Question: Please help me give feedback and answer. 1.To begin this discussion, lets establish that risk and return are probably the most important two considerations that

Please help me give feedback and answer.

1.To begin this discussion, lets establish that risk and return are probably the most important two considerations that any business professional has to contemplate when making business decisions. What do these two words mean and how are they are related? According to Gitman and Zutter they are defined as follows:

- Risk is a measure of the uncertainty surrounding the return that an investment will earn or, more formally, the variability of returns associated with a given asset.

- Return is the total gain or loss experienced on an investment over a given period of time; calculated by dividing the assets cash distributions during the period, plus change in value, by its beginning-of-period investment value.

The relationship between risk and return is direct which means they move in the same direction. If risk goes up so does the expected return. Is there an optimum amount of return for a certain level of risk? The answer is yes. When looking at groups of assets in a portfolio, investment professionals can calculate what is called the Efficient Frontier. This calculation is presented on a graph which highlights each highest possible expected return for each level of risk.

As we continue to explore this topic during the week, we will discuss how these relationships are leveraged by business professionals such as Finance Managers and CFOs.

What is unclear about risk and return so far?

2.

In examining this question, please consider the additional points below:

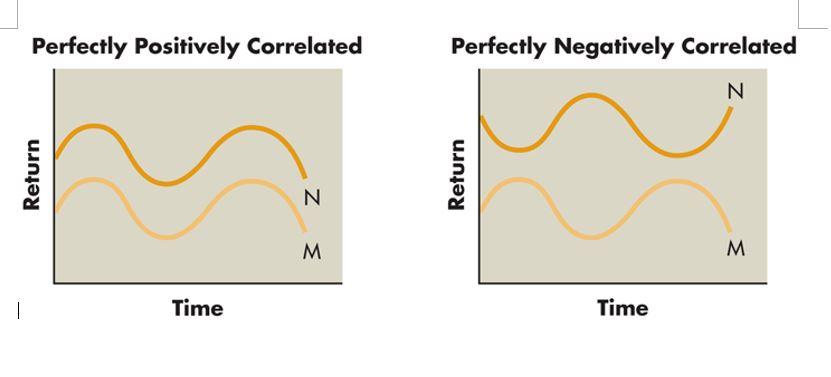

- Correlation is a statistical measure of the relationship between any two series of numbers.

- Positively correlated describes two series that move in the same direction.

- Negatively correlated describes two series that move in opposite directions.

- The correlation coefficient is a measure of the degree of correlation between two series.

- Perfectly positively correlated describes two positively correlated series that have a correlation coefficient of +1.

- Perfectly negatively correlated describes two negatively correlated series that have a correlation coefficient of 1.

For a graphical depiction of the points made above, please see the attached Figures.

Taking a look at your employers company stock or any other firms stock that you are familiar with, please share with the class another company or industry that negatively correlates to it?

Perfectly Positively Correlated Perfectly Negatively Correlated N Return Return N M M 1 Time Time Perfectly Positively Correlated Perfectly Negatively Correlated N Return Return N M M 1 Time Time

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts