Question: Please help me on working this problem with a step by step working. Thank you very much ! 2. Consider a rm whose stock price

Please help me on working this problem with a step by step working. Thank you very much !

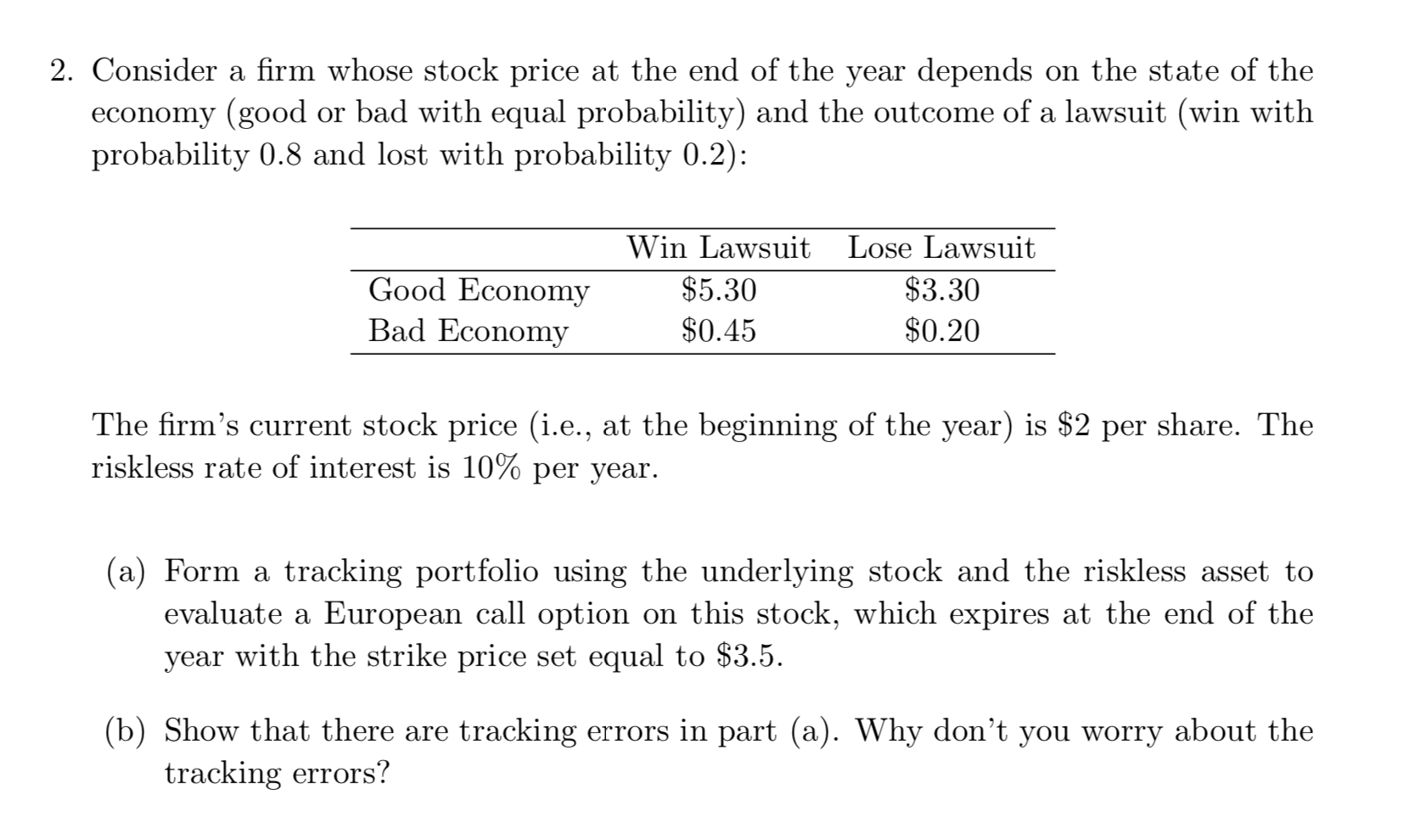

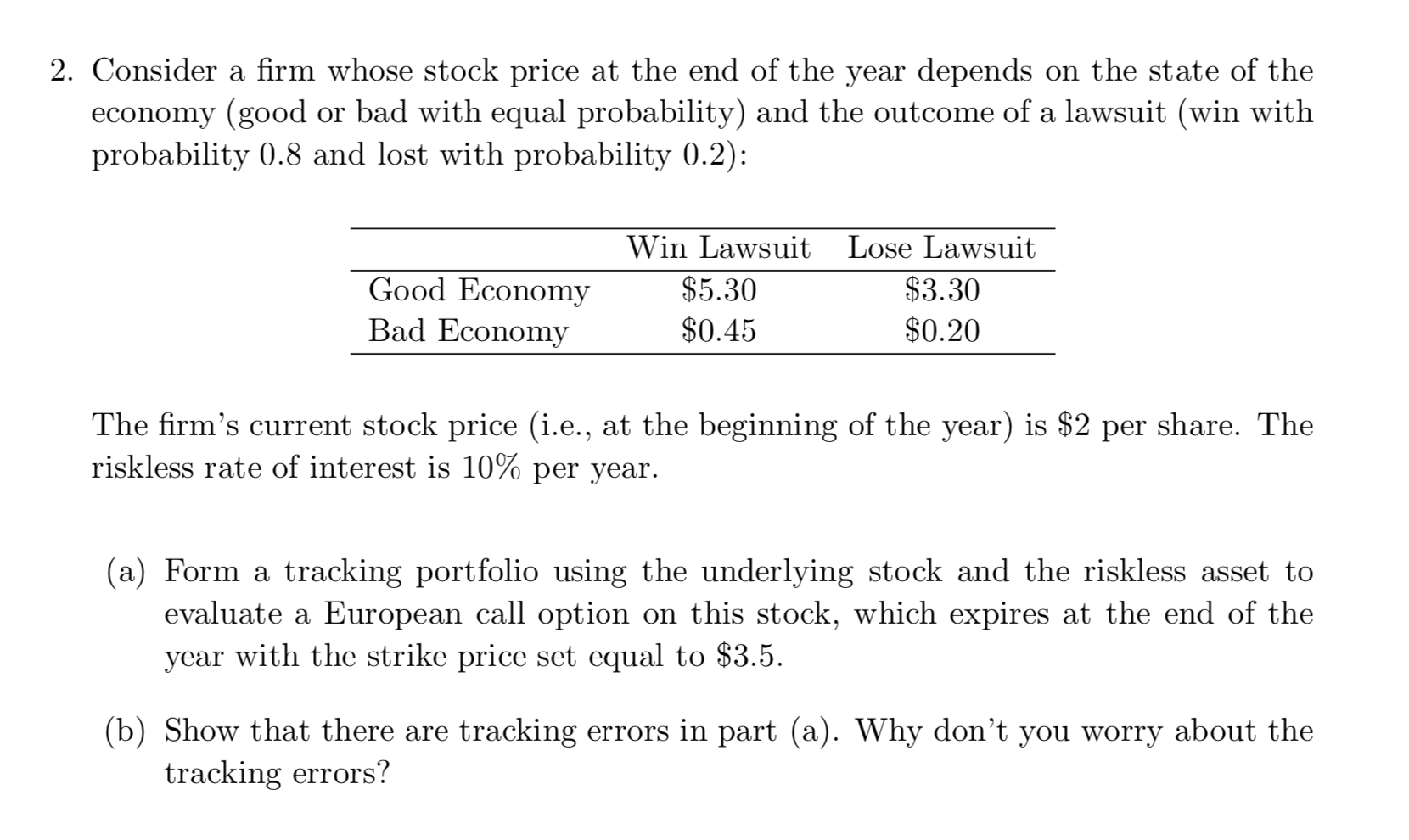

2. Consider a rm whose stock price at the end of the year depends on the state of the economy (good or bad with equal probability) and the outcome of a lawsuit (win with probability 0.8 and lost with probability 0.2): Win Lawsuit Lose Lawsuit Good EconOmy $5.30 $3.30 Bad Economy $0.45 $0.20 The rm's current stock price (i.e., at the beginning of the year) is $2 per share. The riskless rate of interest is 10% per year. (a) Form a tracking portfolio using the underlying stock and the riskless asset to evaluate a European call option on this stock, which expires at the end of the year with the strike price set equal to $3.5. (b) Show that there are tracking errors in part (a). Why don't you worry about the tracking errors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts