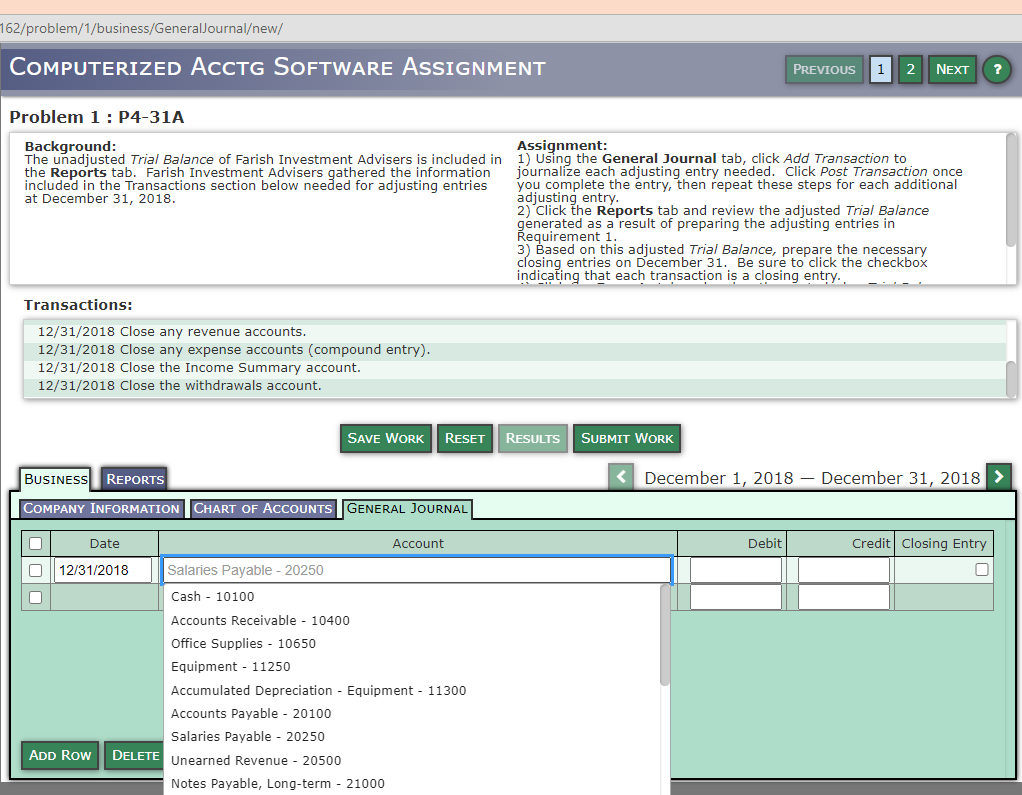

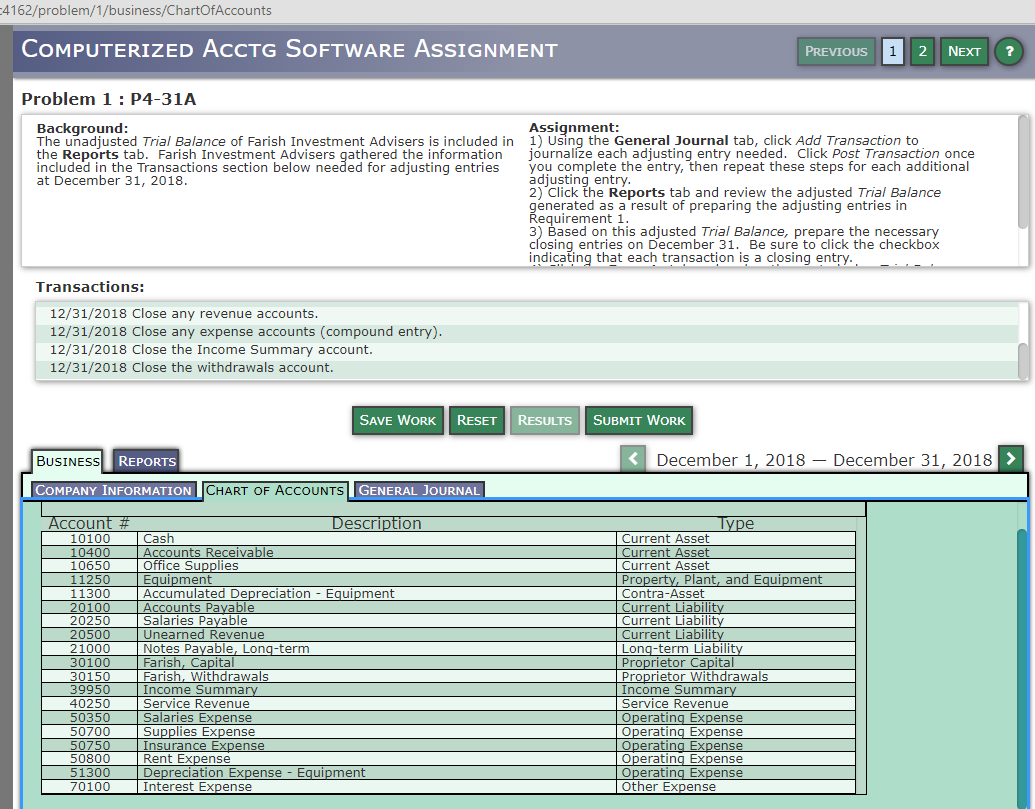

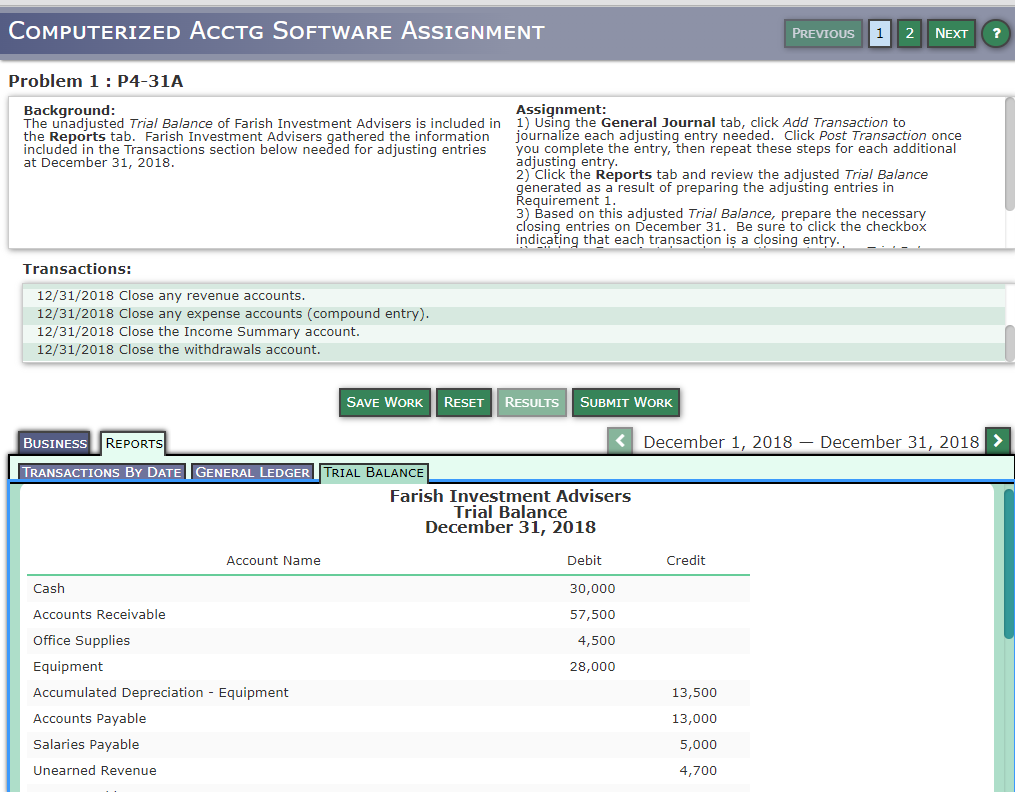

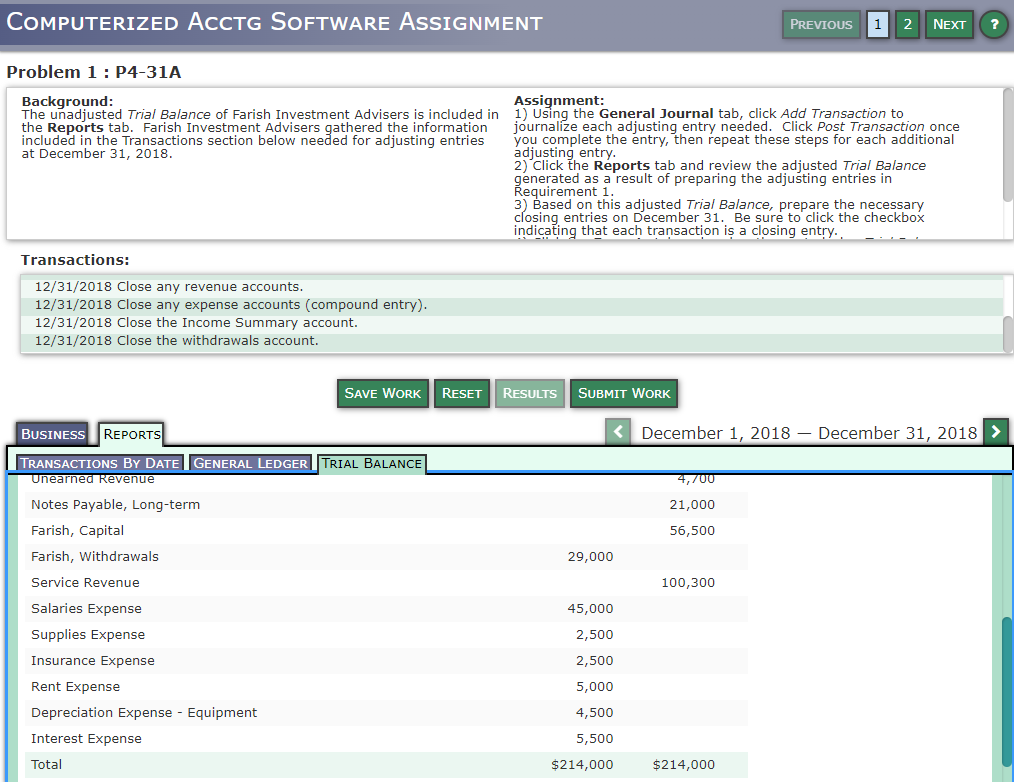

Question: Please help me journal the transaction 62/problem/1/business/GeneralJournalew/ COMPUTERIZED ACCTG SOFTWARE ASSIGNMENT PREVIOUS 1 2 NEXT ? Problem 1 : P4-31A Background: Assignment: The unadjusted Trial

Please help me journal the transaction

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock