Question: please help me fill out this form 2441, I really need help with this, i am not sure where to start. Gereral Facks Roduey and

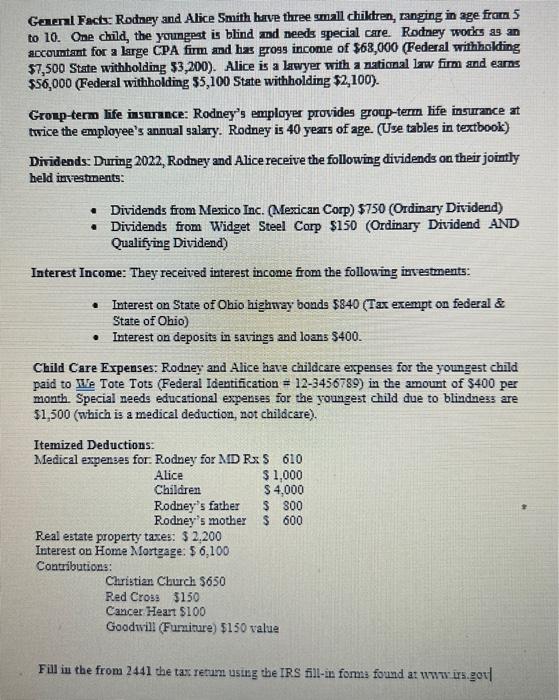

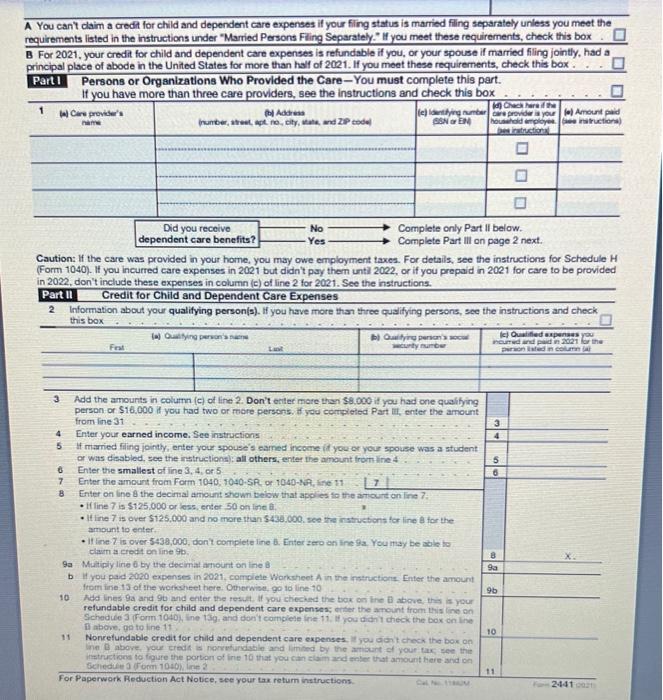

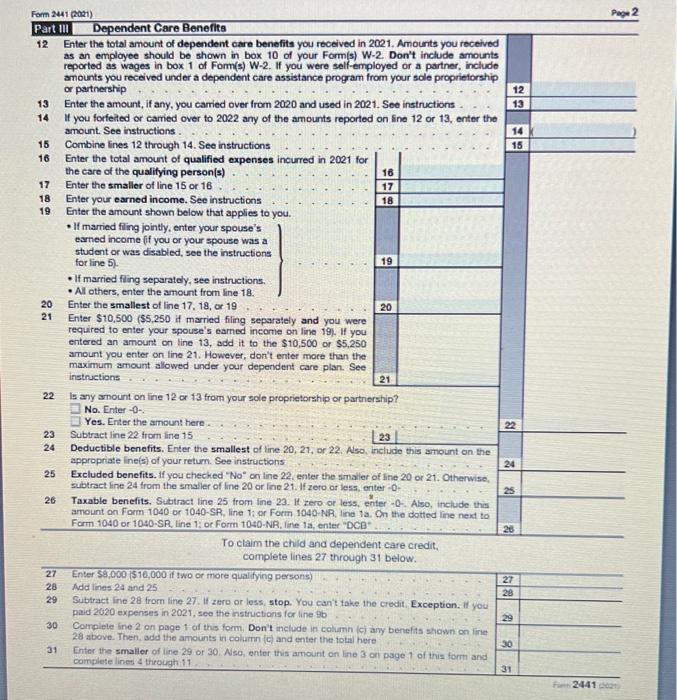

Gereral Facks Roduey and Alice 5mith have three wamall children, ranging in age fram 5 to 10 . One child, the youngrat is blind mod needs qpecial care. Rodney works as an accountant for a large CPA firm and has gross income of $68,000 (Federal witholding $7,500 State withholding $3,200 ). Alice is a lawyer with a national law firm and earns $56,000 (Federal withholding 55,100 State withholding $2,100 ). Gromp-term life insurance: Rodney's employer provides group-term life insurance at twice the employee's annual salary. Rodney is 40 years of age. (Use tables in textbook) Divideads: During 2022, Rodney and Alice receive the following dividends on their jointly held imestments: - Dividends from Mexico Inc. (Mexican Corp) $750 (Ordinary Dividend) - Dividends from Widget Steel Corp $150 (Ordinary Dividend AND Qualifying Dividend) Interest Income: They received interest income from the following invegtments: - Interest on State of Ohio highway bonds $840 (Tax exempt on federal \& State of Ohio) - Interest on deposits in savings and loans $400. Child Care Expenses: Rodney and Alice have childicare expenses for the youngest child paid to TWe Tote Tots (Federal Identification =123456789 ) in the amount of $400 per month Special needs educational expenses for the youngest child due to blindness are $1,500 (which is a medical deduction, not childcare). Itemized Deductions: Fill in the from 2441 the tax retum usugg the IRS fill-in forma found at www irs.gor| A You can' daim a credit for child and dependent care expenses if your filing status is married fling separately unless you meet the requirements listed in the instructions under "Married Persons Fling Separately." If you meet these requirements, check this box B For 2021, your credit for child and dependent care expenses is refundable if you, or your spouse if married fling jointly, had a principal place of abode in the United States for more than half of 2021 . If you meet these requirements, check this box. Part I Persons or Organizations Who Provided the Care-You must complete this part. Caution: if the care was provided in your home, you may owe employment taxes. For details, see the instructions for Schedule H (Form 1040). If you incurred eare expenses in 2021 but didn't pay them unti 2022, or if you prepaid in 2021 for care to be provided in 2022, don't include these expenses in column (c) of line 2 for 2021 . See the instructions. Part il Credit for Child and Dependent Care Expenses 2 Information about your qualifying person(s). If you have more thar three qualifying persons, see the instructions and check this box Enter the smallest of line 17. 18, or 19 Enter $10,500 ( $5,250 if married filing separately and you were required to enter your spouse's earned income on line 19/. If you entered an amount on tine 13, add it to the $10,500 or $5,250 amount you enter on line 21. However, don't enter more than the maximum amount allowed under your dependent care plan. See instructions Gereral Facks Roduey and Alice 5mith have three wamall children, ranging in age fram 5 to 10 . One child, the youngrat is blind mod needs qpecial care. Rodney works as an accountant for a large CPA firm and has gross income of $68,000 (Federal witholding $7,500 State withholding $3,200 ). Alice is a lawyer with a national law firm and earns $56,000 (Federal withholding 55,100 State withholding $2,100 ). Gromp-term life insurance: Rodney's employer provides group-term life insurance at twice the employee's annual salary. Rodney is 40 years of age. (Use tables in textbook) Divideads: During 2022, Rodney and Alice receive the following dividends on their jointly held imestments: - Dividends from Mexico Inc. (Mexican Corp) $750 (Ordinary Dividend) - Dividends from Widget Steel Corp $150 (Ordinary Dividend AND Qualifying Dividend) Interest Income: They received interest income from the following invegtments: - Interest on State of Ohio highway bonds $840 (Tax exempt on federal \& State of Ohio) - Interest on deposits in savings and loans $400. Child Care Expenses: Rodney and Alice have childicare expenses for the youngest child paid to TWe Tote Tots (Federal Identification =123456789 ) in the amount of $400 per month Special needs educational expenses for the youngest child due to blindness are $1,500 (which is a medical deduction, not childcare). Itemized Deductions: Fill in the from 2441 the tax retum usugg the IRS fill-in forma found at www irs.gor| A You can' daim a credit for child and dependent care expenses if your filing status is married fling separately unless you meet the requirements listed in the instructions under "Married Persons Fling Separately." If you meet these requirements, check this box B For 2021, your credit for child and dependent care expenses is refundable if you, or your spouse if married fling jointly, had a principal place of abode in the United States for more than half of 2021 . If you meet these requirements, check this box. Part I Persons or Organizations Who Provided the Care-You must complete this part. Caution: if the care was provided in your home, you may owe employment taxes. For details, see the instructions for Schedule H (Form 1040). If you incurred eare expenses in 2021 but didn't pay them unti 2022, or if you prepaid in 2021 for care to be provided in 2022, don't include these expenses in column (c) of line 2 for 2021 . See the instructions. Part il Credit for Child and Dependent Care Expenses 2 Information about your qualifying person(s). If you have more thar three qualifying persons, see the instructions and check this box Enter the smallest of line 17. 18, or 19 Enter $10,500 ( $5,250 if married filing separately and you were required to enter your spouse's earned income on line 19/. If you entered an amount on tine 13, add it to the $10,500 or $5,250 amount you enter on line 21. However, don't enter more than the maximum amount allowed under your dependent care plan. See instructions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts