Question: please help me, i keep getting these wrong! thank you in advance! Required information [The following information applies to the questions displayed below.) Falcon Crest

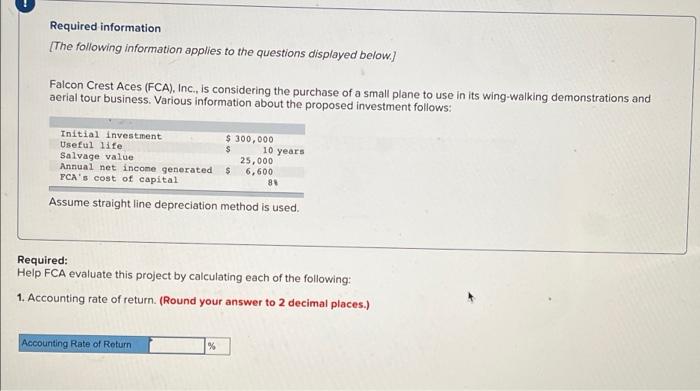

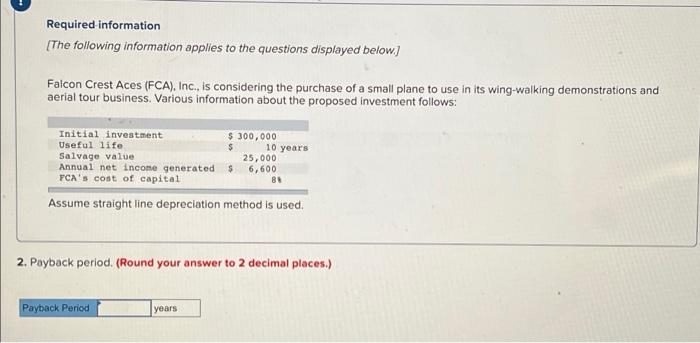

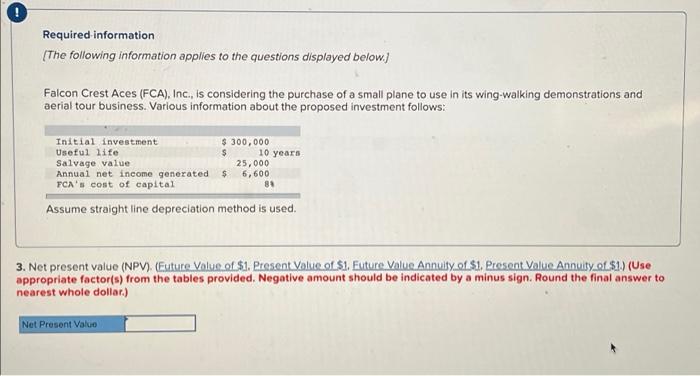

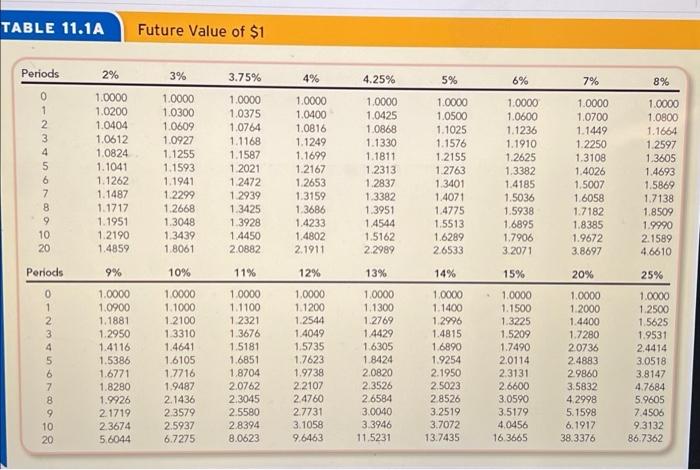

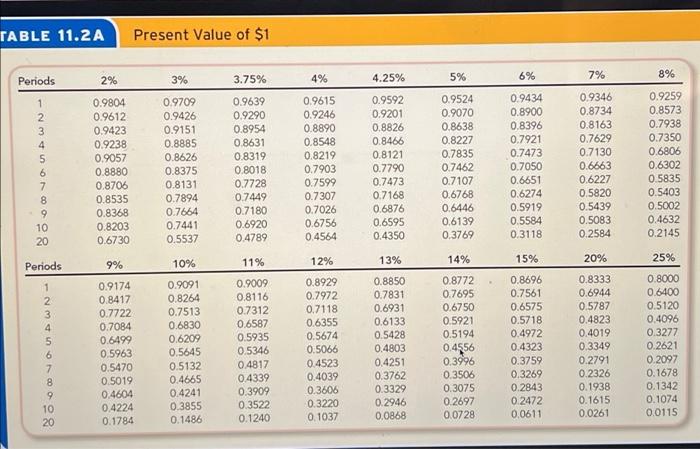

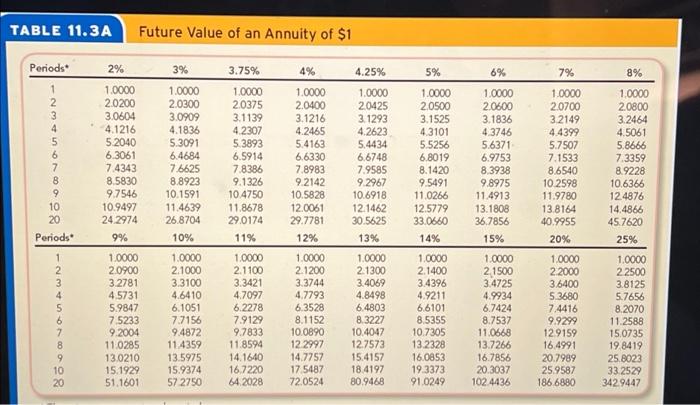

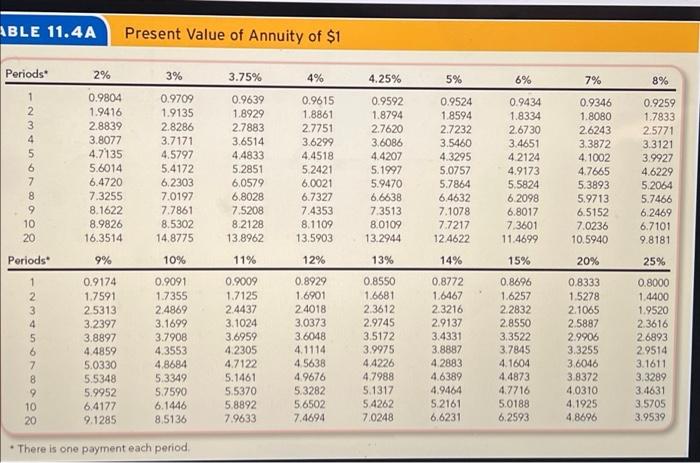

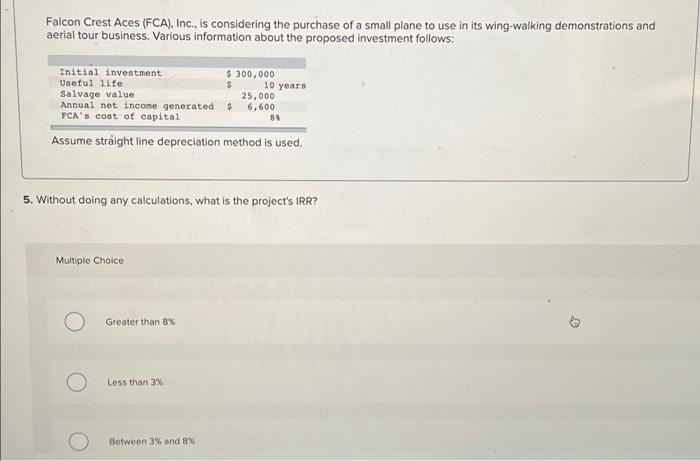

Required information [The following information applies to the questions displayed below.) Falcon Crest Aces (FCA), Inc., is considering the purchase of a small plane to use in its wing-walking demonstrations and aerial tour business. Various information about the proposed investment follows: Initial investment Useful life Salvage value Annual net income generated TCA's cost of capital $ 300,000 $ 10 years 25,000 $ 6,600 80 Assume straight line depreciation method is used. Required: Help FCA evaluate this project by calculating each of the following: 1. Accounting rate of return (Round your answer to 2 decimal places.) 2 Accounting Rate of Return % Required information [The following information applies to the questions displayed below] Falcon Crest Aces (FCA), Inc., is considering the purchase of a small plane to use in its wing-walking demonstrations and aerial tour business. Various information about the proposed investment follows: Initial investment Useful life Salvage value Annual net income generated FCA'S cost of capital $ 300,000 $ 10 years 25,000 $ 6,600 88 Assume straight line depreciation method is used. 2. Payback period. (Round your answer to 2 decimal places.) Payback Period years Required information (The following information applies to the questions displayed below) Falcon Crest Aces (FCA), Inc., is considering the purchase of a small plane to use in its wing-walking demonstrations and aerial tour business. Various information about the proposed investment follows: Initial investment Useful life Salvage value Annual net income generated FCA's cost of capital $ 300,000 10 years 25,000 $ 6,600 88 Assume straight line depreciation method is used. 3. Net present value (NPV). (Euture Value of $1. Present Value of $1. Future Value Annuity of S1, Prosent Value Annuity of S1) (Use appropriate factor(s) from the tables provided. Negative amount should be indicated by a minus sign. Round the final answer to nearest whole dollar.) Net Present Valio TABLE 11.1A Future Value of $1 Periods 2% 3.75% 4% 4.25% 5% 6% 7% 8% 0 2 80 VOUAWN 1.0000 1.0200 1.0404 1.0612 1.0824 1.1041 1.1262 1.1487 1.1717 1.1951 1.2190 1.4859 3% 1.0000 1.0300 1.0609 1.0927 1.1255 1.1593 1.1941 1.2299 1.2668 1.3048 1.3439 1.8061 1.0000 1.0375 1.0764 1.1168 1.1587 1.2021 1.2472 1.2939 1.3425 1.3928 1.4450 2.0882 1.0000 1.0400 1.0816 1.1249 1.1699 1.2167 1.2653 1.3159 1.3686 1.4233 1.4802 2.1911 1.0000 1.0425 1.0868 1.1330 1.1811 1.2313 1.2837 1.3382 1.3951 1.4544 1.5162 2.2989 1.0000 1.0500 1.1025 1.1576 1.2155 1.2763 1.3401 1.4071 1.4775 1.5513 1.6289 2.6533 1.0000 1.0600 1.1236 1.1910 1.2625 1.3382 1.4185 1.5036 1.5938 1.6895 1.7906 3.2071 1.0000 1.0700 1.1449 1.2250 1.3108 1.4026 1.5007 1.6058 1.7182 1.8385 1.9672 3.8697 1.0000 1.0800 1.1664 1.2597 1.3605 1.4693 1.5869 1.7138 1.8509 1.9990 2.1589 4.6610 9 10 20 Periods 9% 11% 13% 14% 20% 25% 0 1 2 3 4 5 6 7 8 9 10 20 1.0000 1.0900 1.1881 1.2950 1.4116 1.5386 1.6771 1.8280 1.9926 21719 2.3674 5.6044 10% 1.0000 1.1000 1.2100 1.3310 1.4641 1.6105 1.7716 1.9487 2.1436 2.3579 2.5937 6.7275 1.0000 1.1100 1.2321 1.3676 1.5181 1.6851 1.8704 2.0762 2.3045 2.5580 28394 8.0623 12% 1.0000 1.1200 1.2544 1.4049 1.5735 1.7623 1.9738 22107 2.4760 2.7731 3.1058 9.6463 1.0000 1.1300 1.2769 1.4429 1.6305 1.8424 2.0820 2.3526 2.6584 3.0040 3.3946 11.5231 1.0000 1.1400 1.2996 1.4815 1.6890 1.9254 2.1950 25023 2.8526 3.2519 3.7072 13.7435 15% 1.0000 1.1500 1.3225 1.5209 1.7490 20114 2.3131 2.6600 3.0590 3.5179 4.0456 16.3665 1.0000 1.2000 1.4400 1.7280 20736 24883 2.9860 3.5832 4.2998 5.1598 6.1917 38.3376 1.0000 1.2500 1.5625 1.9531 2.4414 3.0518 3.8147 4.7684 5.9605 7.4506 9.3132 86.7362 TABLE 11.2A Present Value of $1 Periods 2% 3% 3.75% 4% 4.25% 8% 5% 7% 6% 5 800 vo WN- 0.9804 0.9612 0.9423 0.9238 0.9057 0.8880 0.8706 0.8535 0.8368 0.8203 0.6730 0.9709 0.9426 0.9151 0.8885 0.8626 0.8375 0.8131 0.7894 0.7664 0.7441 0.5537 0.9639 0.9290 0.8954 0.8631 0.8319 0.8018 0.7728 0.7449 0.7180 0.6920 0.4789 0.9615 0.9246 0.8890 0.8548 0.8219 0.7903 0.7599 0.7307 0.7026 0.6756 0.4564 0.9592 0.9201 0.8826 0.8466 0.8121 0.7790 0.7473 0.7168 0.6876 0.6595 0.4350 0.9524 0.9070 0.8638 0.8227 0.7835 0.7462 0.7107 0.6768 0.6446 0.6139 0.3769 0.9434 0.8900 0.8396 0.7921 0.7473 0.7050 0.6651 0.6274 0.5919 0.5584 0.3118 0.9346 0.8734 0.8163 0.7629 0.7130 0.6663 0.6227 0.5820 0.5439 0.5083 0.2584 0.9259 0.8573 0.7938 0.7350 0.6806 0.6302 0.5835 0.5403 0.5002 0.4632 0.2145 9 10 20 10% 9% 11% 12% 13% Periods 14% 15% 25% 20% Bc OWN 0.9174 0.8417 0.7722 0.7084 0.6499 0.5963 0.5470 0.5019 0.4604 0.4224 0.1784 0.9091 0.8264 0.7513 0.6830 0.6209 0.5645 0.5132 0.4665 0.4241 0.3855 0.1486 0.9009 0.8116 0.7312 0.6587 0.5935 0.5346 04817 0.4339 0.3909 0.3522 0.1240 0.8929 0.7972 0.7118 0.6355 0.5674 0.5066 0.4523 0.4039 0.3606 0.3220 0.1037 0.8850 0.7831 0.6931 0.6133 0.5428 0.4803 0.4251 0.3762 0.3329 0.2946 0.0868 0.8772 0.7695 0.6750 0.5921 0.5194 0.4556 0.3996 0.3506 0.3075 0.2697 0.0728 0.8696 0.7561 0.6575 0.5718 0.4972 0.4323 0.3759 0.3269 0.2843 0.2472 0.0611 0.8333 0.6944 0.5787 0.4823 0.4019 0.3349 0.2791 0.2326 0.1938 0.1615 0.0261 0.8000 0.6400 0.5120 0.4096 0.3277 0.2621 0.2097 0.1678 0.1342 0.1074 0.0115 10 20 TABLE 11.3A Future Value of an Annuity of $1 Periods 2% 3% 3.75% 4% 4.25% 5% 6% 7% 8% 1 2 3 4 5 6 7 8 9 10 20 1.0000 2.0200 3.0604 4.1216 5.2040 6.3061 7.4343 8.5830 9.7546 10.9497 24.2974 9% 1.0000 2.0300 3.0909 4.1836 5.3091 6.4684 7.6625 8.8923 10.1591 11.4639 26.8704 10% 1.0000 20375 3.1139 4.2307 5.3893 6.5914 7.8386 9.1326 10.4750 11.8678 29.0174 1.0000 2.0400 3.1216 4.2465 5.4163 6.6330 7.8983 9.2142 10.5828 12.0061 29.7781 12% 1.0000 20425 3.1293 4.2623 5.4434 6.6748 7.9585 9.2967 10.6918 12.1462 30.5625 13% 1.0000 20500 3.1525 4.3101 5.5256 6.8019 8.1420 9.5491 11.0266 12.5779 33.0660 14% 1.0000 2.0600 3.1836 4.3746 5.6371 6.9753 8.3938 9.8975 11.4913 13.1808 36.7856 15% 1.0000 2.0700 3.2149 4.4399 5.7507 7.1533 8.6540 10.2598 11.9780 13.8164 40.9955 20% 1.0000 2.0800 3.2464 4.5061 5.8666 7.3359 8.9228 10.6366 124876 14.4866 457620 25% Periods 11% 2 Dawn 4 5 6 7 8 1.0000 2.0900 3.2781 4.5731 5.9847 7.5233 9.2004 11.0285 13.0210 15.1929 51.1601 1.0000 2.1000 3.3100 4.6410 6.1051 7.7156 9.4872 11.4359 13.5975 15.9374 57 2750 1.0000 2.1100 3.3421 4.7097 6.2278 7.9129 9.7833 11.8594 14.1640 16.7220 64.2028 1.0000 2.1200 3.3744 4.7793 6.3528 8.1152 10.0890 12 2997 14.7757 17 5487 72.0524 1.0000 2.1300 3.4069 4.8498 6.4803 8.3227 10.4047 12.7573 15.4157 18.4197 80.9468 1.0000 2.1400 3.4396 4.9211 6,6101 8.5355 10.7305 13.2328 16.0853 19.3373 91.0249 1.0000 21500 3.4725 4.9934 6.7424 8.7537 11.0668 13.7266 16.7856 20.3037 102 4436 1.0000 2.2000 3.6400 5.3680 7.4416 9.9299 129159 16.4991 20.7989 25.9587 186 6880 1.0000 2 2500 3.8125 5.7656 8.2070 11.2588 15.0735 19.8419 25.8023 33.2529 342.9447 10 20 ABLE 11.4A Present Value of Annuity of $1 Periods 2% 3% 3.75% 4% 4.25% 5% 6% 7% 8% 5 80 cvOWN 0.9804 1.9416 2.8839 3.8077 4.7135 5.6014 6.4720 7.3255 8.1622 8.9826 16.3514 0.9709 1.9135 2.8286 3.7171 4.5797 5.4172 6.2303 7.0197 7.7861 8.5302 14.8775 0.9639 1.8929 2.7883 3.6514 4.4833 5.2851 6.0579 6.8028 7.5208 8.2128 13.8962 0.9615 1.8861 2.7751 3.6299 4.4518 5.2421 6.0021 6.7327 7.4353 8.1109 13,5903 0.9592 1.8794 2.7620 3,6086 4.4207 5.1997 5.9470 6.6638 7.3513 8.0109 13.2944 0.9524 1.8594 2.7232 3.5460 4.3295 5.0757 5.7864 6.4632 7.1078 7.7217 12 4622 0.9434 1.8334 2.6730 3.4651 4.2124 4.9173 5.5824 6.2098 6.8017 7.3601 11.4699 0.9346 1.8080 2.6243 3.3872 4.1002 4.7665 5.3893 5.9713 6.5152 7.0236 10.5940 0.9259 1.7833 2.5771 3.3121 3.9927 4.6229 5.2064 5.7466 6.2469 6.7101 9.8181 8 9 10 20 Periods 9% 10% 11% 12% 13% 14% 15% 20% 25% 1 2 3 4 5 6 7 DOWN 0.9174 1.7591 2.5313 3.2397 3.8897 4.4859 5.0330 5.5348 5.9952 6.4177 9.1285 0.9091 1.7355 2.4869 3.1699 3.7908 4.3553 4.8684 5.3349 5.7590 6.1446 8.5136 0.9009 1.7125 2.4437 3.1024 3.6959 4.2305 4.7122 5.1461 5.5370 5.8892 7.9633 0.8929 1.6901 2.4018 3.0373 3.6048 4.1114 45638 4.9676 5.3282 5.6502 7.4694 0.8550 1.6681 2.3612 2.9745 3.5172 3.9975 4.4226 4.7988 5.1317 54262 7.0248 0.8772 1.6467 2.3216 2.9137 3.4331 3.8887 4.2883 4.6389 4.9464 5.2161 6,6231 0.8696 1.6257 2.2832 2.8550 3.3522 3.7845 4.1604 4.4873 4.7716 5.0188 6.2593 0.8333 1.5278 2.1065 2.5887 2.9906 3.3255 3.6046 3.8372 4,0310 4.1925 4.8696 0.8000 1.4400 1.9520 2.3616 2.6893 2.9514 3.1611 3.3289 3.4631 3.5705 3.9539 9 10 20 There is one payment each period Falcon Crest Aces (FCA), Inc., is considering the purchase of a small plane to use in its wing-walking demonstrations and aerial tour business. Various information about the proposed investment follows: Initial investment $ 300,000 Useful life $ 10 years Salvage value 25,000 Annual net income generated $ 6,600 PCA'S cost of capital BA Assume straight line depreciation method is used. 5. Without doing any calculations, what is the project's IRR? Multiple Choice Greater than 8% Less than 3% Between 3% and 8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts