Question: Please help me on this assignment, I've submitted it 3 times but no ones want to do it: Financial Decision Making Task Part II: A

Please help me on this assignment, I've submitted it 3 times but no ones want to do it:

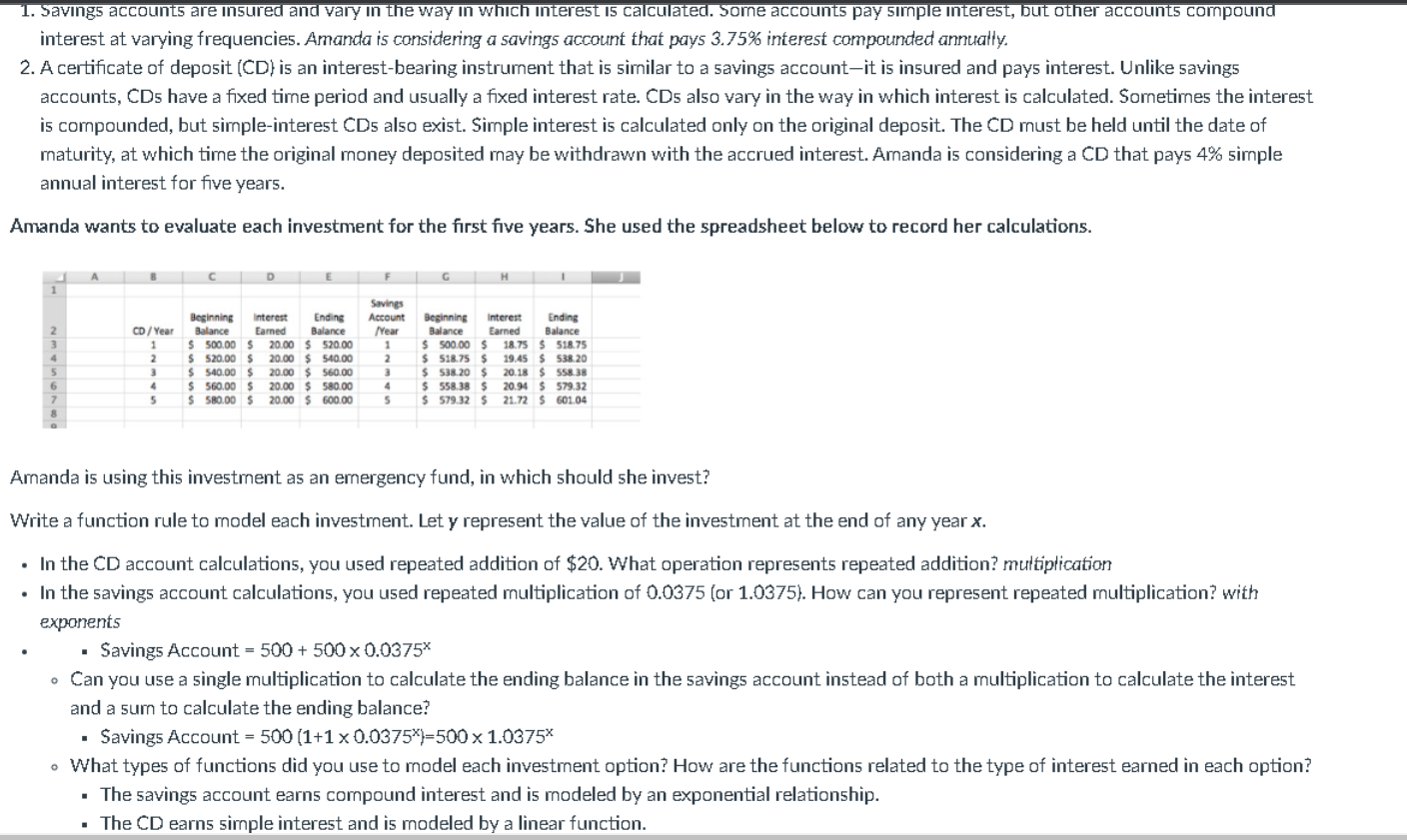

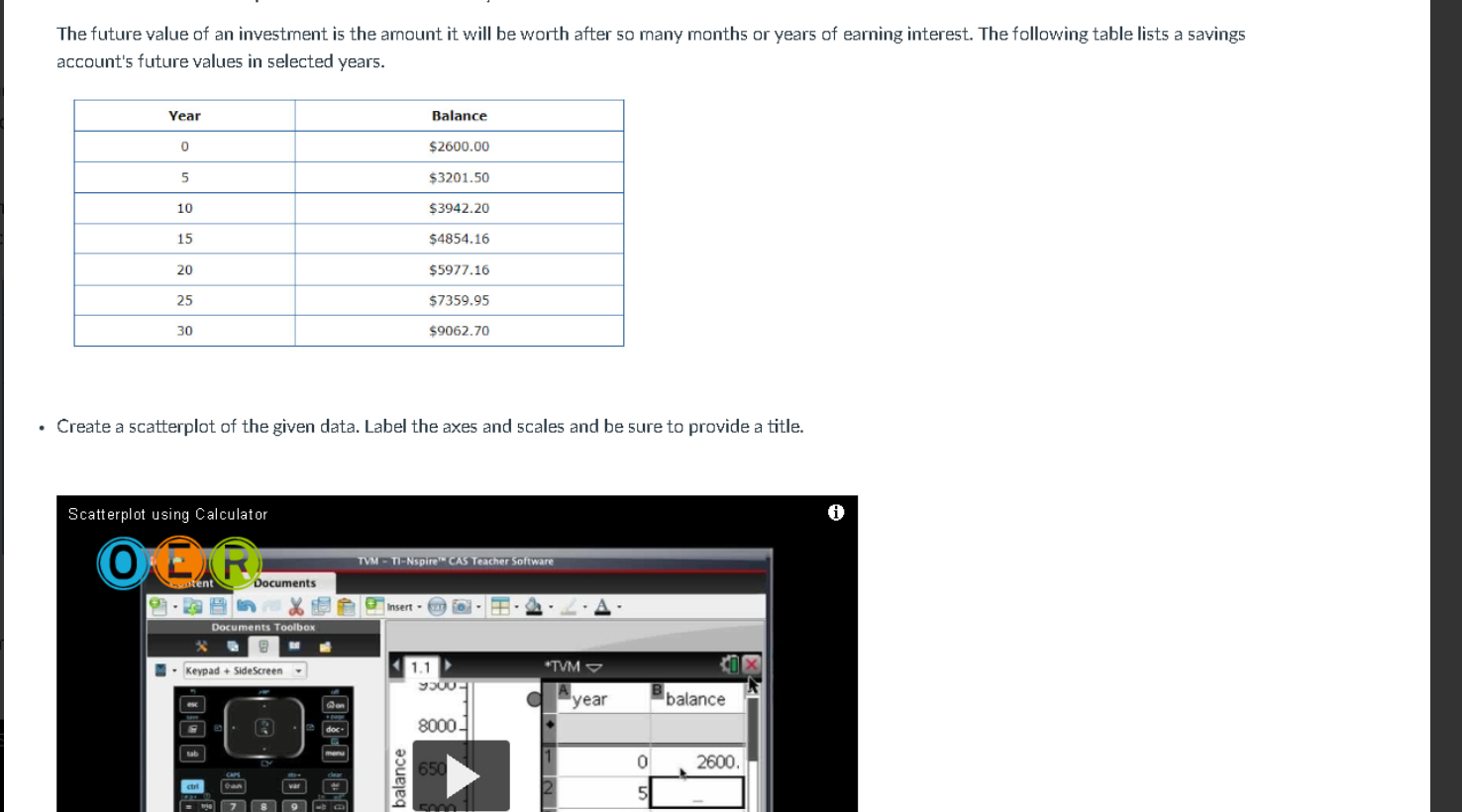

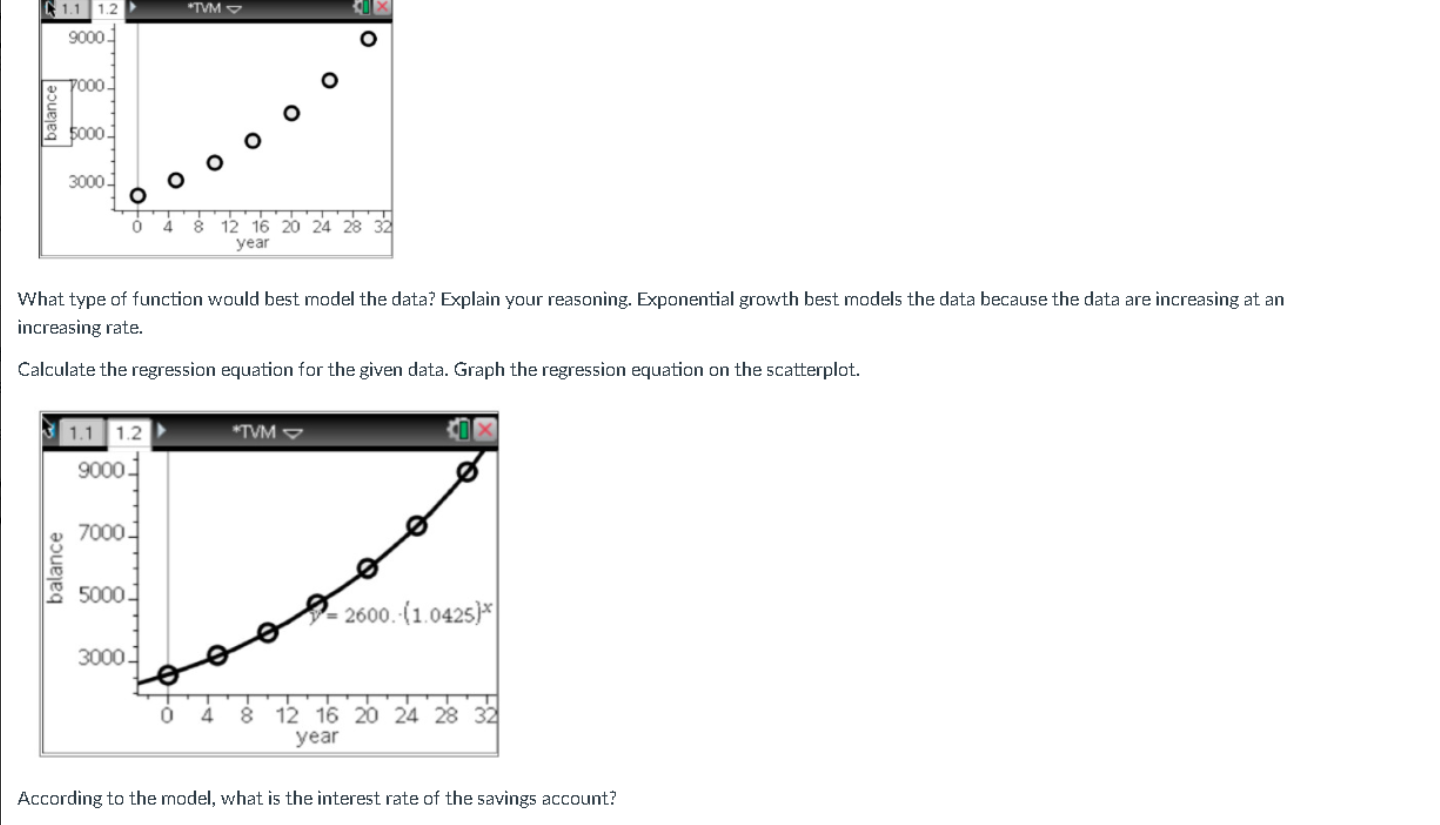

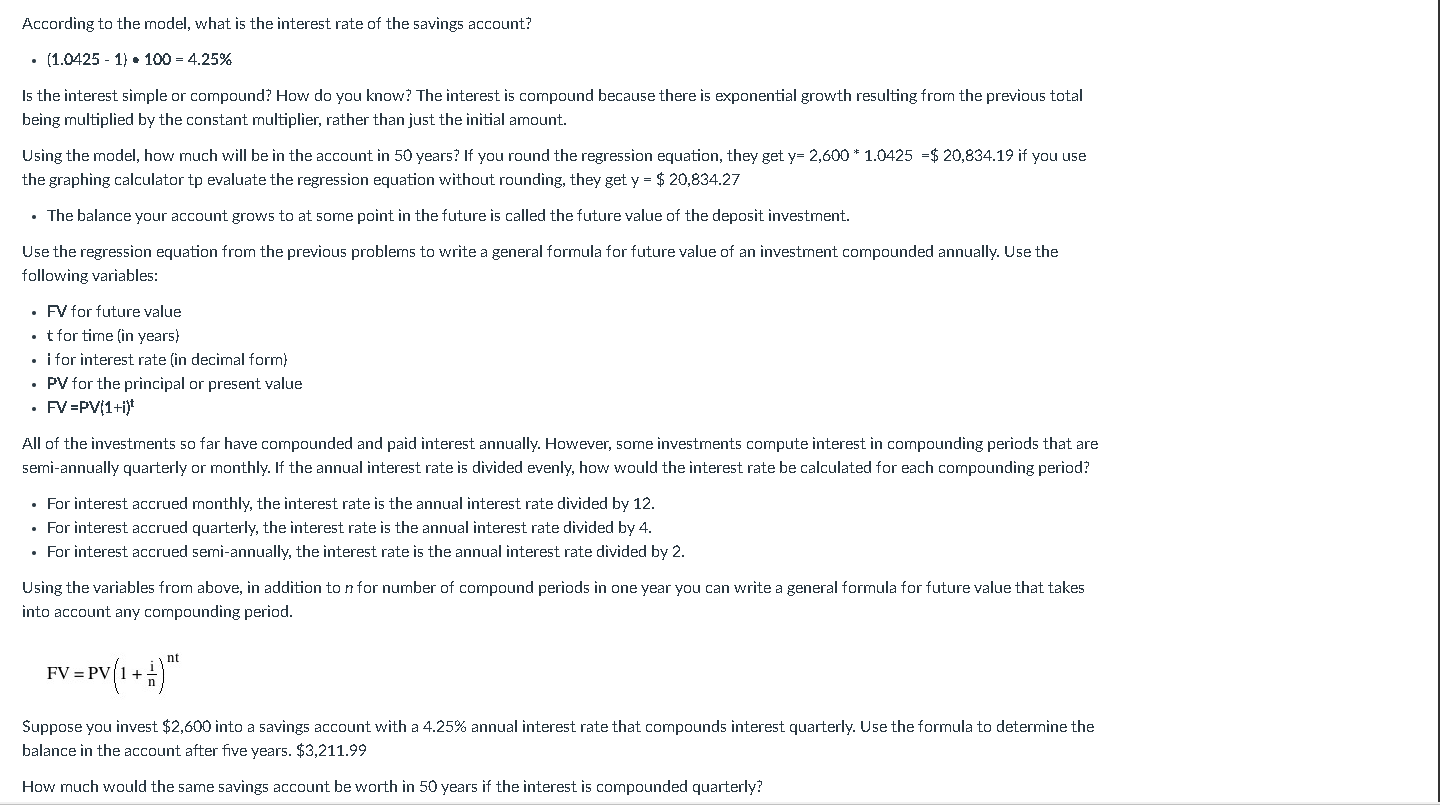

Financial Decision Making Task Part II: A Savings Account Amanda has decided to keep the investment until retirement-40 years from now. Part I: Which Job? You are considering two job offers: a full-time permanent position that pays $55,500 annually and a full- Amanda is considering a savings account that pays 3.75% interest compounded annually. Amanda is considering a CD that pays 4% simple annual interest for five years. time contract job that pays $29 per hour. Estimate the gross annual income, gross monthly income, and the after-tax monthly income for each job offer. The income tax rate is 22.65%. Record your estimates in Use your graphing calculator to graph both functions. job Summary Table 2 on p. VI-22. Use the information for calculating income, taxes, and costs that Amanda used in the example in the slideshow. The contractjob is self-employment, which is taxed an Savings account CD: additional 7.65% of gross income, The permanent position will cost you $95 per month in healthcare benefits and 4% of your after-tax income in retirement contributions. The contractjob will cost you $150 per month in health care benefits and 8% of your after-tax income in retirement contributions, Estimate the take-home income for each job offer and record it in a Job Summary Table. Based on this information, which job should you take? Why? ( don't forget to answer this question!) Job Summary Table Job: Permanent Contract Income information $55,500 per year $29 per hour Process Gross annual income Process Gross monthly income 1. Describe your axes and scaling and sketch your graphs. Compare and contrast the graphs of the two different functions, Explain what you see in terms of the function rulesand the tables. Process After-tax monthly income Process Health insurance 2. Why is there a difference between the two models? Explain your answer using the information Process Retirement plan from the tables, graphs, or function rules. Monthly take-home income REFLECTION: 3. Which investment should Amanda use: the CD or the savings account? Explain your reasoning. 1. Did your decision on which job to take change throughout the analysis? 2. What does that say about the decision process for considering any job offer? 4. How much would the same savings account be worth in 50 years if the interest is compounded quarterly ? 3. When considering variousjob offers, what will factor into your decision?1. Savings accounts are insured and vary in the way in which interest is calculated. Some accounts pay simple interest, but other accounts compound interest at varying frequencies. Amanda is considering a savings account that pays 3.75% interest compounded annually. 2. A certificate of deposit (CD) is an interest-bearing instrument that is similar to a savings account-it is insured and pays interest. Unlike savings accounts, CDs have a fixed time period and usually a fixed interest rate. CDs also vary in the way in which interest is calculated. Sometimes the interest is compounded, but simple-interest CDs also exist. Simple interest is calculated only on the original deposit. The CD must be held until the date of maturity, at which time the original money deposited may be withdrawn with the accrued interest. Amanda is considering a CD that pays 4% simple annual interest for five years. Amanda wants to evaluate each investment for the first five years. She used the spreadsheet below to record her calculations. Savings Beginning interest Ending Account Beginning Interest Ending CD/ Year Balance Earned Balance Year Balance Earned Balance 500.00 20.00 $ 520.00 S 500.00 18.75 $ 518.75 520.00 20.00 540 00 5 518 75 19.45 538.20 20.DO S 20.18 IS S5838 560.00 20.00 580.00 558.38 20.94 5 579.32 580.00 20.00 5 600.00 $ 579.32 5 21.72 $ 601.04 Amanda is using this investment as an emergency fund, in which should she invest? Write a function rule to model each investment. Let y represent the value of the investment at the end of any year x. . In the CD account calculations, you used repeated addition of $20. What operation represents repeated addition? multiplication . In the savings account calculations, you used repeated multiplication of 0.0375 (or 1.0375). How can you represent repeated multiplication? with exponents . Savings Account = 500 + 500 x 0.0375* . Can you use a single multiplication to calculate the ending balance in the savings account instead of both a multiplication to calculate the interest and a sum to calculate the ending balance? . Savings Account = 500 (1+1 x 0.0375*)=500 x 1.0375* . What types of functions did you use to model each investment option? How are the functions related to the type of interest earned in each option? . The savings account earns compound interest and is modeled by an exponential relationship. . The CD earns simple interest and is modeled by a linear function.The future value of an investment is the amount it will be worth after so many months or years of earning interest The following table lists a savings account's 'luture values in selected years. Year Balaan J SAUJJ.L.U 3 7 $113250 ID 55942,2U 15 5535140- 20 EMU/.10 )5- 7159 'm 8'30")? 7\" - Create a scatterplot of the given data. Label the axes and scales and be sure to provide a title. What type of function would best model the data? Explain your reasoning. Exponential growth best models the data because the data are increasing at an increasing rate. Calculate the regression equation for the given data. Graph the regression equation on the scatterplot. According to the model, what is the interest rate of the savings account? According to the model, what is the interest rate of the savings account? - [1.0425 - 1} I 100 = 4.25% Is the interest simple or compound? How do you know? The interest is compound because there is exponential growth resulting from the previous total being multiplied by the constant multiplier, rather than just the initial amount. Using the model, how much will be in the account in 50 years? If you round the regression equation. they get y= 2.600 * 1.0425 =$ 20.834.19 if you use the graphing calculator tp evaluate the regression equation without rounding, they get y = $ 20,334.27 . The balance your account grows to at some point in the future is called the future value of the deposit investment. Use the regression equation from the previous problems to write a general formula for future value of an investment compounded annually. Use the following variables: - FV for future value 0 t for time [in years} i for interest rate [in decimal form} 0 PV for the principal or present value FV=PV(1+i)' All of the investments so far have compounded and paid interest annually. However, some investments compute interest in compounding periods that are semiiannually quarterly or monthly. If the annual interest rate is divided evenly, how would the interest rate be calculated for each compounding period? - For interest accrued monthly. the interest rate is the annual interest rate divided by 12. - For interest accrued quarterly, the interest rate is the annual interest rate divided by 4. . For interest accrued semiiannually, the interest rate is the annual interest rate divided by 2. Using the variables from above. in addition to n for number of compound periods in one year you can write a general formula for future value that takes into account any compounding period. . I'lt FV=PV(1+%) Suppose you invest $2.600 into a savings account with a 4.25% annual interest rate that compounds interest quarterly. Use the formula to determine the balance in the account after ve years. $3,211.99 How much would the same savings account be worth in 50 years if the interest is compounded quarterly? How much would the same savings account be worth in 50 years if the interest is compounded quarterly? 4x5" FV: 2600 x (1 + %) x $21. 526.86 REFLECTION: Is there a dii'Ference between the account balance that was compounded quarterly after 5 years and the account balance that was only compounded annually shown In the table above? If so. is the difference large or small? How might this difference Inuence your decision about investments? - By compounding quarterly, the investment is worth $10.49 more. This is a small increase. This small amount of difference might not matter too much since investments are generally considered over an extended amount of time. Is there a difference between the account balance in 50 years using the formula and the account balance using the model? If so, is the difference large or small? How might this difference inuence your decision about investments? - By compounding quarterly, the investment is worth about $692.68 more after 50 years. This diiierence emphasizes the importance of the factor of time in investing. An investor would be wise to take this into account when making decisions about where to invest money

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts