Question: please help me i will give you a thumbs up!!! Exercise 5-4A (Algo) Effect of inventory cost flow (FIFO, LIFO, and weighted average) on gross

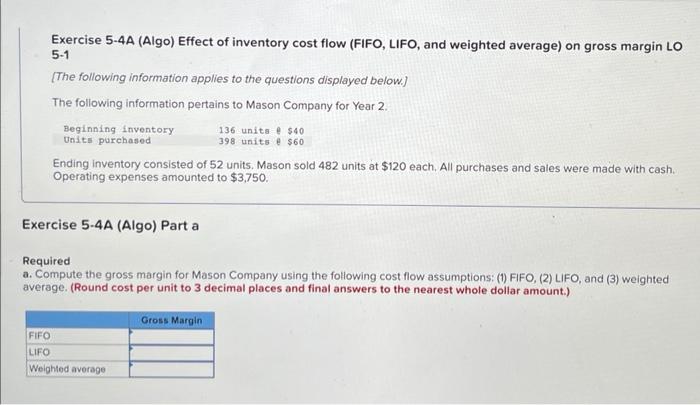

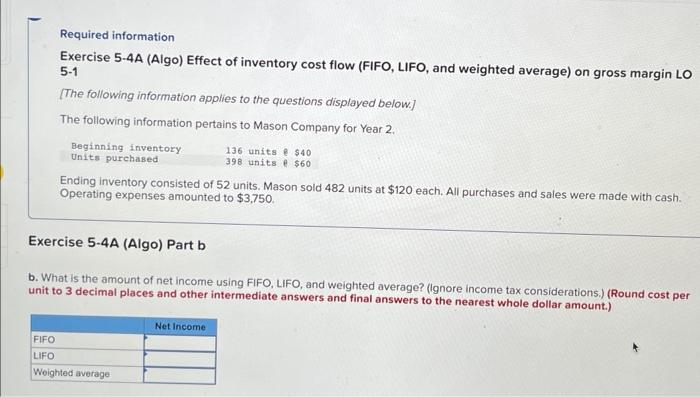

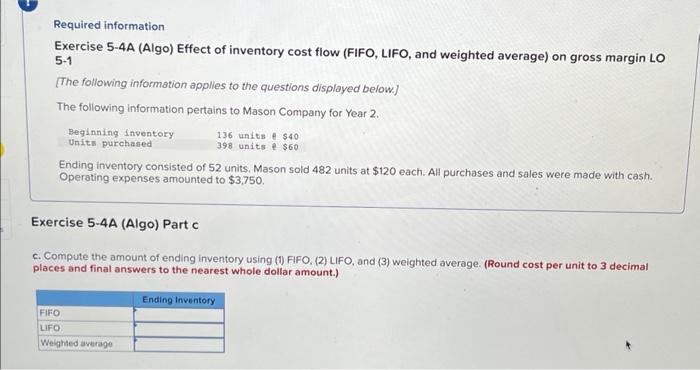

Exercise 5-4A (Algo) Effect of inventory cost flow (FIFO, LIFO, and weighted average) on gross margin LO 5-1 [The following information applies to the questions displayed below.] The following information pertains to Mason Company for Year 2. Ending inventory consisted of 52 units. Mason sold 482 units at $120 each. All purchases and sales were made with cash. Operating expenses amounted to $3,750. Exercise 5-4A (Algo) Part a Required a. Compute the gross margin for Mason Company using the following cost flow assumptions: (1) FIFO, (2) LIFO, and (3) weighted average. (Round cost per unit to 3 decimal places and final answers to the nearest whole dollar amount.) Required information Exercise 5-4A (Algo) Effect of inventory cost flow (FIFO, LIFO, and weighted average) on gross margin LO 5-1 [The following information applies to the questions displayed below.] The following information pertains to Mason Company for Year 2 . Ending inventory consisted of 52 units. Mason sold 482 units at $120 each. All purchases and sales were made with cash. Operating expenses amounted to $3,750. Exercise 5-4A (Algo) Part b b. What is the amount of net income using FIFO, LIFO, and weighted average? (lgnore income tax considerations.) (Round cost per unit to 3 decimal places and other intermediate answers and final answers to the nearest whole dollar amount.) Required information Exercise 5-4A (Algo) Effect of inventory cost flow (FIFO, LIFO, and weighted average) on gross margin LO 5-1 [The following information applies to the questions displayed below.] The following information pertains to Mason Company for Year 2. Ending inventory consisted of 52 units. Mason sold 482 units at $120 each. All purchases and sales were made with cash. Operating expenses amounted to $3,750. Exercise 5-4A (Algo) Part C c. Compute the amount of ending inventory using (1) FIFO, (2) LIFO, and (3) weighted average. (Round cost per unit to 3 decimal places and final answers to the nearest whole dollar amount.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts