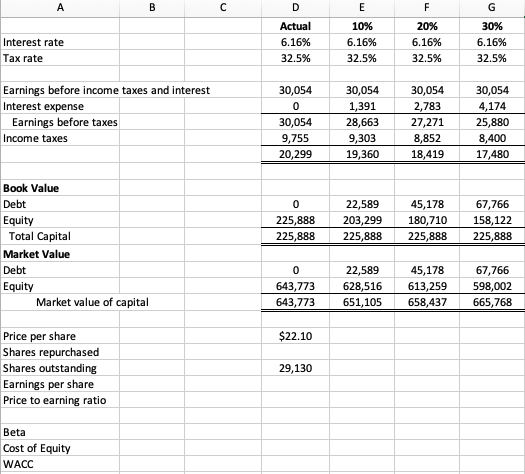

Question: Please help me fill this out for each debt scenario. & please explain how you got the answers. Notes: (1)Interest rate of CPKs credit facility

Please help me fill this out for each debt scenario. & please explain how you got the answers.

Notes: (1)Interest rate of CPKs credit facility with Bank of America: LIBOR + 0.80%. (2)Earnings before interest and taxes (EBIT) include interest income. (3)Market values of debt equal book values. (4)Actual market value of equity equals the share price ($22.10) multiplied by the current number of shares outstanding (29.13 million). (5)Assume a market rate of return of 10.2% for purposes of calculating the cost of equity and a risk-free rate of 5.2%. (6)Remember that the stock price reflects the benefit of the tax shield on interest payments. The share prices for stock repurchases reflect this benefit.

A B D E F G Interest rate Tax rate Actual 6.16% 32.5% 10% 6.16% 32.5% 20% 6.16% 32.5% 30% 6.16% 32.5% Earnings before income taxes and interest Interest expense Earnings before taxes Income taxes 30,054 0 30,054 9,755 20,299 30,054 1,391 28,663 9,303 19,360 30,054 2,783 27,271 8,852 18,419 30,054 4,174 25,880 8,400 17,480 0 225,888 225,888 22,589 203,299 225,888 45,178 180,710 225,888 Book Value Debt Equity Total Capital Market Value Debt Equity Market value of capital 67,766 158,122 225,888 0 643,773 643,773 22,589 628,516 651,105 45,178 613,259 658,437 67,766 598,002 665,768 $22.10 Price per share Shares repurchased Shares outstanding Earnings per share Price to earning ratio 29,130 Beta Cost of Equity WACC A B D E F G Interest rate Tax rate Actual 6.16% 32.5% 10% 6.16% 32.5% 20% 6.16% 32.5% 30% 6.16% 32.5% Earnings before income taxes and interest Interest expense Earnings before taxes Income taxes 30,054 0 30,054 9,755 20,299 30,054 1,391 28,663 9,303 19,360 30,054 2,783 27,271 8,852 18,419 30,054 4,174 25,880 8,400 17,480 0 225,888 225,888 22,589 203,299 225,888 45,178 180,710 225,888 Book Value Debt Equity Total Capital Market Value Debt Equity Market value of capital 67,766 158,122 225,888 0 643,773 643,773 22,589 628,516 651,105 45,178 613,259 658,437 67,766 598,002 665,768 $22.10 Price per share Shares repurchased Shares outstanding Earnings per share Price to earning ratio 29,130 Beta Cost of Equity WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts