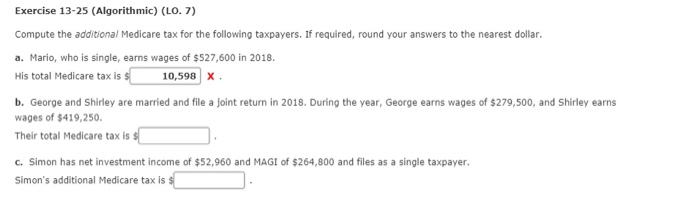

Exercise 13-25 (Algorithmic) (LO. 7) Compute the additional Medicare tax for the following taxpayers. If required, round your answers to the nearest dollar. a. Mario, who is single, earns wages of $527,600 in 2018 His total Medicare tax is 10,598 x b. George and Shirley are married and file a joint return in 2018. During the year, George earns wages of $279,500, and Shirley earns wages of $419,250 Their total Medicare tax is c. Simon has net investment income of $52,960 and MAGI of $264,800 and files as a single taxpayer. Simon's additional Medicare tax is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts