Question: Please help me find the answer ONLY for #2. please explain with details how you got there. thank you! Sachs Brands's defined benefit pension plan

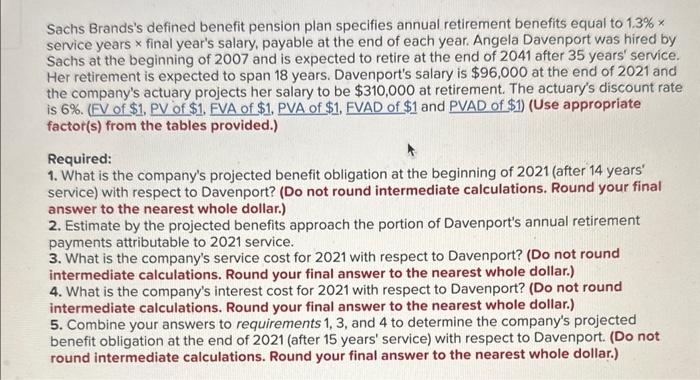

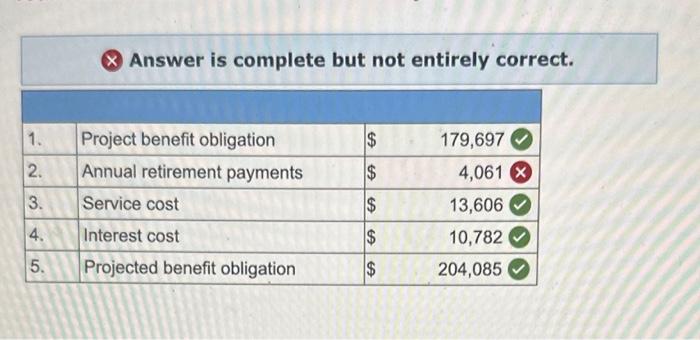

Sachs Brands's defined benefit pension plan specifies annual retirement benefits equal to 1.3% service years x final year's salary, payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2007 and is expected to retire at the end of 2041 after 35 years' service. Her retirement is expected to span 18 years. Davenport's salary is $96,000 at the end of 2021 and the company's actuary projects her salary to be $310,000 at retirement. The actuary's discount rate is 6\%. (FV of $1,PV of $1. FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1 ) (Use appropriate factor(s) from the tables provided.) Required: 1. What is the company's projected benefit obligation at the beginning of 2021 (after 14 years' service) with respect to Davenport? (Do not round intermediate calculations. Round your final answer to the nearest whole dollar.) 2. Estimate by the projected benefits approach the portion of Davenport's annual retirement payments attributable to 2021 service. 3. What is the company's service cost for 2021 with respect to Davenport? (Do not round intermediate calculations. Round your final answer to the nearest whole dollar.) 4. What is the company's interest cost for 2021 with respect to Davenport? (Do not round intermediate calculations. Round your final answer to the nearest whole dollar.) 5. Combine your answers to requirements 1,3 , and 4 to determine the company's projected benefit obligation at the end of 2021 (after 15 years' service) with respect to Davenport. (Do not round intermediate calculations. Round your final answer to the nearest whole dollar.) Answer is complete but not entirely correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts