Question: please help me figure out the formulas D E G You are an intern in the treasurer's office at Hawkins Metal Products, and you have

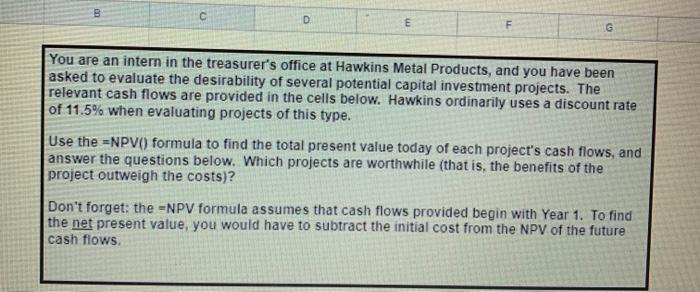

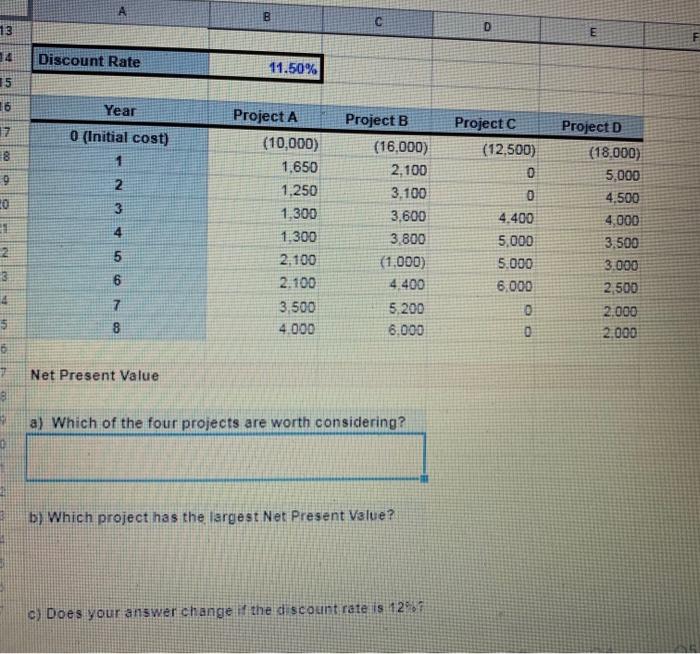

D E G You are an intern in the treasurer's office at Hawkins Metal Products, and you have been asked to evaluate the desirability of several potential capital investment projects. The relevant cash flows are provided in the cells below. Hawkins ordinarily uses a discount rate of 11.5% when evaluating projects of this type. Use the =NPVI) formula to find the total present value today of each project's cash flows, and answer the questions below. Which projects are worthwhile (that is, the benefits of the project outweigh the costs)? Don't forget: the =NPV formula assumes that cash flows provided begin with Year 1. To find the net present value, you would have to subtract the initial cost from the NPV of the future cash flows B 13 D E 14 Discount Rate 11.50% 15 16 Year 7 7 Project C (12,500) 0 O (Initial cost) 1 2 00: 9 0 3 Project A (10,000) 1,650 1.250 1.300 1.300 2.100 2.100 3,500 4.000 Project B (16,000) 2,100 3.100 3.600 3.800 (1,000) 4.400 5.200 6.000 Project D (18.000) 5,000 4.500 4,000 3.500 3.000 2.500 2.000 2.000 5 6 4.400 5,000 5.000 6,000 0 0 2 2 3 5 4. 5 6 7 8 Net Present Value a) Which of the four projects are worth considering? b) Which project has the largest Net Present Value? c) Does your answer change the discount rate is 1297

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts