Question: please help me fill this table out and explain how to get the numbers. thank you LIABILITIES AND EQUITY Current Liabilities: Notes payable Accounts payable

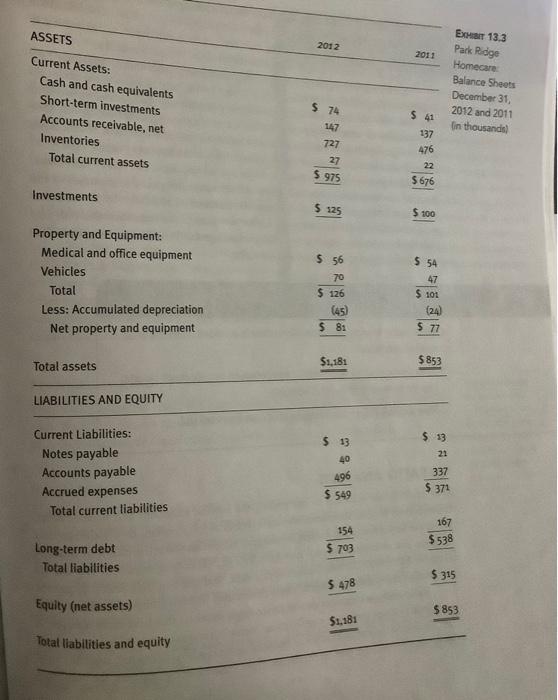

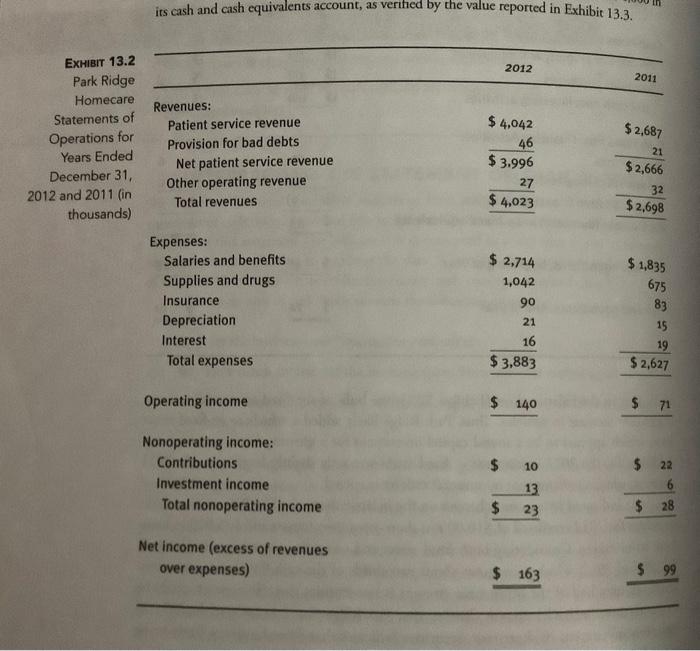

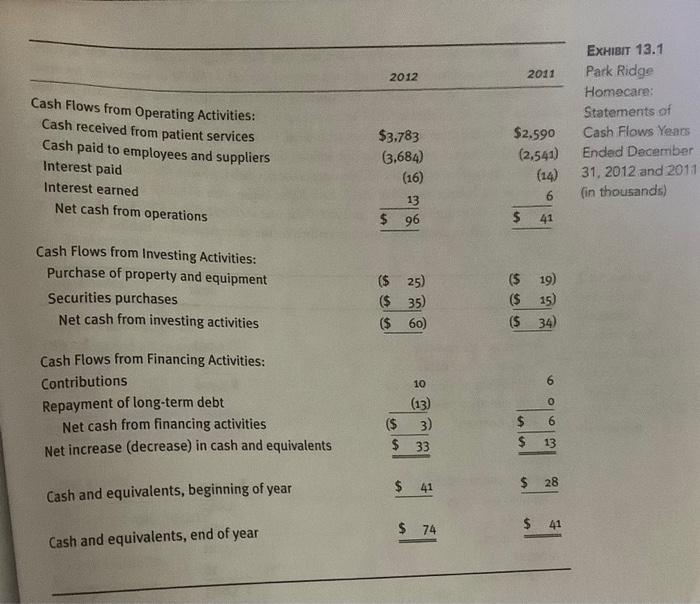

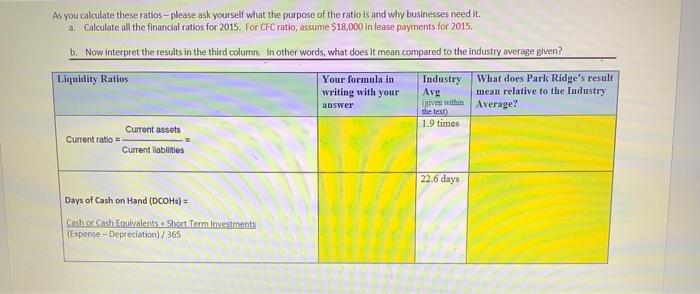

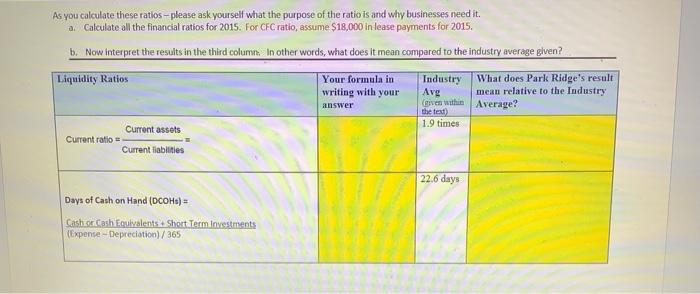

LIABILITIES AND EQUITY Current Liabilities: Notes payable Accounts payable Accrued expenses Total current liabilities Long-term debt Total liabilities Equity (net assets) Total liabilities and equity its cash and cash equivalents account, as verified by the value reported in Exhibit 13.3. ExHIBIT 13.1 Cash Flows from Operating Activities: 2012 2011 Park Ridge Homecare: Statements of Cash received from patient services Cash Flows Years Cash paid to employees and suppliers Ended Dacember Interest paid 31, 2012 and 2011 Interest earned Net cash from operations \begin{tabular}{rr} $3,783 & $2,590 \\ (3,684) & (2,541) \\ (16) & (14) \\ \hline 13 & 6 \\ \hline$96 & $41 \\ \hline \end{tabular} (in thousands) Cash Flows from Investing Activities: Purchase of property and equipment Securities purchases Net cash from investing activities \begin{tabular}{ll} ($25) & (519) \\ ($35) & ((15) \\ \hline($60) & ($34) \end{tabular} Cash Flows from Financing Activities: Contributions Repayment of long-term debt Net cash from financing activities Net increase (decrease) in cash and equivalents Cash and equivalents, beginning of year Cash and equivalents, end of year As you calculate these ratios - please ask yourself what the purpose of the ratio is and why businesses need it. a. Calculate all the financial ratios for 2015 . For CFC ratio, assume $18,000 in lease payments for 2015 . b. Now interpret the resuits in the third column, In other words, what does it mean compared to the industry average given? As you calculate these ratios - please ask yourself what the purpose of the ratio is and why businesses need it. a. Calculate all the financial ratios for 2015. For CFC ratio, assume $18,000 in lease payments for 2015 . b. Now interpret the results in the third column. In other words, what does it mean compared to the industry average given

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts