Question: please help me Here are comparative financial statement data for Waterway Company and Cynthia Company, two competitors. All data are as of December 31, 2022,

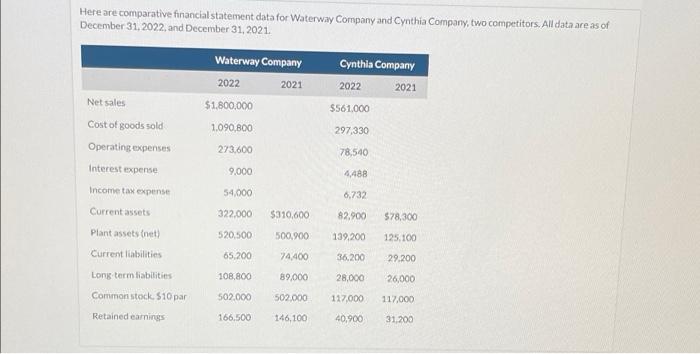

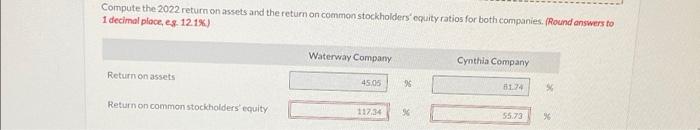

Here are comparative financial statement data for Waterway Company and Cynthia Company, two competitors. All data are as of December 31, 2022, and December 31, 2021. Waterway Company Cynthia Company 2022 2021 2022 2021 Net sales $1,800,000 $561,000 Cost of goods sold 1,090,800 297,330 Operating expenses 273,600 78,540 Interest expense 9,000 4,488 Income tax expense 54,000 6,732 Current assets 322,000 $310,600 82.900 $78,300 Plant assets (net) 520,500 500,900 139,200 125,100 Current liabilities 65,200 74,400 36.200 29.200 Long term liabilities 108,800 89,000 28,000 26,000 Common stock. $10 par 502.000 502,000 117,000 117,000 Retained earnings 166.500 146,100 40,900 31,200 Compute the 2022 return on assets and the return on common stockholders' equity ratios for both companies. (Round answers to 1d I decimal place, eg. 12.1%) Waterway Company Cynthia Company Return on assets 45.05 61.74 % Return on common stockholders' equity 117,34 55.73 % %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts