Question: Please help me!! I also included the excel sheet with extra information! Read the questions carefully, this it difficult. Thanks :) Here is the condensed

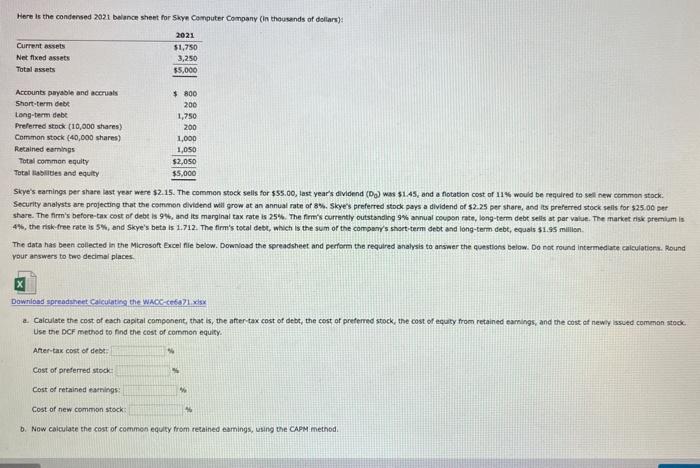

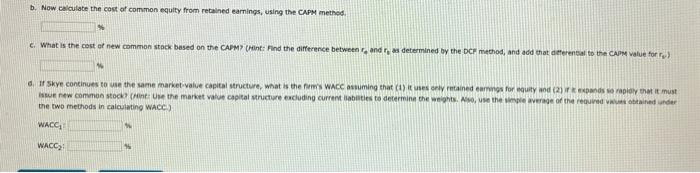

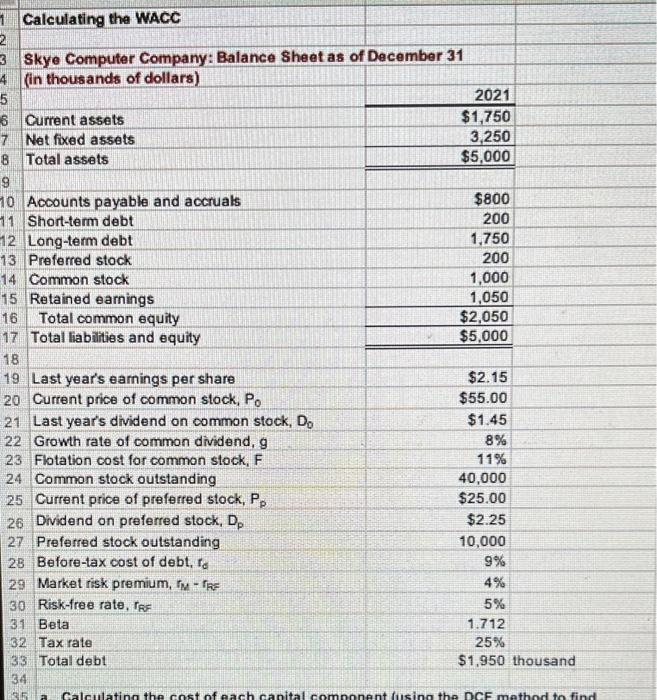

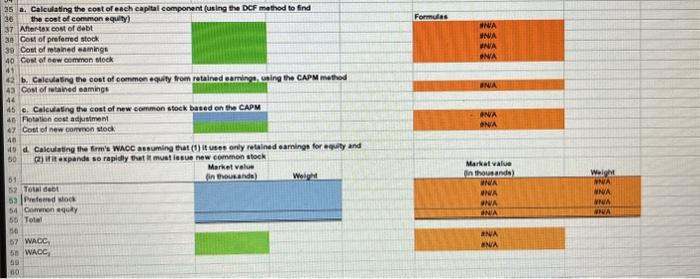

Here is the condensed 202t belance sheet for Siyne Computer Company (in thoucknds of doltars) A Siye's eamings per share last vear were \$2.15. The common stock sells for $55.00, last year's dividend (Do) was $1.45, and a fotation cost of 11 wo would be required to sel new common stock: Security analysts are projectiog thet the common dividend will grow at an annual rate of 8%. Skyes preferred stook pays a dividend of s2.25 per share, and its preferred stock seils tor $25. oo per share. The firm's before-tax cost of debe is 9%, and its marginal tax rate is 25%. The fimn's currently outstsnding 9% annual coupon rahe, long-term debt sells at par value. The market isk premiam in 4\%, the riskefree rate is 5%, and Skye's beta is 1.712 . The firm's tocal debt, which is the sum of the compamy's short term debt and long-term debt, equais 31.95 million. The data has been coliected in the Microsoft Excel file below. Downloud the spreadsheet and perform the required analysis to answer the questions below. Do rot round intermedate caiculatiena. Round pour answers to two decimal places. Downiload spreadaheet Calculating the wacc-cesa?1 xisx a. Caiculate the cost of each capital camponent, thak is, the aftertax cost of debt, the cort of prefernd stock, the cost of equaty from retained eamings, and che cost of newy issued common stodk. Use the DCF methsd to find the cost of common equity. Ater-tax eost of debs: Cost of preferred stock: Cost of retained tamings: Cost of new common stock: b. Now calcutate the cost of common equity trom retained earnings, using the CAPM method. b. Now celculate the cost of common equity from retained earnings, using the CAPM method 6. What is the cost of new common stack based on the CAMM? (hilit: Find the difference between rn and r, as determined oy the DCF mechod, and acd ehat deterensal to the capm value for ry ? 6. If Skye continues to use the same market-value capital structure, what is the fimis wace assuming that (1) it uses oniy rutained earmps for equity and (2) if ze expands we rapiery ehar it must the two methods in calculating wace) WACC1 WACC : Calculating the WACC Skye Computer Company: Balance Sheet as of December 31 (in thousands of dollars) a. Calculating the cost of esch capital component (using the DCF method to find the cost of common equity) Afortax cost of debt Cost of prefered stock Cost of reained eaeningt Cost of bew cemmen siock b. Calevlating the cost of commen equity from retained eaminge, using Ene CAPM method Cost of retained eamings c. Calculating the cost of new ceemmon stock based on the CAPM Fotalion cose ackustment Cot ot new comron stock d. Calculating the firm's WrcC assuming that (1) it uses orty retained eamings for equity and 50 () it it expende so rapidly thet it muat iseue new common atock Market value 51 Tethi deet 53 |Prnteeed wiock 54 Comenen squty Total WACC. WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts