Question: please include formulas You are an intern in the treasurer's office at Hawkins Metal Products, and you have been asked to evaluate the desirability of

please include formulas

please include formulas

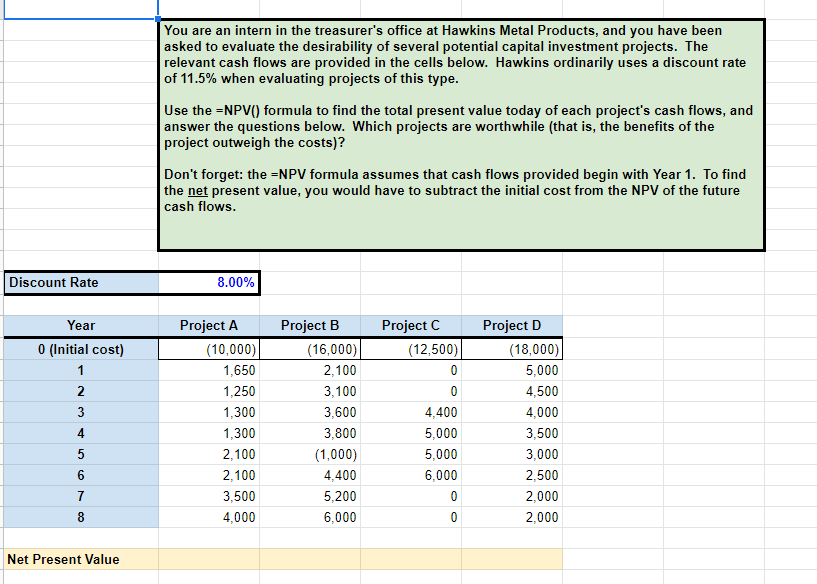

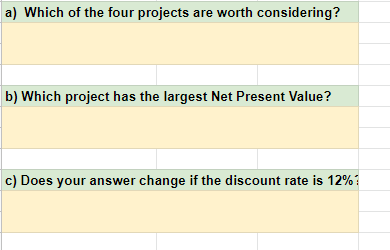

You are an intern in the treasurer's office at Hawkins Metal Products, and you have been asked to evaluate the desirability of several potential capital investment projects. The relevant cash flows are provided in the cells below. Hawkins ordinarily uses a discount rate of 11.5% when evaluating projects of this type. Use the =NPV() formula to find the total present value today of each project's cash flows, and answer the questions below. Which projects are worthwhile (that is, the benefits of the project outweigh the costs)? Don't forget: the =NPV formula assumes that cash flows provided begin with Year 1. To find the net present value, you would have to subtract the initial cost from the NPV of the future cash flows. Discount Rate 8.00% Year 0 (Initial cost) 1 2 3 Project A (10,000) 1,650 1,250 1,300 1,300 2,100 2.100 3,500 4,000 Project B (16,000) 2,100 3,100 3,600 3,800 (1,000) 4,400 5,200 6,000 Project C (12,500) 0 0 4,400 5,000 5,000 6,000 0 0 Project D (18,000) 5,000 4,500 4,000 3,500 3,000 2,500 2,000 2.000 4 5 6 7 8 Net Present Value a) Which of the four projects are worth considering? b) Which project has the largest Net Present Value? c) Does your answer change if the discount rate is 12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts