Question: Please help me get the interest capitalized for 2017. I got $550872, but am wrong.... On January 1. 2016. the Mason Manufacturing Company began construction

Please help me get the interest capitalized for 2017. I got $550872, but am wrong....

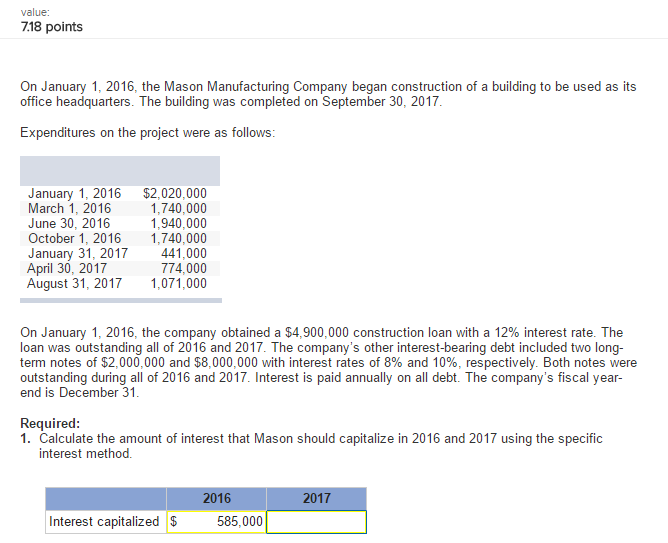

On January 1. 2016. the Mason Manufacturing Company began construction of a building to be used as its office headquarters. The building was completed on September 30. 2017. Expenditures on the project were as follows: On January 1. 2016. the company obtained a $4.900.000 construction loan with a 12% interest rate. The loan was outstanding all of 2016 and 2017. The company's other interest-bearing debt included two long-term notes of $2.000.000 and $8.000.000 with interest rates of 8% and 10%. respectively. Both notes were outstanding during all of 2016 and 2017. Interest is paid annually on all debt. The company's fiscal year-end is December 31. Required: Calculate the amount of interest that Mason should capitalize in 2016 and 2017 using the specific interest method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts