Question: please help me for part (b). what amounts would be entered on form 940 for the following line items? Assume the following data for Blossom

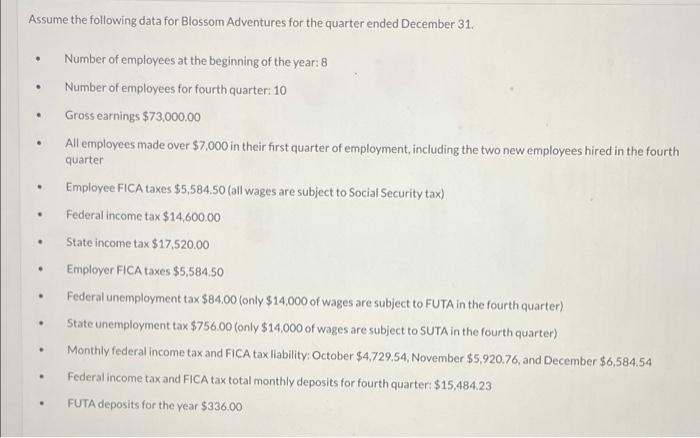

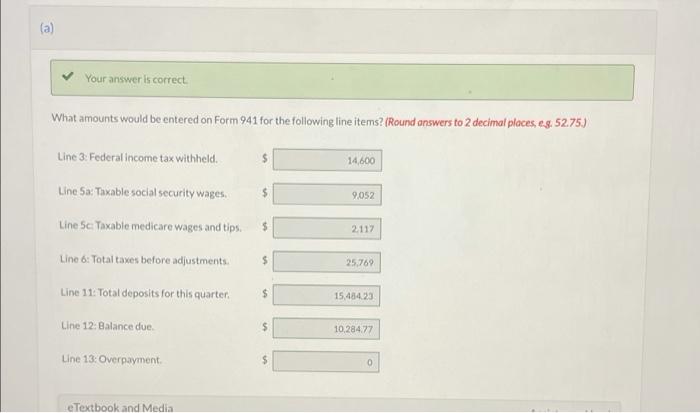

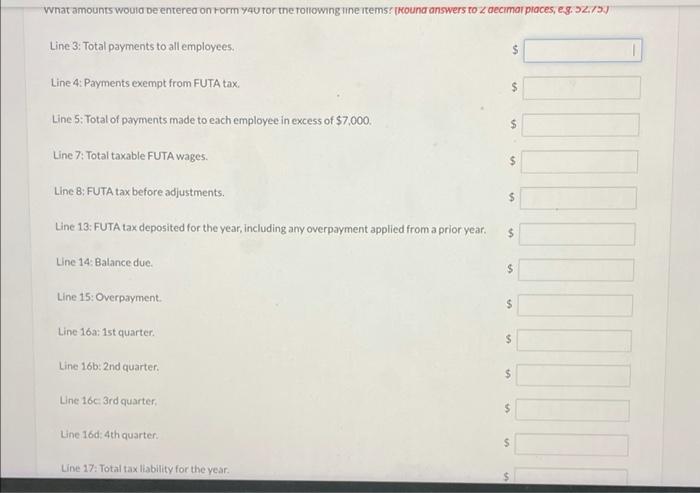

Assume the following data for Blossom Adventures for the quarter ended December 31. . Number of employees at the beginning of the year: 8 . Number of employees for fourth quarter: 10 . Gross earnings $73,000.00 . All employees made over $7,000 in their first quarter of employment, including the two new employees hired in the fourth quarter . Employee FICA taxes $5,584.50 (all wages are subject to Social Security tax) . Federal income tax $14,600.00 State income tax $17,520.00 Employer FICA taxes $5,584.50 . Federal unemployment tax $84.00 (only $14,000 of wages are subject to FUTA in the fourth quarter) . State unemployment tax $756.00 (only $14,000 of wages are subject to SUTA in the fourth quarter) . Monthly federal income tax and FICA tax liability: October $4,729.54, November $5,920.76, and December $6,584.54 . Federal income tax and FICA tax total monthly deposits for fourth quarter: $15,484.23 . FUTA deposits for the year $336.00 . (a) Your answer is correct. What amounts would be entered on Form 941 for the following line items? (Round answers to 2 decimal places, e.g. 52.75.) Line 3: Federal income tax withheld. 14,600 Line Sa: Taxable social security wages. 9,052 Line Sc: Taxable medicare wages and tips. 2117 Line 6: Total taxes before adjustments. Line 11: Total deposits for this quarter. Line 12: Balance due. Line 13: Overpayment. eTextbook and Media $ $ 25,769 15,484.23 10,284.77 What amounts would be entered on Form you for the following line items? (Round answers to z decimal places, e.g. 52.75.) Line 3: Total payments to all employees. $ Line 4: Payments exempt from FUTA tax. Line 5: Total of payments made to each employee in excess of $7,000. Line 7: Total taxable FUTA wages. Line 8: FUTA tax before adjustments. $ Line 13: FUTA tax deposited for the year, including any overpayment applied from a prior year. Line 14: Balance due. $ Line 15: Overpayment. Line 16a: 1st quarter. Line 16b: 2nd quarter. Line 16c: 3rd quarter, Line 16d: 4th quarter. Line 17: Total tax liability for the year.. $ $ $ $ $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts