Question: Please help me identify where I went wrong: The next dividend payment by Skippy Inc. will be $2.95 per share. The dividends are anticipated to

Please help me identify where I went wrong:

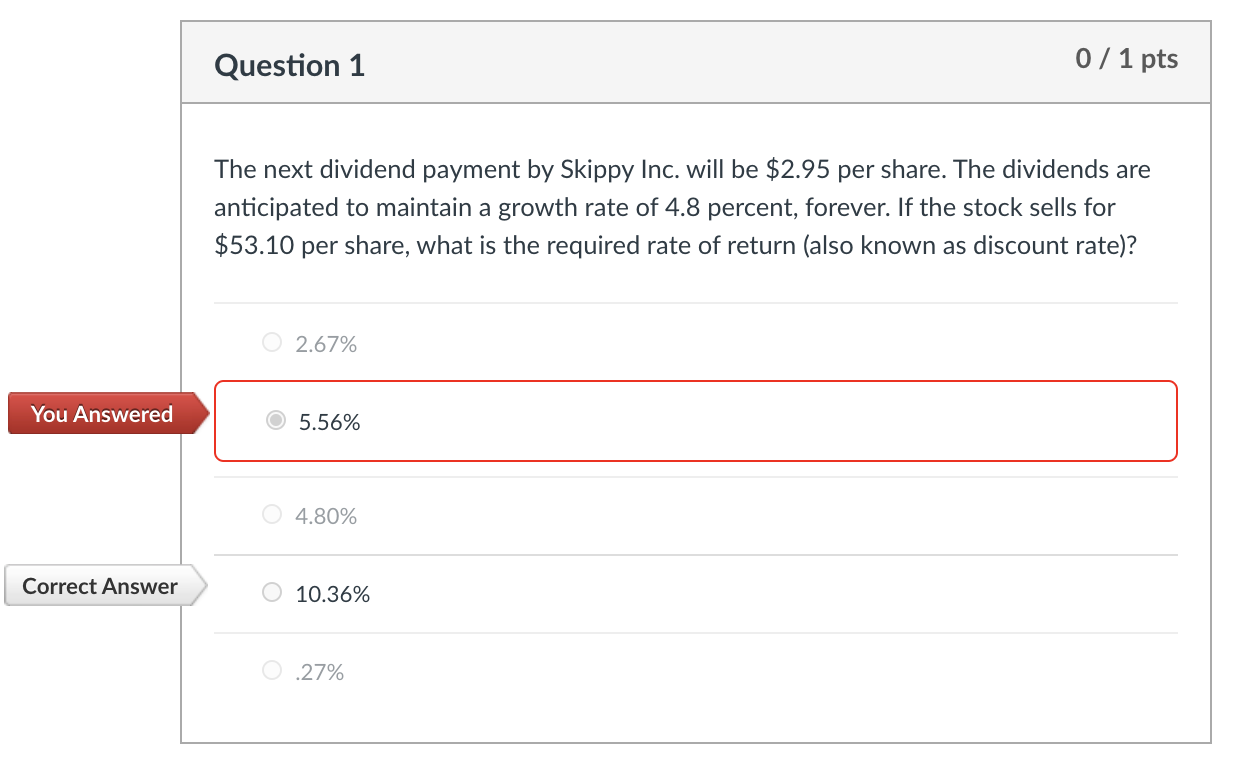

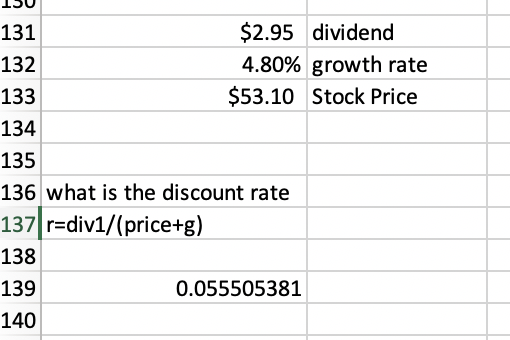

The next dividend payment by Skippy Inc. will be $2.95 per share. The dividends are anticipated to maintain a growth rate of 4.8 percent, forever. If the stock sells for $53.10 per share, what is the required rate of return (also known as discount rate)? 2.67% You Answered 5.56% 4.80% Correct Answer \" 10.36% 27% 131 $2.95 dividend 132 4.80% growth rate 133 $53.10 Stock Price 134 135 136 what is the discount rate 137 r=div1/(price+g) 138 139 0.055505381 140

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts