Question: Please help me in the analysis Computations Current ratio = current assets / current liabilities 575,000/345,000=1.67 times Quick ratio = (current asset - inventory) /

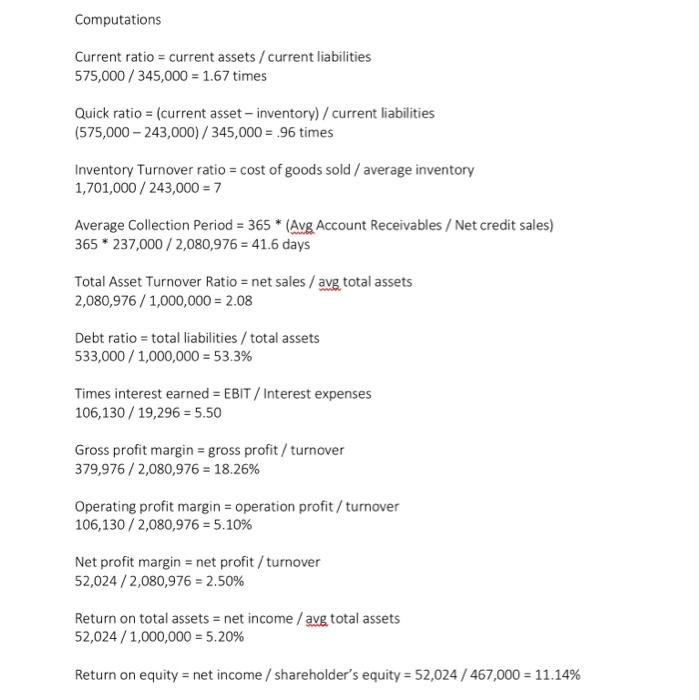

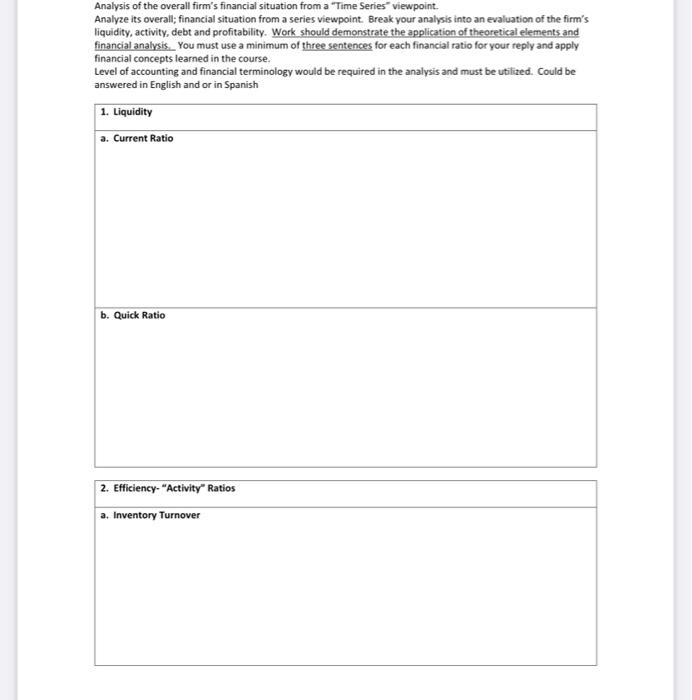

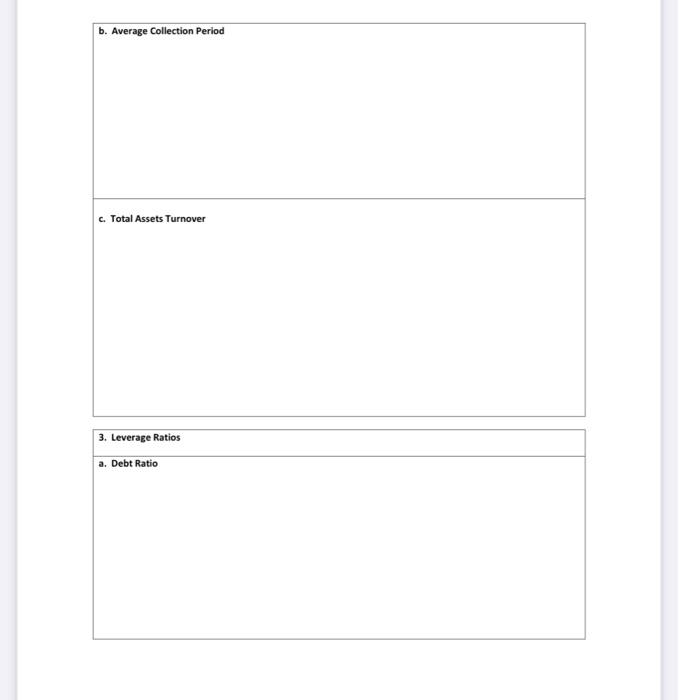

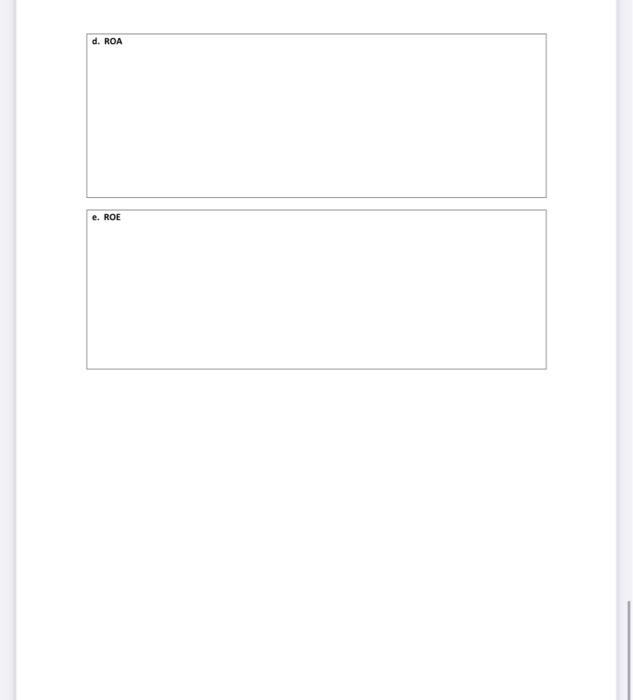

Computations Current ratio = current assets / current liabilities 575,000/345,000=1.67 times Quick ratio = (current asset - inventory) / current liabilities (575,000243,000)/345,000=.96 times Inventory Turnover ratio = cost of goods sold / average inventory 1,701,000/243,000=7 Average Collection Period =365 (Avg Account Receivables / Net credit sales) 365237,000/2,080,976=41.6 days Total Asset Turnover Ratio = net sales / avg total assets 2,080,976/1,000,000=2.08 Debt ratio = total liabilities / total assets 533,000/1,000,000=53.3% Times interest earned = EBIT / Interest expenses 106,130/19,296=5.50 Gross profit margin = gross profit / turnover 379,976/2,080,976=18.26% Operating profit margin = operation profit / turnover 106,130/2,080,976=5.10% Net profit margin = net profit / turnover 52,024/2,080,976=2.50% Return on total assets = net income / avg total assets 52,024/1,000,000=5.20% Return on equity = net income / shareholder's equity =52,024/467,000=11.14% Analysis of the overall firm's financial situation from a "Time Series" viewpoint. Analyze its overall; financial situation from a series viewpoint. Break your analysis into an evaluation of the firm's liquidity, activity, debt and profitability. Work should demonstrate the application of theoretical elements and financial analysis. You must use a minimum of three sentences for each financial ratio for your reply and apply financial concepts learned in the course. Level of accounting and financial terminology would be required in the analysis and must be utilized. Could be answered in English and or in Spanish c. Total Assets Turnover d. ROA e. ROE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts