Question: Please help me, I dont understand im doing wrong with the fair value calculations! Crane, Inc. had the following equity investment portfolio at January 1,

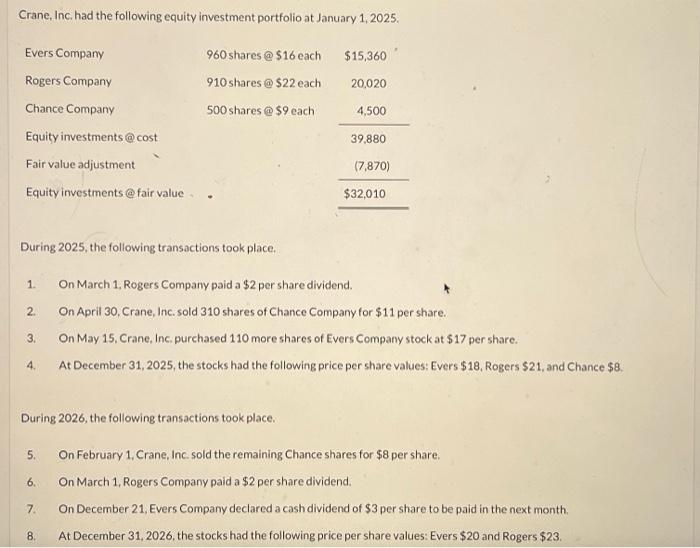

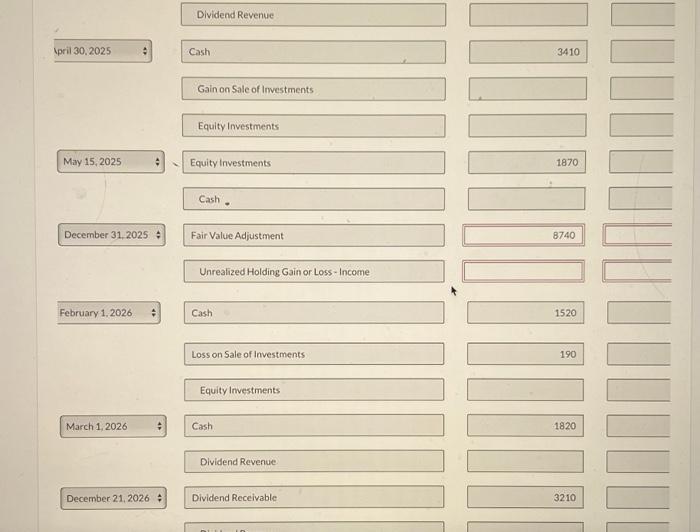

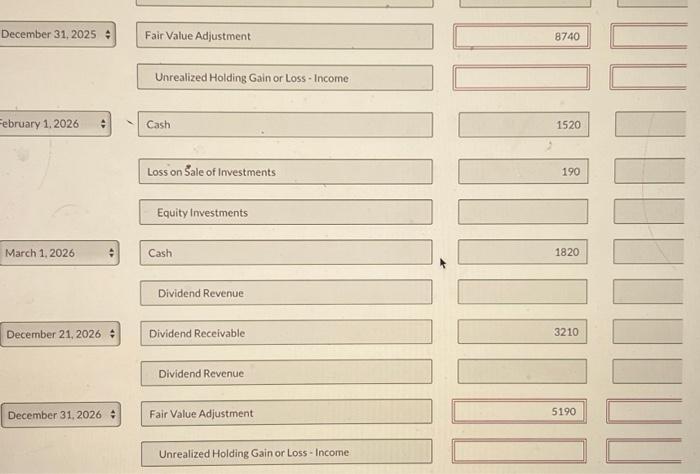

Crane, Inc. had the following equity investment portfolio at January 1, 2025. During 2025, the following transactions took place. 1. On March 1, Rogers Company paid a $2 per share dividend. 2. On April 30, Crane, Inc. sold 310 shares of Chance Company for $11 per share. 3. On May 15, Crane, Inc, purchased 110 more shares of Evers Company stock at $17 per share. 4. At December 31,2025 , the stocks had the following price per share values: Evers $18, Rogers $21, and Chance $8. During 2026, the following transactions took place. 5. On February 1,Crane, Inc. sold the remaining Chance shares for $8 per share. 6. On March 1, Rogers Company paid a $2 per share dividend. 7. On December 21, Evers Company declared a cash dividend of $3 per share to be paid in the next month. 8. At December 31,2026 , the stocks had the following price per share values: Evers $20 and Rogers $23. Dividend Revenue Ipril 30,2025 Cash 3410 Gain on Sale of Irvestments Equity Investments May 15, 2025 Equitylnvestments 1870 Cash. December 31,2025 Fair Value Adjustment 8740 Unreatized Holding Gain or Loss-Income February 1,2026 Cash 1520 Loss on Sale of Investments 190 Equity Investments March 1, 2026 Cash 1820 Dividend Revenue December 21, 2026 Dividend Receivable 3210 December 31, 2025 * Fair Value Adjustment 8740 Unrealized Holding Gain or Loss - Income Eebruary 1,2026 Cash 1520 Loss on ale of Investments 190 Equity Investments March 1, 2026 Cash 1820 Dividend Revenue December 21,2026 * Dividend Receivable 3210 Dividend Revenue December 31,2026 : Fair Value Adjustment 5190 Unrealized Holding Gain or Loss - Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts