Question: Please help me!!!!! If you can, please also post the calculations. Thank you so much!!!!! Part4: Black-Scholes and Binomial Option Pricing Let us compute an

Please help me!!!!!

If you can, please also post the calculations.

Thank you so much!!!!!

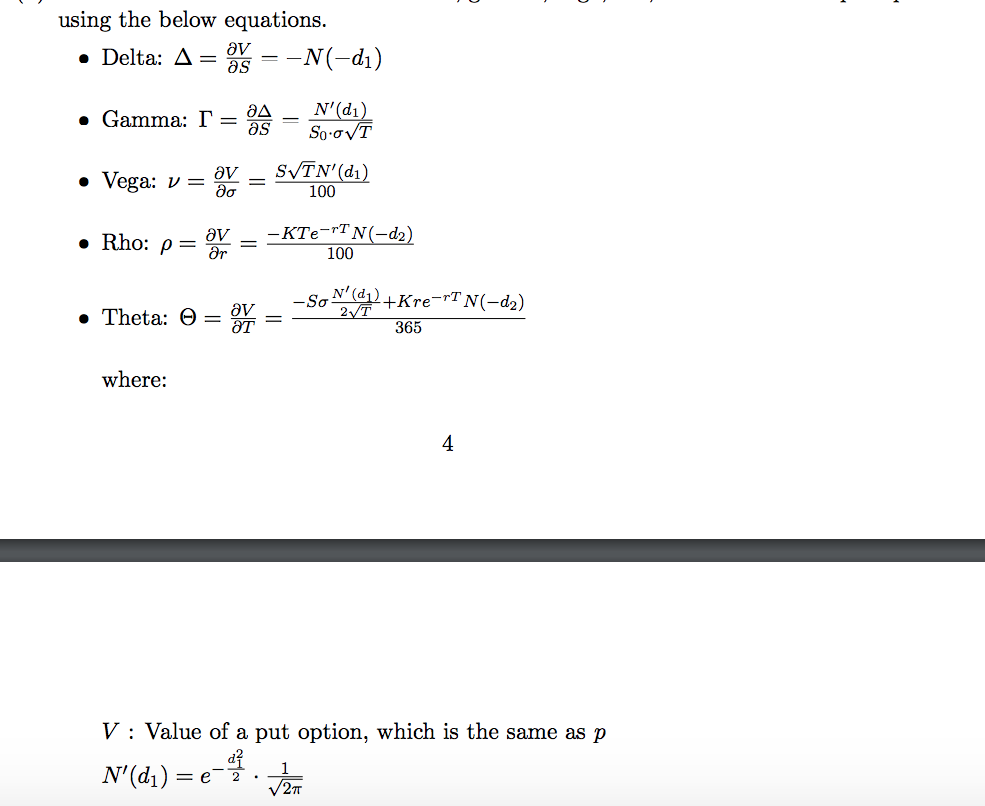

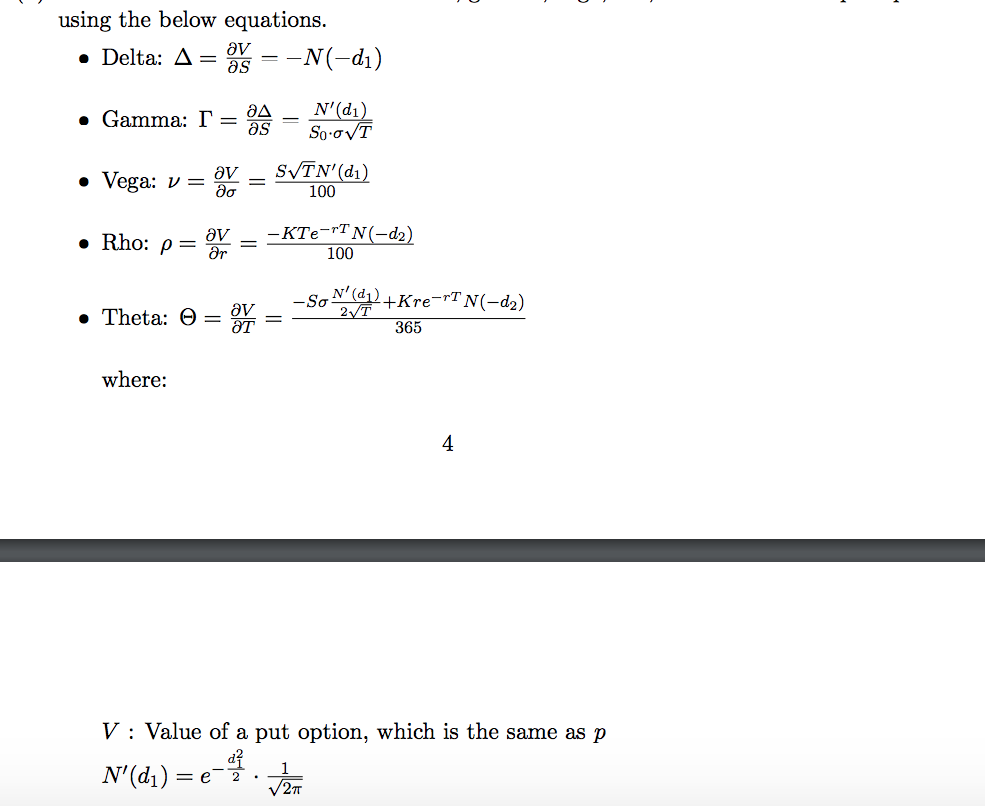

Part4: Black-Scholes and Binomial Option Pricing Let us compute an option price using Black-Scholes Model and Binomial Tree model. 1. Suppose that the current price of BA is $200. The continuously compounded risk-free rate is 1% per year. The annual standard deviations are 20%. Also, assume BA pays no dividends. (a) Compute the value of a long 2 year an European put option with a strike price of $ 195 and the annualized standard deviation is 20% using 1) a two-step (At = 1) binomial tree (BT) model , and 2) the BLACK-SCHOLES (BS) formula, which is given by . call option : c = SoN(di) - Xe rTN(d2) . put option : p = Xe "TN(-d2) - SorTN(-di) d1 = In(So/ X) + (r + 02/2) 1 OVT d2 = ' In(So/ X) + (r - 02/2) 1 OVT That is, d2 = d1 - oVT where: T : Time to maturity So : Asset price X : Exercise price r: Continuously compounded risk free rate " : Volatility of continuously compounded return on the stock N(*) : Cumulative Normal Probability (b) Examine whether BT and BS models have the same answer or not. (c) Use the put-call parity and compute two different 2 year call option prices with two different put option values. (d) Calculate the Greeks that include delta, gamma, vega, rho, and theta for the put option using the below equations. . Delta: A = as - -N(-di)using the below equations. . Delta: A = av as = -N(-di) - 04 . Gamma: I = as N'(d1) So.GVT . Vega: V = av do SVTN' (d1) 100 . Rho: p = av - -KTerTN(-d2) 100 . Theta: 0 = ov = _soV(@1+Kre-rTN(-d2) 2V/T 365 where: 4 V : Value of a put option, which is the same as p N'(d1 ) = e-2 . V2n 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts