Question: Please show work ! Black-Scholes and Binomial Option Pricing Let us compute an option price using the Black-Scholes Model and Binomial Tree model. 1. Download

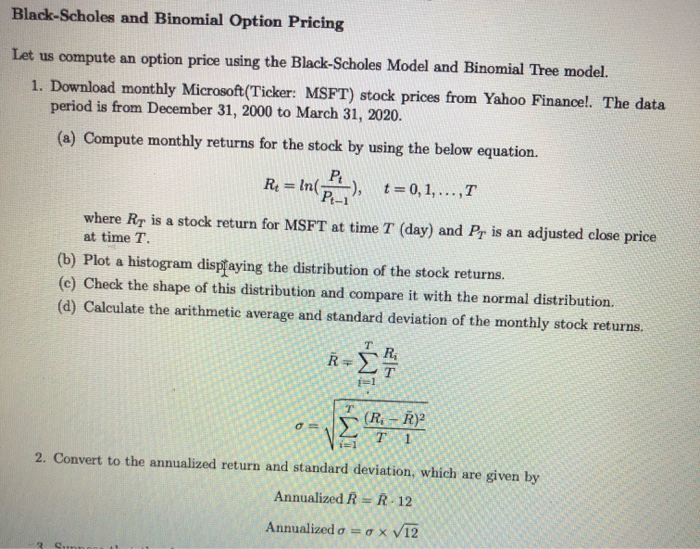

Black-Scholes and Binomial Option Pricing Let us compute an option price using the Black-Scholes Model and Binomial Tree model. 1. Download monthly Microsoft(Ticker: MSFT) stock prices from Yahoo Financel. The data period is from December 31, 2000 to March 31, 2020. (a) Compute monthly returns for the stock by using the below equation. Rt=In), = 0, 1,..., 1 where Ry is a stock return for MSFT at time T (day) and P, is an adjusted close price at time T. (b) Plot a histogram displaying the distribution of the stock returns. (c) Check the shape of this distribution and compare it with the normal distribution. (d) Calculate the arithmetic average and standard deviation of the monthly stock returns. = T 0= (R; - R)? 12 T 1 2. Convert to the annualized return and standard deviation, which are given by Annualized R = R 12 Annualized o = ax V12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts